PDD Holdings’ (NASDAQ:PDD) revenues in the first quarter of 2023 increased by 58% year-over-year to $5.48 billion, surpassing analysts’ expectations of $4.55 billion. This impressive performance of PDD might not have surprised users of TipRanks’ Website Traffic Tool.

Our tool provides data about the performance of a company’s website domain, which can be used to predict the upcoming earnings report. Thus, growth in online usage may point to higher sales in the concerned period.

Ahead of PDD’s Q1 release, the TipRanks website traffic tool pointed to a solid top-line performance in the first quarter (ended March 2023). Global visits to pinduoduo.com climbed by 468.4% year-over-year in the Q1 quarter.

The company’s vast addressable market and high demand for low-priced products due to persistently high inflation might have supported growth during the quarter.

What Are Analysts Saying about PDD?

Following the Q1 earnings release on May 26, six analysts rated PDD stock a Buy. Among these, analyst Joyce Ju of Bank of America Securities maintained a Buy rating and raised his price target to $97 from $95.

According to the analyst, PDD is well-positioned to profit from rebounding demand, improving consumer sentiment, and an improved supply chain.

Also, two Hold ratings were assigned to the stock.

Is PDD a Good Stock to Buy?

Overall, Wall Street is bullish about PDD stock. It has received 10 Buy and two Hold recommendations for a Strong Buy consensus rating. Further, analysts’ 12-month average price target of $102.50 implies 43.5% upside potential from current levels.

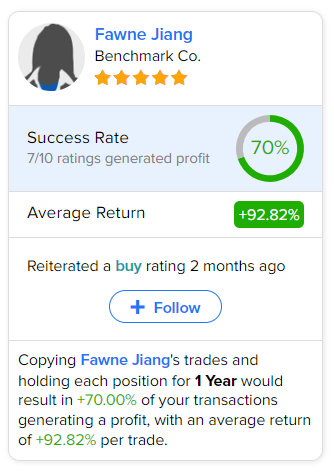

As per TipRanks data, the most accurate analyst for PDD is Benchmark Co. analyst Fawne Jiang. Copying the analyst’s trades on this stock and holding each position for one year could result in 70% of your transactions generating a profit, with an average return of 92.82% per trade.