In this piece, I used TipRanks’ Comparison Tool to evaluate two utilities stocks, PG&E (NYSE:PCG) and NRG Energy (NYSE:NRG), that are worth considering. Upon closer analysis, I am bullish on both stocks in the long term.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The S&P 500 Utilities Sector Index has seen a bumpy ride over the last 12 months, eventually reaching a bottom at around 312 in mid-October. Since then, the index has come bouncing back, although it still reached lows at around 323 twice in March.

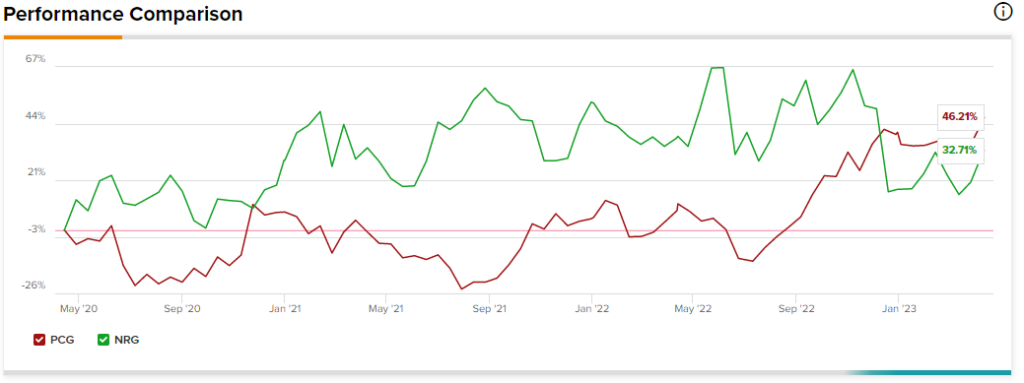

In terms of these two stocks, NRG Energy is down 4.8% over the last year but has gained 13.8% year-to-date, while PG&E is up more than 7% year-to-date, capping its 12-month return at around 36.6%.

With sizable gains in the first months of 2023, investors might be wondering whether there’s any upside left for these two stocks. A closer look at the fundamentals and valuations offers some insight.

PG&E (NYSE:PCG)

PG&E has had a storied history over the last several years, although it’s been in recovery mode since the wildfire-related lawsuits leading up to its most recent bankruptcy filing in January 2019. For context, PG&E paid billions in settlements a few years back because its faulty equipment caused several fires (and deaths). Nonetheless, the company made significant progress in 2022, so a long-term bullish view looks appropriate, even after the strong gains over the last year.

PG&E has been in recovery mode for the last several years, finally returning to profitability in 2022 with $1.8 billion in net income on $21.7 billion in revenue. Unfortunately, the company still recorded -$5.9 billion in negative free cash flow, so despite the profit, recovery continues. The company issued over $16 billion in debt in 2022, signaling that a long road remains ahead.

A key issue for PG&E has been exposure to future wildfires, and the company is making progress on this by moving 10,000 miles of its distribution lines underground. The firm is forecasting 10% earnings-per-share growth through 2025. If it can follow through on that trajectory, it would be huge.

PG&E also looks like a solid investment from a valuation standpoint. It’s trading at a price-to-earnings (P/E) ratio of about 19.9 and a price-to-sales (P/S) ratio of about 1.5 times, versus its average ratios of 16 and 1.0, respectively, over the last five years. Meanwhile, the broader utility industry is trading close to its three-year average P/E of 27.3 and P/S of 2.5 times.

What is the Price Target for PCG Stock?

PG&E has a Strong Buy consensus rating based on five Buys, one Hold, and zero Sell ratings assigned over the last three months. At $18.42, the average PG&E stock price target implies upside potential of 9.6%.

NRG Energy (NYSE:NRG)

NRG Energy is trading at deeply-discounted ratios versus its industry and its own history despite its steadily improving balance sheet and fundamentals. Thus, a bullish view looks appropriate for NRG.

While PG&E is a public utility, NRG Energy is engaged in the retail electricity market in Texas. Several years ago, the state deregulated its electricity market and paved the way for multiple companies to compete for electricity customers. NRG now serves over 6 million retail customers. Also, in 2009, the company started moving into green-energy generation, so it should see tailwinds from the Inflation Reduction Act.

NRG is trading at a P/E of 6.9 and a P/S of 0.26 versus its five-year average P/E of 7.8 and P/S of 0.75. While these low ratios indicate that the company has been trading at a discount to its peers for many years, they also suggest it may be undervalued, especially given its steadily improving financial condition.

For instance, NRG has been steadily paying down debt since 2015, which is an extremely good sign. In 2022, NRG didn’t issue any debt at all, a remarkable turnaround from recent years. Unfortunately, though, NRG flipped into negative cash flow in 2022, reporting -$7 million in free cash flow despite its net income of $1.2 billion. While this should be monitored, utility companies typically have widely fluctuating income, revenue, and margins.

Finally, NRG has an attractive dividend yield of 4%, and it has a history of repurchasing its shares, both of which are shareholder-friendly activities.

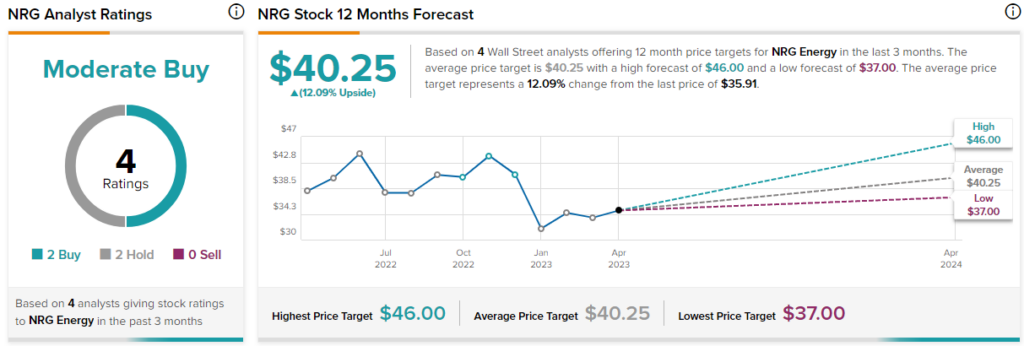

What is the Price Target for NRG Stock?

NRG Energy has a Moderate Buy consensus rating based on two Buys, two Holds, and zero Sell ratings assigned over the last three months. At $40.25, the average NRG Energy stock price target implies upside potential of 12.1%.

Conclusion: Long-Term Bullish on PCG and NRG

Given a recession may be around the corner, the utility market offers some solid options. NRG’s financial condition is better than that of most other utility companies, and its attractive dividend yield makes it a great addition to a dividend portfolio. PG&E also looks good over the long term, although it remains a very risky investment in the near term.