For investors, taking high risks is not always necessary to outperform the market. Instead, maximizing risk-adjusted returns by holding long-term growth stocks with world-class business models has proven to be a winning strategy. One such option for investors looking for a top growth stock in today’s overvalued market might just be Paypal Holdings (PYPL).

This is a company I continue to hold a bullish view on over the long term. The company’s certainly not cheap from a valuation perspective. However, given the roughly 20% dip this stock has seen since July, investors looking for a decent entry point now have it.

Will this stock rebound to new all-time highs in short order? Time will tell. However, there are a number of reasons why investors remain bullish on this stock’s long-term potential. (See Analysts’ Top Stocks on TipRanks)

PayPal’s Wide Moat

A leader in the payments infrastructure space, PayPal is a big deal when it comes to the online transfer of money. A company that was founded as a potential disruptive force to big banks in this regard, PayPal has succeeded in achieving this mission.

The company carries out its operations through a two-sided platform. In other words, PayPal makes revenue on both the buyer and seller end of each transaction. Much like a credit card company, PayPal has been able to scale aggressively, all the while holding incredible margins.

PayPal currently has over 370 million active consumers, and more than 31 million active merchants. This network effect gives the company a large edge over the competition in the online payments space.

Yes, competitors are always on the rise looking to eat PayPal’s lunch. However, thus far, the company has used its scale to its advantage. Accordingly, the company’s stellar financial returns have resulted from this dominance.

This is a company that saw free cash flow margins reach 26% in Q1 2021, an incredible metric. Should cash flows continue to grow, PayPal’s valuation could begin to look a lot cheaper.

The company has been reinvesting less of its cash in growing its business than in the past, largely due to this network effect. Accordingly, investors stand to benefit from what could be impressive performance over the long-term.

Digital Payments Revolution Continues

Estimates suggest the overall transaction volume for digital payments could reach $10.5 trillion by 2025. Considering that cash is still the most preferred payment mode all around the world, PYPL stock arguably has a lot more room to run.

Similar to major credit card players looking to grab more market share in the online payments space, there’s a lot of margin to be had in this hyper-growth space.

There are always going to be headlines calling for the end of the trend toward digital payments. However, there’s also ample reason to believe this is a growth area with tremendous room to run in the years and decades to come.

PayPal’s CEO has recently touted a goal of reaching 1 billion daily active accounts in the coming future. Such a goal would imply absolutely massive growth in the years to come, on the top and bottom line.

The growing popularity of digital payments relative to traditional payment methods (mainly cash) allows for more money to be spent in innovation within this space. PayPal is no exception in this regard. The company has been aggressively investing in improving the company’s offerings to end users. Various crypto-related offerings are one of many steps the company has taken in this regard.

PayPal’s Potential Stock Trading Platform

In addition to the company’s aforementioned move into crypto, PayPal is looking at disrupting other digital, high-margin businesses. One such area this company is looking at is the stock trading business.

Given the company’s existing network (we always seem to come back to that when discussing PayPal), providing a user-friendly brokerage platform for millennials to use seems like an easy vertical for the company to move into.

As we’ve seen with the rise of other digital online brokerages such as Robinhood (HOOD), this can be a very lucrative, high-growth space. Rival Square (SQ) followed a similar strategy and succeeded.

Square found that its users were willing to utilize its app to invest in stocks and crypto. Accordingly, there’s evidence that suggests this is the right move for PayPal.

What ultimately comes of these verticals remains to be seen. However, PayPal has an opportunity to keep disrupting the fintech world. For investors looking to bet on the biggest (and potentially the best) play in this space, there are a lot of reasons to like PYPL stock right now.

Wall Street’s Take

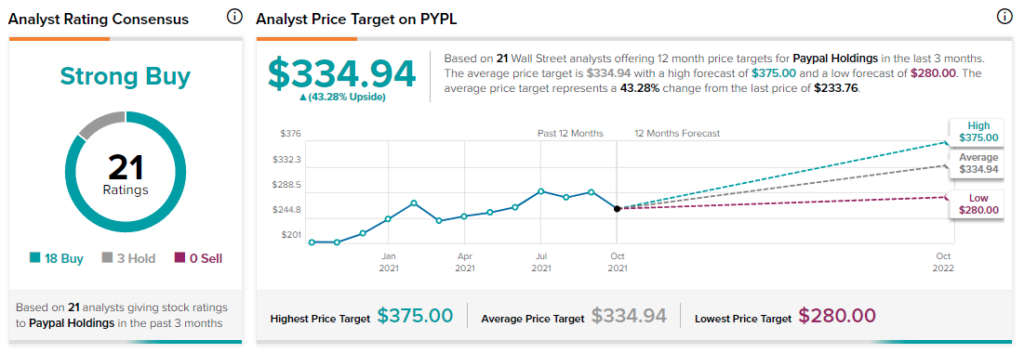

As per TipRanks’ analyst rating consensus, PayPal Holdings stock is a Strong Buy. Out of 21 analyst ratings, there are 18 Buy recommendations and three Hold recommendations.

The average PYPL price target is $334.94. Analyst price targets range from a high of $375 per share, to a low of $280 per share.

Bottom Line on PYPL Stock

PayPal has provided long-term investors with impressive long-term growth in preceding years. Accordingly, this is a company that’s garnered a generous valuation courtesy of its forward-looking growth.

Investors who believe these structural secular catalysts are likely to remain in play for the decades to come may want to consider PayPal right now.

This digital payments company is morphing into so much more.

Disclosure: At the time of publication, Chris MacDonald did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.