PayPal (PYPL) has enjoyed a bit of a resurgence after five mediocre years. The fintech stock is up by 29% year-to-date as a low valuation with suddenly good growth prospects suggests a long-term opportunity. Pessimism has persisted since the height of the pandemic, and rightfully so, but a turnaround has generated momentum, and I’m now bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Looking Closer at PayPal’s Numbers

PayPal’s second quarter was decent. Combine that with a 19x P/E ratio, and it’s easier to feel bullish about the stock. Q2 revenue increased by 8% year-over-year to reach $7.9 billion. Meanwhile, GAAP EPS jumped by 17% year-over-year, reaching $1.08 in the process. It is worth noting that PayPal has a lower P/E ratio than the S&P 500 and most of its fintech peers, such as Visa (V) and Mastercard (MA).

The online payments company also raised its guidance across the board. GAAP EPS is expected to range from $3.88-$3.98 per share in Fiscal Year 2024. That’s a noteworthy boost from the previous estimate of $3.65 per share. Free cash flow should be approximately $6 billion instead of $5 billion, and the company is expected to repurchase $6 billion worth of shares. That’s a 20% jump from the previously anticipated $5 billion in stock buybacks.

However, account growth remains an issue, but even in this area, PayPal reported some positives. For instance, total active accounts slightly dropped year-over-year, but monthly active accounts increased by 3% year-over-year to reach 222 million. Even if PayPal’s days of high user growth are over, it’s nice to see their existing users being more active. It indicates that PayPal is getting a better squeeze out of the same lemon.

The e-Commerce Market Continues to Grow

PayPal’s success is heavily tied to the e-commerce market, as the platform is a top choice for online purchases. Luckily, the e-commerce market is still growing, and that prompts me to be bullish on PayPal. Grand View Research projects that the global e-commerce market size will maintain an 18.9% compounded annual growth rate from now until 2030.

A growing e-commerce market suggests that PayPal can generate more revenue per user in the years ahead. This route can compensate for the company’s slow user growth rates, a detail that heavily contributed to the stock’s post-pandemic plunge. Investors should remember that PayPal is not accepted on Amazon (AMZN), the largest e-commerce giant. However, that hasn’t stopped PayPal from delivering high single-digit revenue and net income growth.

Lower Interest Rates Should Increase Loan Demand

While many people use PayPal for online payments, the fintech firm also helps out with loans. PayPal offers personal and business loans, and you can choose from a few debit and credit cards. The Federal Reserve’s decision to lower rates should drive more demand for its financial products, which adds to my bullishness.

The Fed cut its rate by 0.50% in September, marking the biggest rate cut in 23 years. Additional rate cuts are expected in 2025, with each one increasing the demand for loans and credit cards. PayPal’s selection of financial products can increase engagement with its current user base and drive more people to its platform. Although lower interest rates may not cause user growth to accelerate in a meaningful way, they should generate more engagement from active users.

PayPal Is Capitalizing on the Crypto Boom

Another reason to be bullish on PayPal is that the firm recently expanded its crypto capabilities by allowing merchants to buy, hold, and sell digital assets, allowing it to capitalize on the crypto boom. This is not PayPal’s first foray into crypto, but new options can help the company generate gains for its shareholders.

Investors can look at Robinhood’s (HOOD) financial reports to gauge how crypto can impact PayPal’s bottom line. Robinhood generated $81 million from crypto transactions in Q2 2024, which was up by 161% year-over-year. Crypto has plenty of enthusiasm among individuals and businesses. PayPal already has a vast user base, and continued efforts to tap into crypto can bring more people back to the platform. Crypto can increase PayPal’s monthly active users and result in new signups.

Is PayPal Stock a Buy?

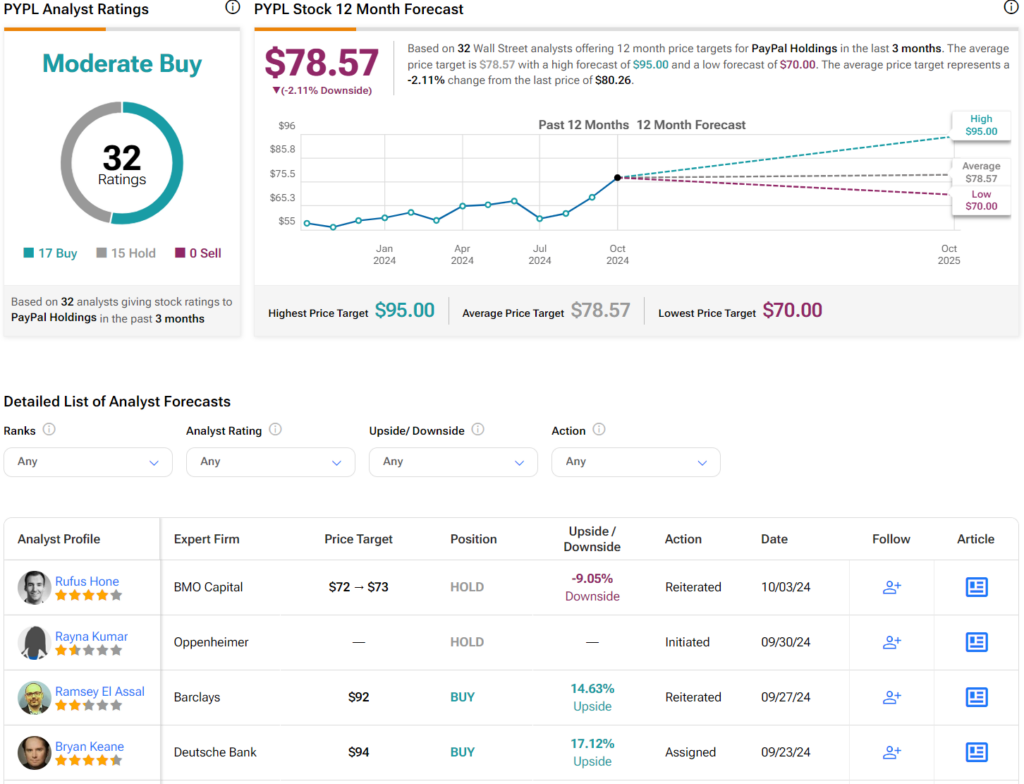

PayPal stock is currently rated as a Moderate Buy among 32 analysts. The stock has received 17 Buy ratings and 15 Hold ratings. No analyst gave the stock a Sell rating. PayPal’s recent rally has caught many analysts by surprise, as the average PYPL price target implies 2% downside risk. However, the highest price target of $95 per share suggests that PayPal stock can gain an additional 18% from current levels.

PayPal Stock Is a Compelling Turnaround Story

PayPal is a compelling turnaround story that offers a decent margin of safety. The stock’s valuation is lower than most fintech stocks, and it trades at a discount compared to the S&P 500. Lower interest rates can lead to more demand for PayPal’s loans, while the crypto boom can attract more users to PayPal’s platform. The company’s turnaround is in progress, and it can result in respectable gains for long-term investors.