Despite a 38% surge in its stock price over the last 12 months, Paycom Software (PAYC) isn’t drawing much attention from the financial press these days. The company only went public in 2014, but it operates as a part of a trio of large companies in a mature, and sometimes boring, field of human resources management.

Paycom, though, brings a little style to the party. It is the first of its kind to integrate many different HR functions into a single app, in addition to processing payrolls completely online. The company has put its focus on security and simplicity, and it’s paying off. Paycom is growing its revenue at an impressive pace.

That said, Paycom still only holds a small percentage of the overall industry. One theory is that Paycom’s one-size-fits-all approach is better as an enterprise solution, while a competitor like Automatic Data Processing (ADP) offers different packages that appeal to small and medium-sized businesses.

If that’s true, you would expect Paycom to come out of the pandemic in better shape than its competitors because although there were job cuts at the enterprise level, small or medium-sized businesses may not have been able to survive.

Paycom Continues to Grow Quickly

Currently, PAYC trades at a price-to-sales (P/S) ratio of 30x. At first glance, ADP’s P/S multiple of 5x might appear to offer a better value. However, in Paycom’s case, a higher P/S ratio is warranted because it is growing revenue at a faster rate, and it has been able to maintain consistent margins (around 30%) to increase profit.

This sets up an interesting dynamic where Paycom, whose market capitalization is approximately one-third of ADP’s ($24.9 billion vs. $71.4 billion), has revenues that are less than 10% of its competitor. If Paycom can maintain its current sales growth, its revenues could significantly tighten the gap with ADP in the next five years.

How realistic is that 30% sales growth? Despite the pandemic, Paycom was able to grow its revenue by 14% in 2020.

Fourth Quarter Earnings Reflect a Double Beat

Paycom has beaten analysts’ estimates in three out of the last four quarters. The company posted earnings per share of 84 cents, which was above the consensus estimate of 79 cents, but lower than the 86 cents reported in the same period last year. Revenue also came in comfortably higher ($220.9 million versus an estimate of $213.9 million) on a year-over-year basis.

Technical Analysis of PAYC Stock

On the day of its earnings call, PAYC stock found support at its 50-day moving average on relatively normal volume. That’s a bullish sign for investors, but based on its slow stochastic indicator, it’s likely that the stock may move sideways or even have a downturn.

Analysts Weigh In

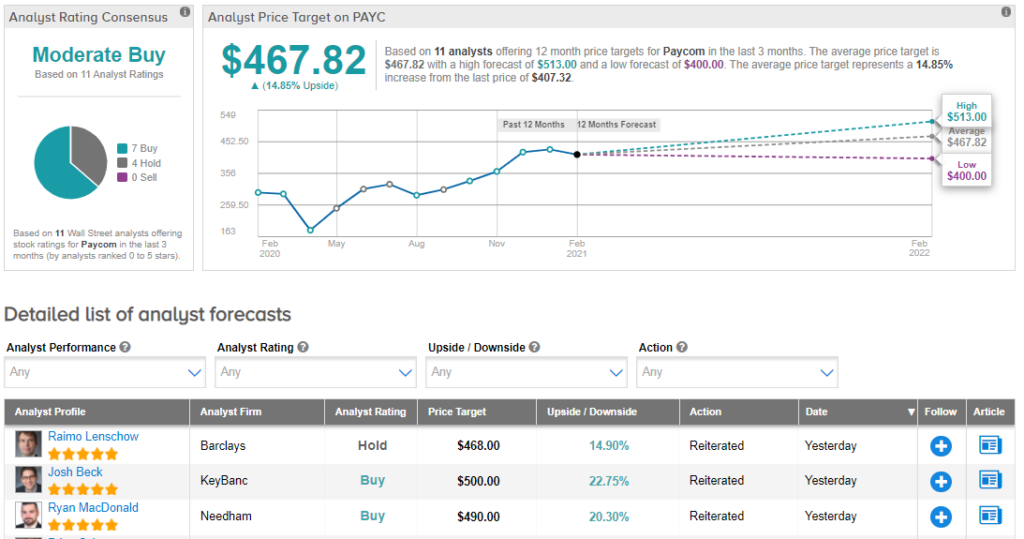

The analyst community gives PAYC a Moderate Buy consensus rating, based on 7 Buy ratings and 4 Hold ratings. Given its average analyst price target of $467.82, shares could rise 15% in the year ahead (See Paycom Software stock analysis on TipRanks)

Buy PAYC on the Next Dip

There’s a lot to like about PAYC stock, particularly since it appears to be growing revenue at a time when its largest competitors are not. However, the hiring outlook remains murky, and that could be a potential headwind over the next couple of quarters.

As long as Paycom continues to deliver on the top and bottom lines, any pullbacks could reflect buying opportunities.

Disclosure: On the date of publication, Chris Markoch did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.