Palantir Technologies (NYSE:PLTR) is a solid company with growing revenue. However, Palantir stock is too pricey after a year-long rally. After heeding the warning of a prominent Wall Street expert, I am bearish on PLTR stock, and investors may choose to take profits if they have any.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Colorado-based Palantir Technologies provides software and services in the areas of cybersecurity and threat detection. The company’s products/services have embedded artificial intelligence (AI) functionalities, and this helps to explain why short-term traders gobbled up Palantir shares this year.

I even recently spotted a commentator asking whether Palantir Technologies will be the next Microsoft (NASDAQ:MSFT). When I see questions and comments like that, I think of the old Benjamin Graham/Warren Buffett quote, “Be fearful when others are greedy.” At the end of the day, it’s entirely possible to like Palantir as a company but still be cautious about the stock at its current price.

Acknowledging the Bullish Argument for PLTR Stock

To be completely fair and balanced, I must admit that there’s a bull case for Palantir Technologies. For what it’s worth, Palantir grew its revenue by 17% year-over-year to roughly $558 million in 2023’s third quarter. That’s not too bad, and this result exceeded the consensus estimate of $556 million.

Furthermore, Palantir Technologies reported adjusted EPS of $0.07 in Q3 2023, slightly edging out the consensus call for $0.06. Again, that’s pretty good. It’s also worth noting that Palantir scored a seven-year, $414 million data-communication platform contract with England’s National Health Service (NHS).

On the other hand, these positive developments don’t seem to justify the stunning run of PLTR stock in 2023. Prior to today, the stock price had gained around 200% year-to-date. Moreover, Palantir Technologies’ GAAP trailing 12-month price-to-earnings (P/E) ratio is a whopping 261.5x, versus the sector median P/E ratio of 26.3x.

As the saying goes, the bigger they are, the harder they fall. This year, Palantir Technologies stock behaved like a “Magnificent Seven” stock, but with only pretty good quarterly financial results. Today, we’re all witnessing what can happen when there’s a huge air pocket below a stock that’s just waiting to be filled.

Has the Big Cliff Dive Begun?

Today, as PLTR stock tumbled by over 9%, some traders undoubtedly wondered whether a pin was letting the air out of the overinflated Palantir Technologies balloon. Indeed, the pin was a prominent analyst who issued a warning about Palantir.

Backing up a little bit, in late November, Deutsche Bank (NYSE:DB) analyst Brad Zelnick called into question whether the aforementioned seven-year NHS contract would generate as much revenue for Palantir Technologies as previously had been expected. With this and other considerations in mind, Zelnick reiterated a Sell rating on Palantir stock along with a $11 price target, implying sharp drawdown potential.

Now, William Blair analyst Louie DiPalma is expressing a similar concern about Palantir Technologies, and evidently, the market is listening and responding. Palantir has a four-year data-platform contract with the U.S. Army, and it’s valued at $458 million. Due to complex intellectual property (IP) concerns, there may be friction between Palantir Technologies and the U.S. Army.

Consequently, Zelnick raised the possibility that the contract’s value “will be significantly less than the original $458 million.” Since Palantir Technologies relies heavily on government contracts for revenue, the market reacted harshly to Zelnick’s commentary. I suspect that the sell-off was exaggerated today because PLTR stock had spent the previous months running too high, too fast.

Is PLTR Stock a Buy, According to Analysts?

On TipRanks, PLTR comes in as a Strong Buy based on four Buys, five Holds, and five Sell ratings assigned by analysts in the past three months. The average Palantir Technologies price target is $15.18, implying 17.5% downside potential.

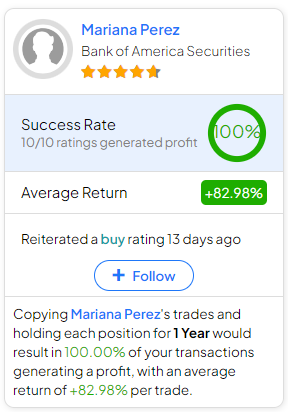

If you’re wondering which analyst you should follow if you want to buy and sell PLTR stock, the most accurate analyst covering the stock (on a one-year timeframe) is Mariana Perez of Bank of America (NYSE:BAC) Securities, with an average return of 82.98% per rating and a 100% success rate. Click on the image below to learn more.

Conclusion: Should You Consider PLTR Stock?

As you can tell, analysts aren’t overwhelmingly enthusiastic about Palantir Technologies, even though short-term stock traders treated Palantir like a “Magnificent Seven” company. Today, overeager investors got a taste of what can occur when an overpriced stock succumbs to buyers’ exhaustion.

Don’t get the wrong idea here. I appreciate Palantir Technologies’ decent revenue growth, and the company could offer good value to the shareholders if the share price falls further. Until that happens, however, I am not considering PLTR stock because it’s just too pricey.