With the uranium market suddenly suffering from a supply shortage, geothermal energy specialist Ormat Technologies (NYSE:ORA) could benefit. Like uranium, geothermal represents a clean source of energy, which stems from heat generated by the earth’s core. Further, this process is renewable, as the heat flowing from the earth’s interior replenishes itself. Still, bearish traders don’t seem to appreciate the narrative. That could be a mistake, given the rising relevance of the industry. Thus, I’m bullish on ORA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ORA Stock Can Take Advantage of a Competitive Dilemma

According to the International Energy Agency, nuclear power represents “an important low-emission source of electricity, providing about 10% of global electricity generation.” That’s a lot despite the sector’s controversies. In contrast, geothermal energy accounts for about half a percent of renewables-based installed capacity for electricity generation, per the International Renewable Energy Agency.

It’s not nothing. However, when stacked against uranium, it’s about as close to nothing as you can get. And on the surface, this narrative didn’t help ORA stock. Coincidentally, Ormat – which specializes in providing alternative and renewable geothermal energy technology – suffered a rough outing last year. Further, ORA is down more than 29% in the past 52 weeks.

However, this narrative could change, thanks to a combination of competitive fallout and political realities. First, the uranium market suffered a sudden supply dilemma. In particular, as I mentioned in a previous TipRanks article, Kazatomprom – Kazahkstan’s state uranium company – disclosed that shortages of key materials like sulfuric acid have stymied efforts to produce yellowcake, a type of uranium concentrate powder used in the preparation of uranium fuel.

Second, the loss of robust supplies of uranium may have a significant downwind impact on the broader energy ecosystem. After all, global population trends continue to march northward, implying increased consumption. As well, a tight U.S. labor market and a sustained growth trajectory of its economic machinery will likely exacerbate energy resource constraints.

However, political and commercial influencers maintain that society must move forward with clean and renewable energy sources. In other words, while “dirty” sources of energy could help address any electricity generation shortfalls, they’re frowned upon. So, while geothermal isn’t exactly a high-volume participant, it could get more of the spotlight due to uranium sector challenges. That should be positive for ORA stock.

In addition, the geothermal industry is no slouch. According to MarketsandMarkets, the sector could expand at a compound annual growth rate of 5.9% from 2022 to 2027, reaching a valuation of $9.4 billion. If Ormat could grab a bigger piece of the pie, ORA stock could rise higher.

The Market Framework Appears to Favor ORA Stock

Nevertheless, the Street doesn’t seem to care too much for ORA stock, likely based on historical trends. While shares had their moment in early 2021, it’s generally been a slog. For example, in the past five years, Ormat only returned shareholders 18%. That’s not exactly compelling stuff.

As a result, bearish traders have taken sizable bets against ORA stock. According to an options flow screener – which exclusively filters for big block transactions likely made by institutions – on December 20, a major entity (or entities) sold 1,025 contracts of the Mar 15 ’24 80.00 Call. To be fair, that was a shrewd play because ORA traded for $75.68 at the time of the transaction.

Now, ORA stock is near $64, allowing the bears to breathe a sigh of relief. However, what’s interesting is that open interest has continued to rise from the December 20 transaction. That’s a solid indicator that the bears believe more downside is possible. Otherwise, if the pessimists wanted to secure their profits, they would have closed their positions, and that would have resulted in a reduction in open interest.

However, if ORA stock continues to fall and the bears prematurely close their position, they would effectively be leaving money on the table. That’s because closing a sold call prior to expiration costs money: a trader would have to pay money for the countervailing transaction (buying calls). In a bid to maximize full profitability, the call writers are holding on.

Frankly, that’s risky. By not securing the profits now, the bears are vulnerable to whatever happens in the market. Because anything can happen, they could possibly end up trading profits for losses.

Moreover, ORA’s short interest of 7.63% of its float and its short interest ratio of 10.07 days to cover are somewhat elevated. If ORA stock does rise for whatever reason, that could panic the bears who are directly shorting the security. This panic could easily affect the options market, creating a high-risk situation for the pessimists.

Hot Multiple Is a Risk Factor to Consider

Although ORA stock may be compelling, it’s not a perfect investment. One particular risk factor to consider is its hot multiple. Right now, shares trade at 36.2x trailing-year earnings. While it’s difficult to neatly classify Ormat’s business, it’s related to the renewable utilities sector. However, this industry features an earnings multiple of only 22.8x.

Still, with a major power sector facing problems, it could be the geothermal ecosystem’s time to shine. With Ormat’s dominant profile in the space, ORA stock could be due for a comeback.

Is ORA Stock a Buy, According to Analysts?

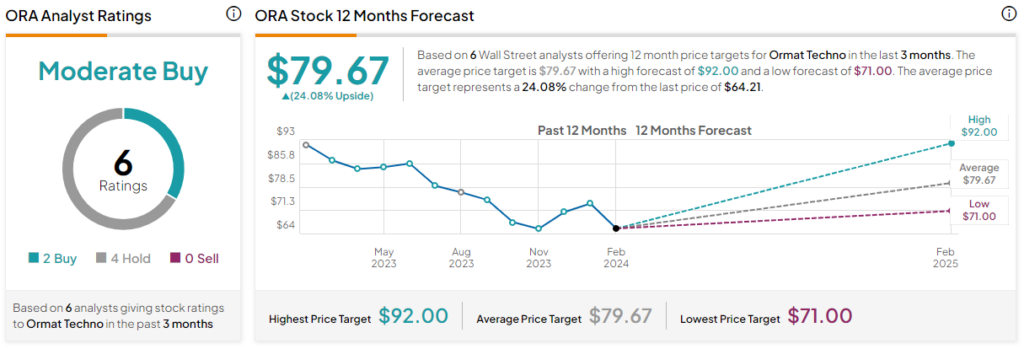

Turning to Wall Street, ORA stock has a Moderate Buy consensus rating based on two Buys, four Holds, and zero Sell ratings. The average ORA stock price target is $79.67, implying 24.1% upside potential.

The Takeaway: ORA Stock Could Take Advantage of a Competitive Misfortune

Although geothermal energy represents only a small portion of the globe’s electricity generation, the sector could get renewed interest due to the uranium sector’s supply shortage. Further, because this industry represents a clean and renewable energy source, Ormat could benefit from political realities. To be fair, ORA stock isn’t trading at a discount. However, short traders may have pushed the needle too far, setting up the possibility of an unexpected bounce back.