Markets got off to a rocky start in the first two sessions of 2024, kicking off a shortened trading week with sharp losses on the S&P 500 and the NASDAQ. These losses come after the S&P index finished 2023 just a half-percent away from its all-time record level, set on January 3, 2022. While not an ideal start to the year, there’s still a sense that this is a breather, a break from the prolonged rally that started this past October.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Supportive factors in the market news include the Fed’s recent indications of a shift toward interest rate cuts in the offing and the solid results from the recent Q3 earnings season. Oppenheimer’s chief investment strategist John Stoltzfus notes that the improving economic data backs up perceptions that the Fed’s efforts to bring down the rate of inflation are succeeding, and that headwinds may subside this year.

“Our expectations are for further upside in stock prices this year,” Stoltzfus wrote, “supported by the aforementioned fundamental improvements which helped get the markets out of the funk they’d been driven to in 2022. That said 2024 will of course be its own year with issues carried over from last year mixed in with the challenges that are developing as the calendar turns the page…”

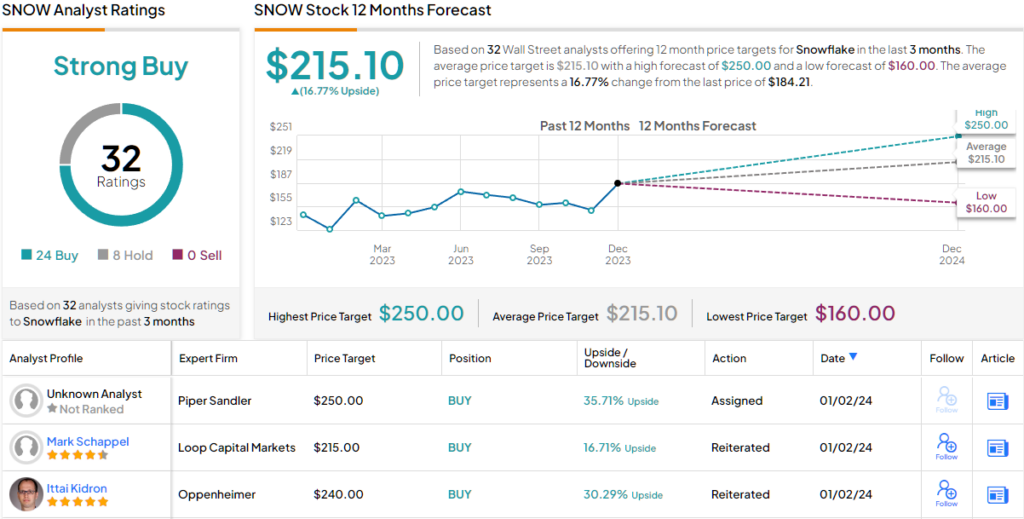

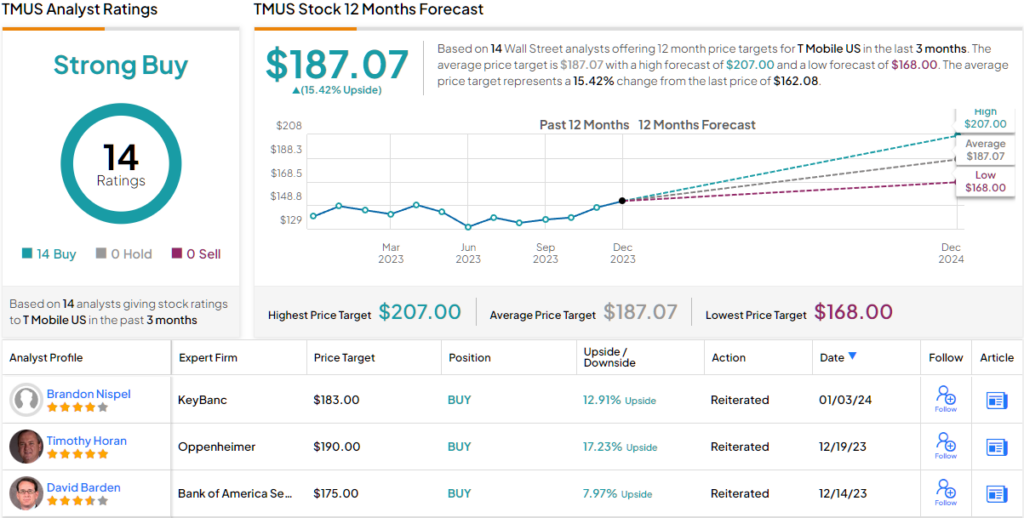

Against this backdrop, Oppenheimer analysts have singled out two top picks for 2024, so we decided to give them a closer look. According to the latest data from TipRanks, they both hold ‘Strong Buy’ ratings from the rest of the Street. Let’s take a closer look.

Snowflake, Inc. (SNOW)

We’ll start in the world of data management and analytics, where Snowflake has taken a lead as a provider of data-as-a-service, taking the popular as-a-service subscription model and applying it to cloud-based data services software. Snowflake’s ‘Data Cloud’ brings the power of public cloud services and a global network to bear on data management, so that customers – even small customers – can reap the benefits of nearly unlimited scale for maximum efficiency.

With the Data Cloud, enterprise users can unite their siloed data records, share data across business segments, get the most efficient use of up-to-date data analysis, and make all of this seamless across multiple public cloud systems. Snowflake makes this possible through its unique platform, giving solutions to multiple facets of data management. The company aims for a world in which data access makes it possible for organizations of all sorts to meet their ongoing opportunities.

While all that sounds like a mouthful, what it means at the bottom line is Big Business. Snowflake boasts some 8,500 enterprise customers, including 436 that generate more than $1 million each in trailing 12-month product revenue and another 647 that are members of the Forbes 2000 list. As of the most recent data available in 2024, Snowflake’s platform handles more than 3.9 billion daily queries, and the company has over $3.7 billion in remaining performance obligations, or the work backlog, on the books.

Snowflake’s shares have outperformed the S&P 500 in the past year, gaining some 38% in the last 12 months compared to the index’s 24% appreciation. The company supported its share growth with solid financial metrics in its last reported quarter, 3Q of fiscal year 2024. The top line, total revenue, was up 32% year-over-year to $734.2 million, and beat the forecast by over $20 million. The revenue total was driven by a 34% y/y increase in product revenue, which came in at $698.5 million.

The company’s earnings, the non-GAAP EPS figure, came in at 25 cents, more than double the 11-cent figure from the prior-year quarter. The fiscal 3Q24 EPS was 9 cents better than had been expected.

For Oppenheimer’s 5-star analyst Ittai Kidron, this background represents just part of the story. Setting out his case for this company, Kidron lists several reasons that the Montana-based data firm should have a good year.

“We highlight Snowflake as one of our top picks for 2024. We see multiple tailwinds that can deliver upside for the year and to next year’s outlook. These include: (1) an improving macro environment, less intense cloud optimization activities that can drive consumption growth; (2) expanding market presence within the Federal vertical; (3) a rise in compute consumption with upcoming new products (Dynamic Tables, native apps framework, Unistore, Snowpark Container Services, etc.); and (4) growing adoption of AI/ML capabilities (Snowpark, Horizon, Cortex, Document AI, etc.). While shares have bounced back in 2023 , we believe they do not fully capture the upside to expectations and are reasonably priced when accounting for ~30% top-line growth and 27% FCF margins,” Kidron wrote.

The analyst, who is rated by TipRanks among Wall Street’s 50 best stock pros, puts an Outperform (i.e. Buy) rating on SNOW shares, and his $240 price target suggests the stock has an upside of 30% for the next 12 months. (To watch Kidron’s track record, click here)

The Strong Buy consensus rating on this stock is backed up by 32 recent reviews from the Wall Street analysts – reviews that break down to 24 Buys over 8 Holds. The shares are trading for $184.21, and their $215.10 average target price points toward ~17% gain on the one-year time horizon. (See SNOW stock forecast)

T-Mobile US (TMUS)

Next up is one of the largest companies in the US telecom and tech scenes, T-Mobile. This modern telecom provider, founded in 1994, has become the nation’s leader in providing 5G wireless services – and is the only wireless network provider to offer 5G across the whole of the Lower 48, as well as in Alaska, Hawaii, Puerto Rico, and the US Virgin Islands.

Along with its solid lead in the 5G market, T-Mobile is working to improve its position in the US rural and business wireless markets. Each of these offers a substantial addressable market – on the order of 50 million households for rural wireless, and over 50 million corporate liable lines in the business arena. The company aims to achieve a 20% market share in these sectors by 2025. At the same time, T-Mobile is looking to add between 7 million and 8 million new customers to its high-speed internet service, a market with $90-plus billion in annual industry revenues.

The scale of this company can be seen in a single number: 117.9 million. That was T-Mobile’s total customer count at the end of 3Q23. It was a record high for the company and reflected gains in all segments. Notable among those were the 557,000 net high-speed internet additions, for a total of 4.2 million high-speed internet customers, and the 1.2 million postpaid net customer additions. The company also saw 850,000 postpaid phone net customer additions.

The gains in raw customer numbers were good, but the company generated some mixed results on the financial side. The company saw total revenues of $19.25 billion for the quarter, a total that included $15.9 billion in total service revenues. The top line missed expectations, however, and came in $120 million below the forecast.

The bottom line showed a better outcome. T-Mobile brought in a GAAP EPS of $1.82, up $1.42 per share from the prior-year quarter. This was year-over-year growth of 355%, the best in the industry. The 3Q23 EPS also beat the forecast by 10 cents per share. The company’s free cash flow was also strong. The adjusted FCF of $4 billion was up 94% year-over-year, another instance of best-in-industry growth.

Taken together, this caught the attention of Timothy Horan, another of Oppenheimer’s 5-star analysts. Horan took care to point out T-Mobile’s lead in the 5G realm and its solid cash flows, writing of the company, “TMUS remains ahead of peers on its 5G build and coverage and continues to gain share in rural and enterprise… TMUS remains our top pick in wireless and is set to see strong FCF per share growth and has a healthy balance sheet with low leverage. We think TMUS will have the opportunity to take more pricing action in 2024, particularly for FWA which it has hinted at. We maintain our positive outlook on TMUS as the network and value leader which has driven outperformance vs. peers in the 5G-era; however, we see its lead beginning to narrow as VZ/T wrap up their C-Band deployments.”

Looking ahead, Horan gives TMUS an Outperform (i.e. Buy) rating, and he sets his price target at $190 to imply a one-year upside potential of 17%. (To watch Horan’s track record, click here)

This solid leader in the US wireless and telecom business gets a unanimous Strong Buy consensus rating from the Wall Street analysts, based on 13 recent positive stock reviews. The shares’ $162.08 current trading price and $187.07 average target price together suggests a potential upside of ~15% by the end of this year. (See TMUS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.