Optimism in the air. The S&P 500 is up 4% so far this year, and the Q4 earnings results – we’re about halfway through the reporting season – have been better than expected. The conventional wisdom, and hints from the Federal Reserve, say that interest rates will start coming down later this year, and there’s a growing belief that the economy may have dodged the recession bullet.

In his recent market strategy note, Oppenheimer’s chief investment strategist John Stoltzfus describes the current mood well, writing, “Resilience remains the operative word in our view and something economic data and corporate earnings results have managed to show so far. Our expectations remain for the Fed to remain watchful for data that could justify a rate cut when it can feel the time is right. We expect it will most likely do such in the second half of the year (and perhaps as late as the fourth quarter) and at that with just two cuts. We remain positive on equities…”

Stoltzfus’s last statement raises a question, however: just which equities investors should consider buying?

Some of Oppenheimer’s top-rated analysts are tackling that very issue, and their answers may surprise you. They’re picking out some under-the-radar stocks that show significant upside potential – in one case, as much as 518% for the year ahead. With potential gains like those, investors should investigate further. Let’s dive in and use the TipRanks database for some extra color regarding these stocks’ possible trajectory.

Sensata Technologies (ST)

We’ll start with a mid-cap industrial technology company, Sensata. This firm is a specialist in sensor systems, particularly in the automotive industry. The company has business offices and operations in 16 countries around the world, and its product portfolio includes more than 3,000 individual items, from brake pedal force sensors to pressure switches, and everything in between. The company’s product lines have applications in automotive technology, electrification, and even air mobility, as well as the heavy vehicle and marine industries, and HVAC technology.

In short, Sensata is a complex and high-tech engineering firm, bringing industrial and manufacturing know-how into the digital world. Sensors are a fascinating technology, and Sensata has built a solid business on them, but they are only part of the story. It’s one thing to gather data, and another to use it. Sensata’s INSIGHTS makes available data-based solutions for IoT, so that users can optimize their supply chain management from end-to-end. The service includes supply chain and logistics monitoring, worksite and assets monitoring, telematics, and a cloud platform to tie it all together, so that businesses can see their big picture.

On the financial side, Sensata has just reported 4Q23 earnings, dialing in mixed results. At the top-line total, revenue reached $992.5 million, representing a 2.2% year-over-year drop, but edging ahead of consensus by $13.58 million. However, at the other end of the equation, adj. EPS of $0.81 fell short of analyst expectations by $0.05.

Oppenheimer analyst Christopher Glynn recently saw reason to bump up his stance on this stock, citing several reasons for his upbeat take. He writes of ST, “Our upgrade focuses on significant ramp in new business wins over the past several years, capital allocation pivot to debt reduction, and solid positioning for margin performance. ST is the leading independent global sensors player, with ~55% sales into automotive markets, low 20%s HVOR (heavy vehicle/off-road), ~25% Industrial, aerospace, appliance/ HVAC, other.”

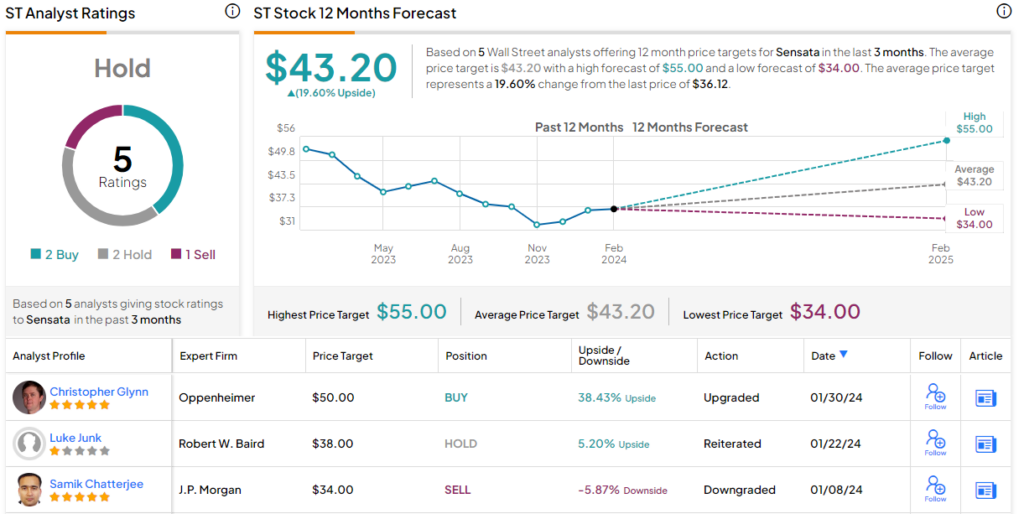

These comments support the 5-star analyst’s Outperform (Buy) rating, while his $50 price target points toward a one-year share appreciation of 38%. (To watch Glynn’s track record, click here)

While the Oppenheimer view here is upbeat, Wall Street generally is more cautious. Sensata’s stock has a Hold rating from the analyst consensus, based on 5 recent reviews that include 2 Buys, 2 Holds, and 1 Sell. That said, the shares are priced at $36.12 and their $43.20 average price target suggests a 20% upside for the year ahead. (See Sensata stock forecast)

Pinstripes Holdings (PNST)

From industrial tech we’ll shift gears and look at the restaurant industry. Pinstripes is an Italian-themed bistro chain, with 15 locations in 9 states. The restaurant offers Italian-American menus for lunch and dinner, as well as other entertainments – bowling and bocce ball if your party decides to take a break from the meal. Private event rooms are also available, as are catering services featuring breakfast, lunch, pizzas, and flatbreads.

This laid-back, casual ‘dinertainment’ chain went public on the first day trading day of this year, January 2, after completing a SPAC transaction with Banyan Acquisition Corporation. The business combination was announced in June of last year, and the PNST ticker debuted on Wall Street with the New Year. Pinstripes raised $70 million in cash as part of the transaction. Looking ahead, Pinstripes has another 6 locations under construction.

This newly public stock has already caught the eye of Oppenheimer’s Brian Bittner, one of the Street’s top analysts, ranked in the top 3% overall. Bittner is impressed by Pinstripes’ unique combination of eatery and entertainment venue, and sees that as a path forward for the company. He is also attracted to the relative discount in the stock’s current price. Bittner writes, “PNST represents an intriguing and more speculative investment opportunity within the attractive ‘eatertainment’ category. The company is armed with robust unit economics and proven portability as it enters a growth inflection aimed at scaling its profitable EBITDA model… PNST is down [68%] since its 1/2/2024 debut, which we believe is primarily driven by investor concerns related to its de-SPAC capital structure (i.e., high-cost debt, warrants). This has created an interesting risk/reward, if mgmt successfully executes its new unit opening strategy and achieves our financial forecasts.”

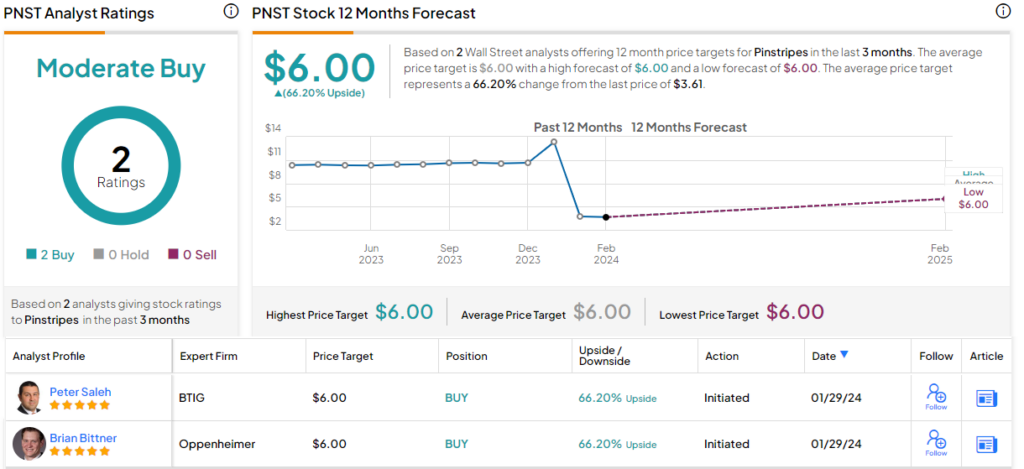

Bittner goes on to initiate his coverage of these shares with an Outperform (Buy) rating, and he complements that with a $6 price target that implies a 66% potential gain in the next 12 months. (To watch Bittner’s track record, click here)

While there are only 2 recent analyst reviews on this stock, they both agree that PNST is a stock to Buy, making the Moderate Buy consensus rating unanimous. The average price target is $6, matching Bittner’s objective. (See Pinstripes’ stock forecast)

Jasper Therapeutics (JSPR)

The last stock we’ll look at here is Jasper Therapeutics, a biotechnology company focused on developing new medications from mast cells and stem cells. Stem cells are so-called basal cells, cells that are found in various areas throughout the body and act as precursors to the more mature cellular structures that we’re composed of. Mast cells are a form of white blood cell, found in connective tissue throughout the body. Both mast and stem cells have important functions in the immune system and in repairing damage to the body.

Jasper has created briquilimab, a targeted anti-c-Kit monoclonal antibody that is specially designed to impact both mast and stem cells. The drug candidate can deplete mast cells and diseased stem cells, and has been demonstrated to enable safer and more effective stem cell transplants. Briquilimab acts in different ways on different types of cellular targets. As an anti-c-Kit agent, the drug candidate blocks the interaction of SCF and c-Kit, and permits an orderly cell death in mast cells. In disease conditions driven by disorders of mast cells, the drug candidate has been shown to have an anti-inflammatory action by removing the underlying source of the inflammatory response.

Because stem cells are so fundamental to so many biological processes, briquilimab has multiple potential indications – and Jasper is studying the drug candidate as a potential treatment for numerous diseases. Targeted conditions include chronic spontaneous urticaria (CSU), lower to intermediate risk myelodysplastic syndromes (MDS), severe combined immunodeficiency (SCID), sickle cell disease (SCD), Fanconi anemia (FA). This list includes several life-threatening conditions, and briquilimab has shown promise in early studies. An initial data readout from the Phase 1b/2a study of briquilimab in CSU expected in mid-2024.

Jasper’s shares trade on the NASDAQ, and earlier this year the company initiated a 1-for-10 reverse stock split in order to increase the share price to remain in compliance with NASDAQ’s minimum share price requirements. The split was made effective on January 4. Existing shareholders received 1 new share for each 10 shares previously held (a holder of 100 shares would now have 10), without reducing the value of the shareholding.

This is a pre-revenue company that runs at a net loss – but that hasn’t stopped analyst Jay Olson, in his note for Oppenheimer, from laying out a sound future for the stock. Olson, a 5-star analyst, believes that this year will see catalysts for briquilimab as a value-generator, and he says of the company, “Following our recent meeting with management, we’re increasingly optimistic about JSPR heading into 2024. We think the company has made significant progress following strategic re-prioritization for briquilimab a year ago and see 2024 as an inflection year for briquilimab value-creation as we await key study readout in CSU expected mid-year. With recent dynamics of other MoAs including the CRL for dupilumab, mixed data of remibrutinib, and setback of lirentelimab, we remain optimistic on the c-Kit mechanism in CSU and potentially additional mast cell-driven diseases with clinical PoC provided by barzolvolimab.”

“We update our model to reflect JSPR’s recent reverse stock split and reiterate our Outperform rating as we continue to see significant upside potential heading into the mid-year CSU update,” the analyst went on to add. (To watch Olson’s track record, click here)

That Outperform (Buy) rating is backed by an $80 price target that indicates his confidence in a truly robust one-year upside potential of 518%. Olson’s is the only recent analyst review on file for JSPR, which is currently trading at a price of $12.95. (See Jasper’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.