Okta, Inc. (NASDAQ:OKTA), a global leader in the identity solutions sector, has come under pressure in recent weeks due to a major security breach, triggering a market sell-off that likely presents a good opportunity for investors who have been waiting on the sidelines.

On October 20, Okta’s Chief Security Officer David Bradburry acknowledged in a blog post that Okta’s support case management system had been accessed by an unauthorized user. The hacker was able to view files uploaded by some customers as part of support cases. Despite the short-term pressures resulting from this security breach, Okta seems well-positioned to grow in the long term. Therefore, I’m bullish on OKTA stock.

Okta’s Response Will be Scrutinized by Customers and Analysts

In the cybersecurity sector, hackers gaining unauthorized access to client accounts is not uncommon, but at the same time, these events can leave a long-lasting impact on a security solutions provider. In addition to the security breach, stakeholders often pay attention to the company’s response to the breach and the support extended to prevent similar occurrences in the future. Okta’s initial response to the alerts it received about this security breach does not seem satisfactory at first glance.

BeyondTrust, a security company that is also a customer of Okta, claimed in a blog post recently that it alerted Okta of a potential security breach on October 2. BeyondTrust claims to have prevented an unauthorized user from gaining access to an in-house Okta administrative account. Okta, in return, alerted its customers about this breach weeks later, which does not paint a good picture of the company.

Okta is currently investigating this incident to find the root causes and formulate a strategic response to prevent such security breaches from happening in the future.

Long-Term Growth Potential Remains Intact

Okta operates as an identity and access management (IAM) solutions provider within the broad cybersecurity market, and the company has been able to climb the ladder in recent years to emerge as a leader in this space. This is a fast-growing market, with Grand View Research projecting the market to grow at a CAGR of 13% through 2030.

The growth of this market will be driven by the increasing cloud adoption on a global scale, which is forcing both small and large-scale enterprises to take measures to prevent their data from being accessed by unidentified users.

IAM solutions offer many benefits to organizations, including the ability to automatically delete inactive accounts, detect policy violations, and remove unwanted access privileges on an ongoing basis.

Okta offers two main types of IAM solutions: workforce identity solutions, allowing a company’s employees to access both in-house and cloud-based company resources, and customer solutions, allowing the customers of a company to access relevant resources securely.

Aided by the ongoing digital transformation that has boosted the demand for zero-trust applications, Okta’s revenue has grown in leaps and bounds from just $41 million in 2015 to almost $2 billion in 2022. The company’s success in the last few years is a testament to its ability to penetrate the identity management market, and the stellar growth ahead for this market paints a promising long-term picture for Okta.

Some of Okta’s recent customer wins validate the company’s strong footing in the market. OpenAI, the parent company of ChatGPT, uses Okta’s identity cloud solutions for authentication processes, which gives an indication of how Okta remains to benefit from the rise of generative AI applications in the future.

Some of Okta’s noteworthy customers include Apple (NASDAQ:AAPL), CVS Health (NYSE:CVS), and Chevron (NYSE:CVX). Billion-dollar enterprises choosing Okta to secure their identity access frameworks is a vote of confidence in the technology deployed by the company.

Is OKTA Stock a Buy, According to Analysts?

Okta has come under pressure from Wall Street analysts, with the company suffering from its second major security breach within just two years. Earlier this year, Okta’s systems failed to prevent the attacks on MGM Resorts International (NYSE:MGM) as well, adding worries to the company’s ability to remain a leader in the identity access solutions sector.

Evercore ISI analyst Peter Levine, in a note to clients, claimed that Okta’s short-term pipeline will be negatively impacted by the recent security breach, thereby forcing analysts to revise their revenue estimates for Fiscal 2024 and 2025. Citigroup (NYSE:C) analyst Fatima Boolani also raised concerns about the potential for reputational risk resulting from the security breach.

With analysts striking a negative tone, Okta stock may remain under pressure in the foreseeable future due to a series of potential negative earnings revisions for the current and next fiscal year.

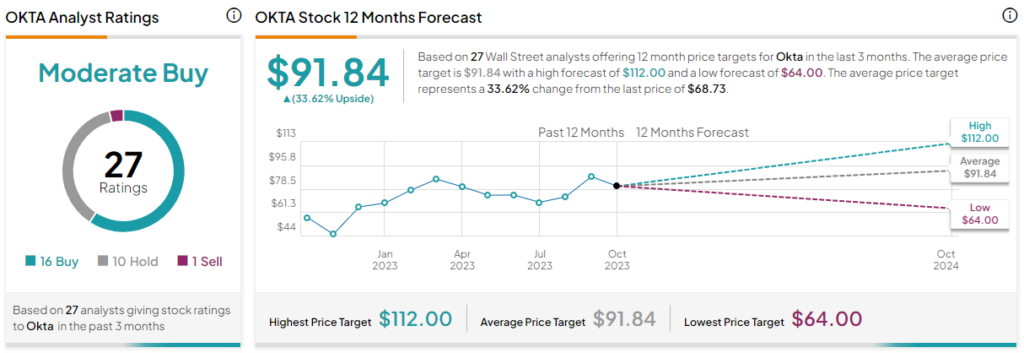

Based on the ratings of 27 Wall Street analysts, the average Okta price target is $91.38, which implies upside of 33.6% from the current market price.

The Takeaway: Okta Looks Attractive

Okta is becoming increasingly attractive as the market plays a blind eye to the company’s long-term prospects while focusing on the short-term impact of the recent security breach. Investors, however, will have to stomach some pains in the short term as the company navigates a challenging few months that will be characterized by its response to the security breach and the potential loss of business resulting from this security event.

Still, while there are concerns regarding Okta’s short-term market and financial performance, the company seems well-positioned to thrive in the long run, potentially enjoying competitive advantages resulting from its growing scale. I believe the recent market sell-off presents an opportunity for long-term-oriented investors to gain exposure to Okta at a meaningfully cheaper valuation compared to just a few weeks ago.