From $115 a week ago, to just $34 and change as of today’s close, investors in First Republic Bank (NYSE:FRC) have been taken on a wild — and terrifying — ride this past week.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ever since SVB Financial blew up last week, taking down Signature Bank with it, investors in regional banks such as First Republic have wondered if the same issues that killed two regional banks already — ill-considered investments in long-term Treasury bonds that are losing value as interest rates rise — could trip up their own regional bank stocks next. In fact, according to The Wall Street Journal, First Republic’s issue is that it has secured mortgages on its balance sheet worth only $117.5 billion at present, but booked at $136.8 billion in value — creating a $19.3 billion “fair-value gap” that’s three times bigger than First Republic’s entire market capitalization.

Management’s repeated insistence that First Republic possesses “strong capital and liquidity positions,” a “well-diversified deposit base,” and “over $60 billion of available, unused borrowing capacity at the Federal Home Loan Bank and the Federal Reserve Bank” hasn’t convinced investors that it’s safe to continue banking with First Republic.

But here’s something that might.

This afternoon, in an exclusive report, the Journal confirmed that a consortium of all the country’s biggest banks — JP Morgan, Citigroup, Bank of America, and Wells Fargo — along with many of its smaller banks — Morgan Stanley, Goldman Sachs, U.S. Bancorp, PNC, and Truist among them — are getting together to give First Republic a $25 billion capital injection. This money would both shore up First Republic’s balance sheet, and also give it liquid cash with which to pay back depositors as they exit.

In theory, this should accomplish at least two things. First, it should ensure that depositors (who leave) can get their money back, potentially heading off a broader run on the nation’s banks. At the same time, it should reassure depositors (who stay) that they’re not missing their last chance to get their money back — and that it’s safe to leave it in First Republic’s vaults.

So good news for First Republic.

More broadly, though, the rescue effort — details of which are still being worked out — gives the rescuing banks the opportunity to do well (for First Republic) by doing good (for themselves). These other banks are inheriting a tidal wave of depositors fleeing First Republic, after all, and these are good customers, and good credit risks. WSJ notes that First Republic is famous for catering to “wealthy individuals and businesses, primarily on the coasts.” Meta founder Mark Zuckerberg himself apparently banks with First Republic (or at least he used to).

As they depart First Republic to open accounts at JP Morgan, et al, they’re bringing along money that the rescuing banks can then turn around and use to save First Republic. And if shoring up First Republic does succeed in preventing a broader bank run, these rescuing banks may inoculate themselves from suffering bank runs of their own.

Granted, there are still i’s to be dotted and t’s to be crossed, and details a-plenty to be nailed down. But for the time being at least, investors seem relieved to see the nation’s banks working together to contain the contagion — and First Republic shares are bouncing back strongly, up 10% today.

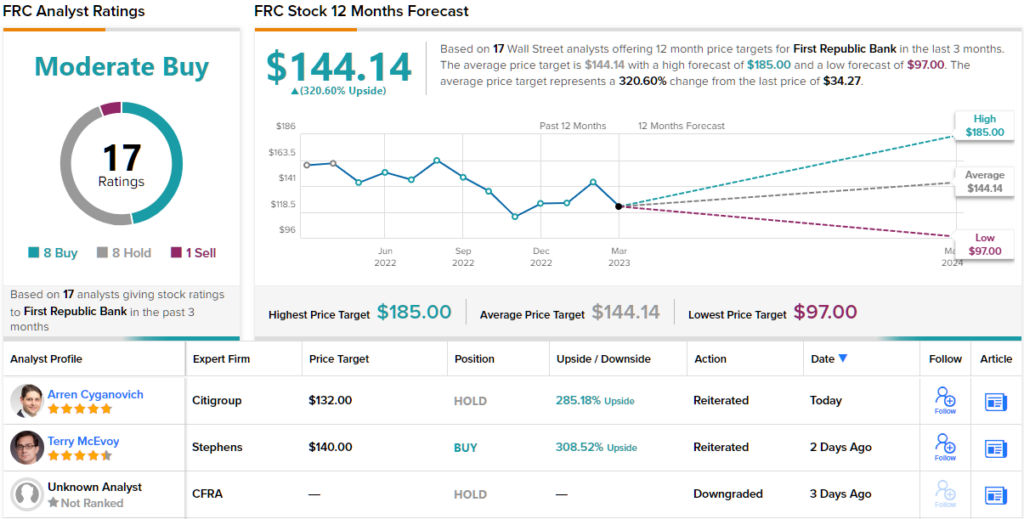

Turning to the analyst community, opinions are mixed. With 8 Buys, 8 Holds and 1 Sell assigned in the last three months, the word on the Street is that FRC is a Moderate Buy. At $144.14, the average price target implies a whopping 320% upside potential. (See FRC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.