Shares of tech giant Nvidia (NASDAQ:NVDA) have lost substantial value this year. A slowdown in growth and overall selling in tech stocks weighed on its share price. Despite the decline, NVDA stock has negative signals from hedge funds, corporate insiders, and retail investors, implying the stock could remain pressured in the short term.

But before reaching a conclusion, let’s examine why Nvidia stock is down and what’s on the horizon for its investors.

Why Is Nvidia Share Price Falling?

Nvidia manufactures ICs (integrated circuits) and high-end GPUs (graphics processing units). It witnessed an overwhelming demand for its products, leading to a rally in its stock price. Come 2022, Russia’s invasion of Ukraine, COVID-led restrictions in China, and macro weakness across many parts of the world weighed on Nvidia’s growth and dragged its stock down.

It’s worth mentioning that NVDA stock has lost over 50% of its value this year alone. While macro and geopolitical headwinds continue to play spoilsport, the U.S. government’s hardened stance to prevent technology transfers to China (including Hong Kong) and Russia and the new license requirement for exports to these countries further pose challenges.

What Is the Prediction for Nvidia Stock?

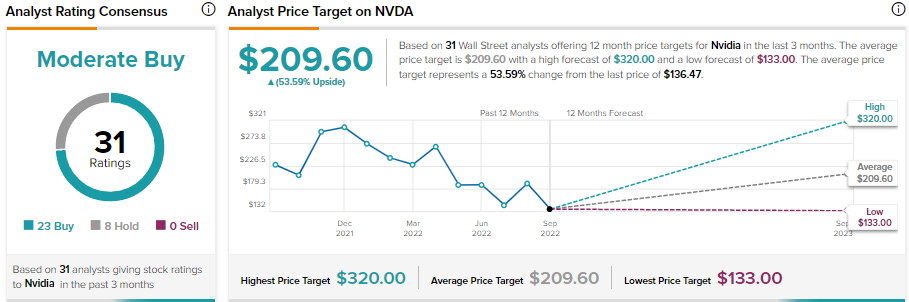

Analysts remain cautiously optimistic about Nvidia’s prospect, given the increase in headwinds and a slowdown in its business. NVDA stock sports a Moderate Buy consensus rating on TipRanks based on 23 Buys and eight Holds. Further, due to a noteworthy decline in its price, NVDA’s average price target of $209.60 implies 53.6% upside potential.

Moreover, as stated above, hedge fund managers, corporate insiders, and retail investors have lowered their exposure to NVDA stock.

Hedge funds sold 417.9K NVDA stock last quarter. Meanwhile, insiders sold NVDA stock worth 36M during the same period. Also, 0.8% of investors holding portfolios on TipRanks lowered their exposure to NVDA stock in the last 30 days. Overall, NVDA stock carries a Neutral Smart Score of four out of 10.

Bottom Line: Ongoing Headwinds to Limit Upside in the Short Term

The U.S. government’s license requirement for exporting its A100 and forthcoming H100 ICs to China and Russia, continued sales decline in the gaming and professional visualization segment, a slowdown in the data center revenues, and supply constraints could limit the upside in NVDA stock in the short term.

Read full Disclosure