The world runs on energy; just think about how much of your life depends on the little outlets in the walls. For now, the bulk of our power generation capacity is supported by fossil fuels, mostly coal and natural gas, that are pulled out of the ground. Long-term, however, the social and political pressures on fossil fuels are reducing their use, and will reduce it further. Despite huge subsidies, wind and solar power simply cannot replace the lost capacity, and we will have to find it somewhere.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

One solution, within reach now, is nuclear power. Yes, the spent nuclear fuel will have to be disposed of, with huge radiation safeguards – but on the positive side, nuclear power plants emit no pollutants, have a tiny footprint compared to wind or solar installations, and produce a tremendous amount of usable energy at high levels of efficiency.

These facts point toward a simple conclusion: nuclear power facilities are going to start expanding. There is simply no other way to generate the electricity we need – to maintain basic services and to expand the use of electric vehicles – while reducing fossil fuels.

This hasn’t passed unnoticed by mining industry experts. Heiko Ihle of H.C. Wainwright is following the uranium producers, and he sees two stocks in particular that are reaping strong benefits from the positive outlook on the metal. We’ve used the TipRanks platform to find the latest details on these two names. Let’s take a closer look..

Don’t miss

- J.P. Morgan Sees at Least 60% Gains in These 2 ‘Strong Buy’ Stocks — Here’s Why They Could Soar

- ‘Buy the Dip’: Analysts Say These 2 Beaten-Down Stocks Offer a Compelling Entry Point — Here’s Why They Could Rebound

- Oppenheimer Isn’t Ready to Abandon Its S&P 500 4,900 Target Just Yet — Here Are 2 Stocks That Could Lead the Way

Ur-Energy, Inc. (URG)

First on our list of uranium stocks is Ur-Energy, a small-cap uranium mining company operating in Wyoming. The company engages in mining and recovery operations, and its full range of activities includes the acquisition, exploration, and development of uranium mineral properties, as well as actual mining operations.

These operations were currently focused on two land holdings in Wyoming. Ur-Energy had been working on the Lost Creek Project since 2013, and since starting production there, the company had produced 2.7 million pounds of uranium. The company had plans to open up 12 mining areas at Lost Creek.

The second main operating area was the Shirley Basin Mine Site, also in Wyoming. Ur-Energy was working to restore this old mining area, which was active from the 1960s to the 1990s, to production status. The company had obtained the required permits, registrations, and licenses, and reported that it was ‘construction ready’ to develop the mining infrastructure in the holding.

In addition to these main holdings, Ur-Energy was also in the early stages of exploration at several other sites in the Great Divide Basin of Wyoming.

Earlier this week, the company released its 3Q23 results. Management described a positive uranium market for mining companies, as demand was outpacing production. The company currently had cash assets of $54.6 million and was predicting revenues for the period 2023 through 2028 to reach $220 million. For the first nine months of this year, the company sold a total of 190,000 pounds of usable U3O8 at an average per-pound price of $62.56.

Among the bulls is H.C. Wainwright’s Heiko Ihle, who outlines several reasons why Ur-Energy is an attractive investment opportunity for investors: “We remain confident in URG’s capabilities to ramp-up its Lost Creek project. In addition, maintain our favorable view on the company’s sales agreements. Management is currently in discussions with three companies in the global nuclear industry for additional sales agreements, while the executive team remains confident that a deal could be met with all three entities during 4Q23. Longer-term, we expect there to be increasing necessity and incentive to bring the firm’s Shirley Basin project online assuming the company proves successful in building out its contract book.”

Ihle wraps up his review of this company by pointing out its high production potential, particularly important at a time of strong demand pressures, saying, “In conclusion, when looking to meet growth in uranium demand, we highlight that Lost Creek’s wellfield is permitted and licensed for an annual recovery of up to 1.2Mlbs of uranium, while Shirley Basin holds a licensed capacity of 1.0Mlbs.”

For Ihle, this adds up to a Buy rating for the stock, and his $2.80 price target indicates potential for a 72% upside in the next 12 months. (Watch Ihle’s track record)

Currently, this stock is selling for $1.63, and its average price target of $2.35 suggests a 44% increase on the one-year horizon. The shares have a Moderate Buy consensus rating based on 2 recent positive analyst reviews. (See URG stock forecast)

Energy Fuels (UUUU)

Next on our list is Energy Fuels, a $1.2 billion company whose activities encompass uranium mining and exploration, as well as milling and processing. Energy Fuels is the leading producer and processor of fuel-grade uranium in the US, a position that will only grow more profitable as demand for nuclear fuel increases in the coming years. In addition to uranium, Energy Fuels also produces vanadium and is moving into the rare earths niche, with the goal of rebuilding the position of the US in this vital supply chain.

At the operational level, Energy Fuels has four working uranium mines, seven development projects, and the only operational uranium mill in the US. The company has sold 380,000 pounds of uranium as of the end of Q2 this year, at an average price of $60.01 per pound – and realized a gross margin of 56%. The company expects to add 180,000 pounds of U3O8 to that total by the end of this year.

Energy Fuels’ operations generated a total of $6.8 million in revenue during the second quarter of this year, the last quarter reported. This top line came in $900,000 better than had been expected and was up 6% year-over-year. The firm’s bottom-line figure, an EPS loss of 3 cents per share, was in line with expectations. The company is expected to release earnings figures for Q3 on November 3, and the forecast is for $5.7 million at the top line.

Once again, we check in with H.C. Wainwright’s Heiko Ihle, who is upbeat on Energy Fuels. The analyst is particularly impressed by the company’s continuing efforts to expand its production and output, as he writes, “Looking ahead, we expect the firm to continue generating revenue from uranium sales… Additionally, the company has made further progress in preparing four of its conventional uranium and uranium/vanadium mines in order to resume ore production. In preparing UUUU’s operations, significant workforce expansion, rehabilitation, and development of surface and underground infrastructure have been ongoing over the last several months… Looking ahead, the firm is actively making necessary investments in order to put one or more of its conventional facilities into production as soon as late-2023.”

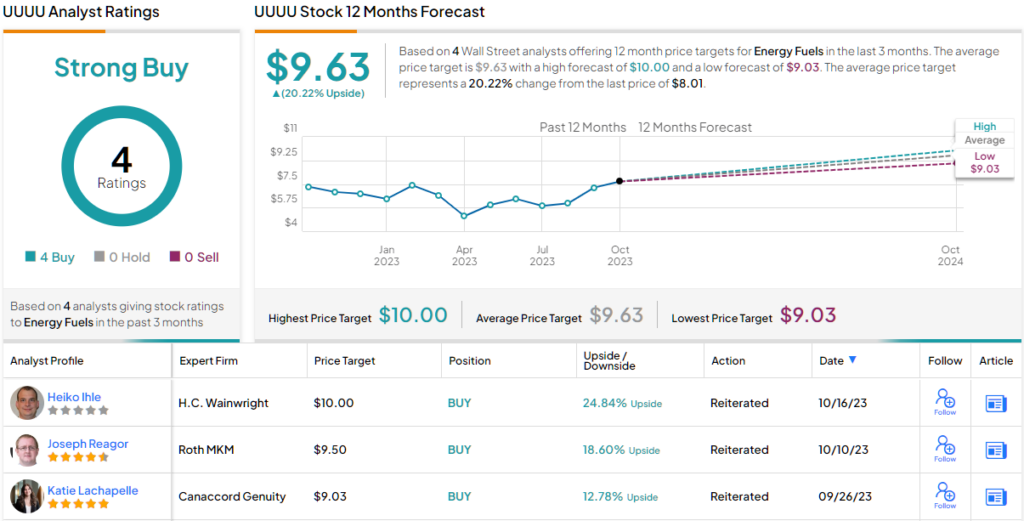

This stance backed up Ihle’s Buy rating on UUUU shares, and his $10 price target implies a one-year upside potential of 25%.

Overall, shares in UUUU have a Strong Buy rating from the Street’s analyst consensus, based on 4 positive reviews set in recent weeks. The stock is selling for $8.01 and the average price target, now at $9.63, suggests an upside of 20% going into next year. (See Energy Fuels’ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.