“The world is changing: I feel it in the water, in the earth, and in the air,” wrote Tolkien of the aftermath of the War of the Ring.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

We’re not living in an epic fiction, but change is definitely in the air. Our world is shifting towards a more chaotic multi-polar geopolitical reality, and economies are making a difficult switch from easy-money policies to more fiscally restrained regimes. For investors, the immediate effect is felt in stubborn inflation, high interest rates, and an uncertain market environment.

But for the stout-hearted and the risk-friendly, these transitional moments offer solid opportunities for staking out just the right portfolio. At least that’s the opinion of the strategy team at investment giant JPMorgan.

“For investors this is an empowering moment in many ways, and it requires action – building smarter portfolios for a world in transition,” the strategists wrote. “With the economy and asset markets in flux, portfolios themselves may also need to also make a transition… Today we believe that a 60/40 allocation (60% equities, 40% bonds) can once again form the bedrock of portfolios. But there is so much more to explore beyond the 60/40. Markets now appear to be offering a promising and diverse opportunity set, whatever your return targets or risk tolerance.”

The analysts at JPMorgan have quantified this outlook, and picked out plenty of stocks that are ready to gain 60% or better in the months ahead. We’ve opened up the TipRanks database to pull the details on two of these JPM picks. Let’s take a closer look.

Don’t miss

- ‘Buy the Dip’: Analysts Say These 2 Beaten-Down Stocks Offer a Compelling Entry Point — Here’s Why They Could Rebound

- Oppenheimer Isn’t Ready to Abandon Its S&P 500 4,900 Target Just Yet — Here Are 2 Stocks That Could Lead the Way

- J.P. Morgan Is Looking for the Silver Lining in the Current Market Headwinds — Here Are 2 Stocks the Banking Giant Likes Right Now

Aptiv PLC (APTV)

We’ll begin in the automotive hub of Detroit, where Aptiv, a leading global technology company, has been at the forefront of innovation in the automotive industry. The company is a descendant of the Detroit auto parts stalwart Delphi. In 2017, Delphi split off its powertrain and aftermarket parts segments to focus all operations on automotive tech platforms, on-road computing and networking, and the software architecture for autonomous and/or connected vehicles. This new focus on car-tech was rebranded, and Aptiv was born.

Today, Aptiv has a presence in 48 countries, where it operates 11 technical centers and 131 manufacturing facilities. The company employs more than 200,000 people, addressing the toughest challenges of the mobility economy, using deep software and systems integration to enable the transition to the software-defined vehicles of the future. These vehicles will combine electrification with intelligently connected software architectures, and Aptiv is at the heart of the shift.

The automotive industry is increasingly shifting toward high-tech integration. We can see this in the promotion of electric vehicles, as well as the development of connected autonomous vehicles. All of this requires exactly the technology – software, computer control systems, high-end networking – that Aptiv specializes in. The company’s focus on this niche has been profitable, and in the last quarter reported, 2Q23, Aptiv brought in $5.2 billion at the top line, up 28% year-over-year and $340 million above the forecast. At the bottom line, the company’s $1.25 in non-GAAP earnings per share beat expectations by 23 cents.

Writing from JPMorgan, analyst Ryan Brinkman sees plenty to like here. He writes, “Our rating considers Aptiv’s attractive product and geographic exposures and cost-base profile as well as its strong balance sheet and strong free cash flow generation providing opportunities to pursue accretive acquisitions and/or shareholder-friendly activities. Aptiv provides investors an opportunity, through its business segments focused on Electronics & Safety and Electrical/Electronic Architecture, to leverage the strongest secular growth themes within the automotive industry, namely the mega trends of electrification of vehicles and increasing penetration of active safety, autonomous driving features, and connectivity.”

Getting to his own bottom line, Brinkman comes to a bullish conclusion for investors: “We expect significant growth over the market and high margins and returns to continue to reinforce the high quality of Aptiv’s business segments to investors.”

Brinkman’s comments on APTV back up his Overweight (i.e. Buy) rating, and his $145 price target implies a solid 67% upside potential for the coming year. (Watch Brinkman’s track record)

Overall, Aptiv has 11 recent analyst rating on file, with a split of 10 Buys, 1 Hold, and 1 Sell giving the stock a Strong Buy consensus rating. The average price target of $132.27 suggests a one-year gain of 52% from the current trading price of $86.98. (See APTV stock forecast)

TDCX, Inc. (TDCX)

Based in Singapore, TDCX, the next JPMorgan pick, specializes in delivering high-end customer experience business process outsourcing services to its enterprise clients, providing the tech and human intelligence needed to build customer loyalty and expand online communities. The company works with a wide range of clients in sectors from digital advertising to social media, fintech to gaming, e-commerce to online streaming. The firm is known for its expertise and has a strong presence in the Asia-Pacific region, where it has become the go-to BPO provider for the region’s high-growth companies.

A few numbers will set the stage for a look at TDCX. The company operates in over 40 languages, has won more than 340 industry awards, and employs more than 15,000 people worldwide. In the first half of this year, TDCX recorded 96% of its revenue from the Asia-Pacific region, a region with a reputation for fast-growing economic expansion. Furthermore, TDCX is targeting a significant market opportunity – the outsourced customer experience market is expected to reach approximately $100 billion globally by 2025.

For now, TDCX is reporting strong results as it strives to maximize its share of that market. The company reported $126.5 million in revenue for 2Q23, marking a 5.5% year-over-year increase, although it slightly missed the forecast by $3.8 million. At the bottom line, the company’s EPS of 15 cents remained flat year-over-year but exceeded the estimates by a penny. TDCX’s financial results are supported by solid growth in its client base – the company reported a 52% year-over-year increase in its total client numbers, rising from 60 in June of last year to 92 as of June 30 this year.

The solid earnings report and TDCX’s industry footprint formed the base for JPM analyst Ranjan Sharma’s review of the company. Sharma wrote, “We believe TDCX’s roster of industry leaders is likely to drive a healthy revenue CAGR of 8% over FY23-26E revenues. These revenues are coming with industry-leading profitability. TDCX’s EBITDA margin of >25% compares to its peers at <25% and its EBITDA/headcount of ~$10k compares to $3k- $9.6k (in 2021). Talent management is a moat for TDCX’s business. TDCX’s net cash position along with strong FCF raises prospects for M&A.”

Looking ahead, the analyst outlined a path for TDCX to navigate the headwinds it will be facing: “We believe TDCX’s depressed valuations are pricing-in business continuity concerns arising from GenAI. While we believe GenAI could result in price deflation and automation, we believe the impact to the CX industry should be offset by higher outsourcing. TDCX could also benefit from potential rise in content moderation of social media platforms.”

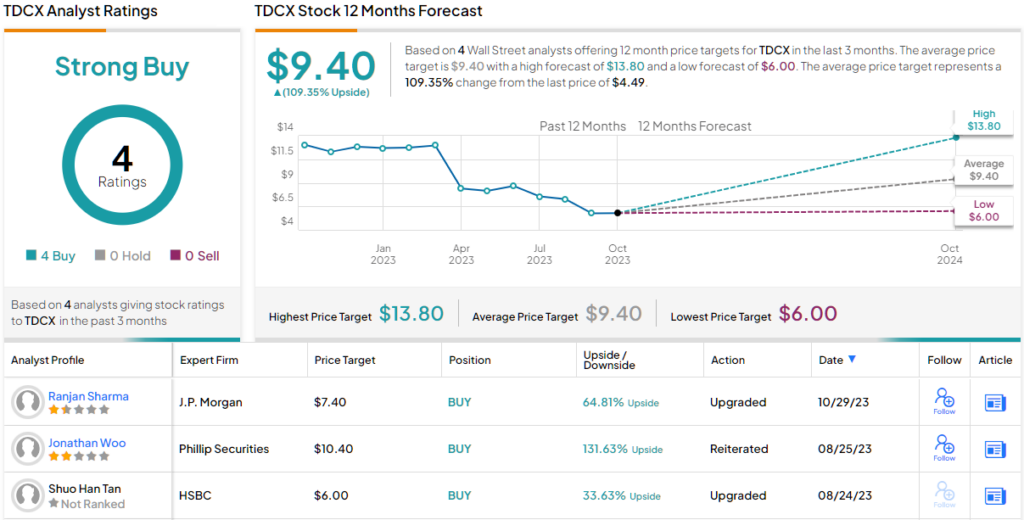

In Sharma’s view, all of this adds up to an Overweight (i.e. Buy) rating. His price target for TDCX, now set at $7.40, implies a one-year gain of ~65% for the shares. (Watch Sharma’s track record)

Overall, the Strong Buy consensus rating on TDCX is unanimous, based on 4 positive analyst reviews set recently. The shares are selling for $4.49 and the average target price of $9.40 is even more bullish than the JPMorgan view, suggesting a robust 109% upside for the next 12 months. (See TDCX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.