Novavax (NASDAQ:NVAX) stock hasn’t gotten a booster shot in 2023 yet, but it might end up recovering and even rallying before the year is over. I am bullish on NVAX stock because it’s the underdog vaccine stock that people are ignoring today but might obsess over soon.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered in Maryland, Novavax has been manufacturing a variety of vaccines since the 1980s. It’s somewhere between a small-cap and a mid-cap company (one might call it a “smid-cap”), with a market capitalization of ~$798 million.

Suffice it to say, Novavax hasn’t been the number-one vaccine maker in the U.S. and probably never will be. However, if you like to find underappreciated companies and stocks with multi-bagger potential, I invite you to learn more about Novavax.

Novavax: Definitely Not a Market Leader

Novavax certainly isn’t the leader of the U.S. vaccine industry. That title might go to a rival like Pfizer (NYSE:PFE) or Moderna (NASDAQ:MRNA). Those companies are much bigger and better-known than Novavax.

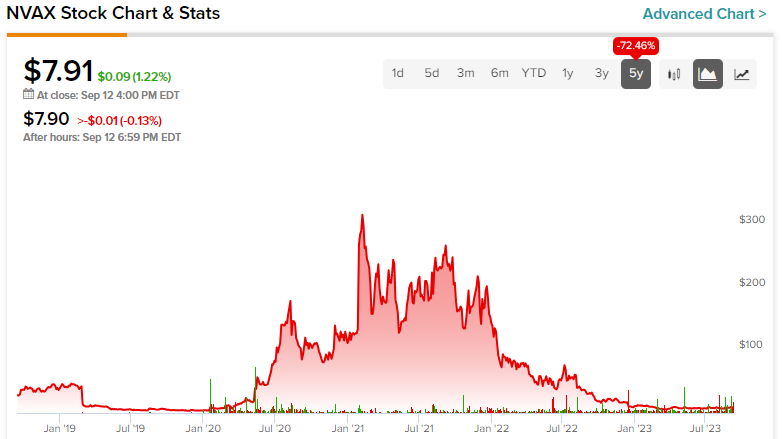

In 2020, Pfizer and Moderna grabbed large shares of the COVID-19 vaccine market before Novavax ever had a fighting chance to compete. However, look at the chart, and see what happened to NVAX’s stock price. It skyrocketed from $10 to a 2021 peak of around $300 because Novavax still participated in the rush to quickly manufacture vaccines.

In other words, Novavax stock could still have 2x, 3x, or even greater potential even though the company won’t be first to market. Could there be a repeat of 2020-2021 in 2023? It’s possible, as, unfortunately, there’s been a new wave of COVID-19 infections.

Recently, COVID-19 hospitalizations were up 16% in the U.S., and First Lady Jill Biden tested positive for COVID-19. Consequently, B. Riley analyst Mayank Mamtani declared that “The bottoming process to COVID vaccine stocks appears to be underway.” Mamtani could be right about that since school is just starting in the U.S., and infection risk is elevated.

Granted, Pfizer and Moderna already received approvals for their new COVID-19 boosters from the Food and Drug Administration (FDA). This doesn’t exclude Novavax from jumping into the fray with its own COVID-19 booster shot in the near future, however. After all, the Centers for Disease Control and Prevention (CDC) just called for widespread use of updated COVID-19 vaccines, so there’s no reason for the government to block Novavax from helping out.

A Checkup on Novavax’s Financial Health

Of course, I wouldn’t make a bullish call on NVAX stock unless Novavax was a financially-sound business. First and foremost, this is a profitable company with fast-growing revenue.

Here are the specifics. In 2023’s second quarter, Novavax generated $424 million in revenue, which is more than double the $186 million generated in the year-earlier quarter. In addition, Novavax greatly reduced its cost of sales from $271 million in Q2 2022 to just $56 million in this year’s second quarter.

Hence, Novavax demonstrated remarkable bottom-line improvement in the span of just a year. The company went from a net loss of $510 million in the year-earlier quarter to net income of $58 million in Q2 2023. Moreover, Novavax earned $0.58 per share during the quarter, easily beating the consensus forecast of a $1.33-per-share loss.

It might even be said that NVAX stock is exceptionally cheap right now. On a trailing 12-month basis, Novavax’s price-to-sales (P/S) ratio is 0.41x, and that’s much lower than the sector media P/S ratio of 3.72x.

Is NVAX Stock a Buy, According to Analysts?

On TipRanks, NVAX comes in as a Moderate Buy based on three Buys and one Sell rating assigned by analysts in the past three months. The average Novavax price target is $25, implying 216% upside potential.

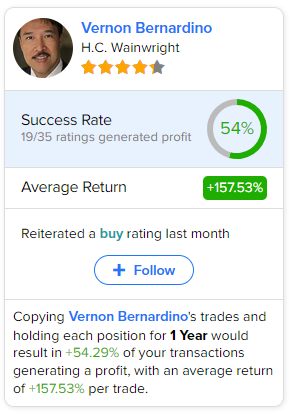

If you’re wondering which analyst you should follow if you want to buy and sell NVAX stock, the most accurate analyst covering the stock (on a one-year timeframe) is Vernon Bernardino of H.C. Wainwright, with an average return of 157.53% per rating and a 54% success rate. Click on the image below to learn more.

Conclusion: Should You Consider NVAX Stock?

I’ll admit — it’s risky to invest in Novavax. It’s a smaller company than Pfizer and Moderna, and Novavax can’t claim to be a market leader in delivering COVID-19 vaccines.

On the other hand, Novavax doesn’t have to be the first or biggest mover in the market. With a new wave of COVID-19 infections in the U.S. in 2023, Novavax has another chance to show what it can accomplish. Thus, investors with an appetite for risk should consider NVAX stock, as it could be a big mover.