Covid is back in the headlines again. Turns out first lady Jill Biden has tested positive for Covid-19, albeit suffering only from “mild symptoms.” Meanwhile, President Joe Biden’s test results have come back as negative.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, it’s not only at the White House where the coronavirus is making an unwelcome return. On the back of an upward curve that started toward the end of July, over the past week, Covid hospitalizations have witnessed a 16% uptick in the US. This spike comes against a backdrop of students heading back to school and ahead of a booster shot rollout with a fall vaccination campaign set to get underway.

While the news of Covid’s resurgence is a negative development for most, one group could stand to benefit: the formerly, hugely popular coronavirus vaccine stocks.

These are the firms that developed approved Covid-19 vaccines and saw their stock prices soar to giddy heights during the peak of the pandemic as investors piled in to ride the ‘coronavirus stock’ mania. Now, with a resurgence of cases dominating the headlines once again, is it time for investors to consider jumping back into coronavirus vaccine stocks?

Considering the post-pandemic pullback amongst these names, B. Riley analyst Mayank Mamtani certainly thinks so.

“The bottoming process to COVID vaccine stocks appears to be underway as the anticipated late summer/fall’23 COVID cases spike makes for the underappreciated view of stable demand picture via annual booster paradigm (similar to flu shots totaling 150M dose volume/year) at least in the niche elderly and high-risk population cohorts (50M+ dose volume/year),” Mamtani opined.

So, with this in mind, we opened the TipRanks database to dig up the details on two leaders in the Covid-19 vaccine field. Let’s see if the analysts think these are worth a punt right now.

Novavax, Inc. (NVAX)

If there’s one name that epitomizes the coronavirus stock trend more than any other, it might just be Novavax. In a little over a year, between the start of 2020 and 2021, the shares posted growth of a barley imaginable ~8,000% as investors/the public pinned their hopes on Novavax being the one to win the Covid-19 vaccine race.

Novavax’ vaccine (sold under the brand names Nuvaxovid and Covovax), did get eventual approval but it could be said it came a bit too late. After various issues delayed its market entry, the vaccine became the fourth to be authorized in the United States, but momentum had already been somewhat lost and sales proved disappointing. The result has been a stock that now sits a huge 97% below the all-time high reached in February 2021.

That said, the most recent quarterly report was promising with the company swinging to profitability. Novavax delivered net income of $58 million compared to a $510.5 million loss in the same period a year ago. That led to EPS of $0.58, easily trumping Street expectations of -$1.33. Meanwhile, boosted by rising demand of the Covid vaccine, revenue climbed 128% higher to reach $424.43 million, while beating the Street’s forecast by $165.44 million.

The company also said it began regulatory filings in the U.S. ahead of the launch for an updated jab targeting the Omicron XBB strain so it can be available for a fall booster shot campaign.

According to B. Riley’s Mamtani, the evolving Covid landscape could work in favor of this Gaithersburg, Maryland-based firm.

“Increased attention on emerging variants could meaningfully alter vaccine demand (perception), a key variable to reaffirming Street’s belief in NVAX’s FY23 revenue guidance of $1.3B-$1.5B,” said the analyst. “NVAX and peers MRNA/PFE have guided to a range of 2H23 vaccine demand expectations in the ballpark of 75-90M shots… Post 2Q print, we published a sensitivity analysis exploring U.S. demand, market penetration, and price/shot in context of NVAX meeting revenue guidance. Our analysis indicates NVAX could meet guidance if demand is as expected with 5% market penetration. Importantly, increased vaccination rates above current expectations improve chances of meeting guidance meaningfully.”

All told, Mamtani rates NVAX a Buy while his $15 price target implies ~70% upside from current levels. (To watch Mamtani’s track record, click here)

Elsewhere on the Street, the stock garners an additional 2 Buys and 1 Sell, for a Moderate Buy consensus rating. The average target is more bullish than Mamtani will allow; at $25, the figure makes room for 12-month returns of 183%. (See Novavax stock forecast)

Moderna, Inc. (MRNA)

If Novavax represents the coronavirus stock that delivered the heftiest returns to investors during the height of the pandemic, one other name can be considered the era’s biggest success. Moderna was a little-known biotech when the coronavirus became a growing concern but by the time the pandemic came to an end, it was a global household name.

That’s because unlike the delays that plagued the approval of Novavax’s offering, Moderna’s Spikevax was beaten to the approval finish line only by Pfizer/BioNtech’s offering with its mRNA vaccine instantly catapulting it into the big leagues.

While the company is advancing other vaccines – it anticipates a launch for its respective messenger-RNA-based RSV vaccine and cancer vaccine mRNA-4157 for melanoma in 2024 and 2025 – it has also suffered a big comedown and as Covid-19 has retreated so have the vaccine’s sales dwindled.

In Q2, revenue fell by almost 93% year-over-year from $4.7 billion to $344 million, although the figure still came ahead of the analysts’ forecast by $38.44 million.

Additionally, its R&D expenses and SG&A costs increased, and the biotech delivered a net loss of $1.4 billion vs. net income of $2.2 billion in the year-ago period. Still, EPS of -$3.62 beat expectations by $0.48.

Looking ahead, Moderna boosted its sales outlook for the year from a minimum of $5 billion to between $6-8 billion, although gross margins are set to suffer with the new guide implying high 40%s compared to low 60%s previously.

These issues are recognized by RBC analyst Luca Issi, although on balance, Issi maintains confidence in the Moderna story.

“While we acknowledge that modeling the long term COVID tail remains challenging, we think the short terms dynamics are well appreciated given 2023 guidance ($7b at the mid-point) is actually above $6.5b consensus, and we now know that $1b in advanced purchasing agreements will contribute to 2024 (vs $5.9b consensus),” Issi explained. “On gross margin, MRNA reiterated that unpredictable volume is compressing margins, but they remain confident that margins will re- expand back to 75-80% once volume becomes more predictable…”

These comments underpin Issi’s Outperform (i.e., Buy) rating on MRNA, which is backed by a $190 price target, suggesting shares will push 75% higher over the coming year. (To watch Issi’s track record, click here)

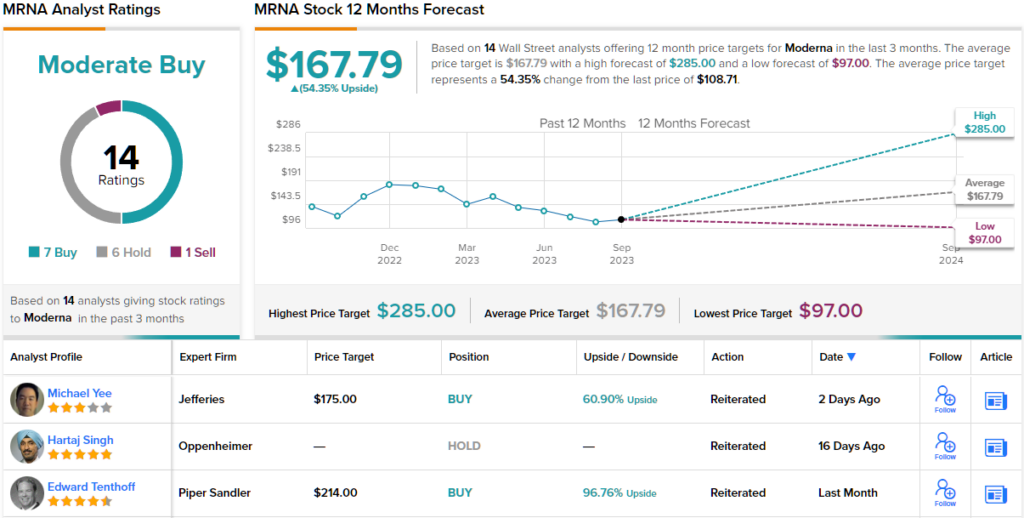

Overall, 6 other analysts join Issi in the bull camp and with an additional 6 Holds and 1 Sell, the stock claims a Moderate Buy consensus rating. Most analysts consider the shares meaningfully undervalued at current levels; at $167.79, the average target implies gains of 54% lie in store for the year ahead. (See Moderna stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.