It’s been a challenging 2022 for Nike (NYSE:NKE) stock investors, but a blow-out second quarter report has investors buzzing over its future. The demand slowdown experienced in key markets might have been difficult, but it’s allowed Nike to restructure its inventory levels in preparation for the coming holiday season. This should position the company well going into 2023 when demand will rise again across China, the U.S., and other far-reaching global markets that promise great returns for its shareholders. Hence, we are bullish on NKE stock’s prospects for the coming year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

NKE stock seems to be on the rebound, with its shares gaining over 18% in the past three months. The sportswear giant benefitted from a cooler-than-expected inflation report, strong second-quarter results, and good news out of China.

Nike has proven its worth with a decade-long streak of raising its dividend. Moreover, Nike recently increased its dividend by 11%, a testament to its long-term growth potential, moving closer to Dividend Aristocrat status. Additionally, with a payout ratio of just 35%, it still has plenty of room to grow its payouts.

This is especially admirable when considering that current earnings are down, demonstrating Nike’s unwavering commitment to providing quality products and rewarding shareholders with stable dividends.

Nike Delivers Strong Second Quarter Results

Nike delivered a stunner during its second-quarter results, shattering expectations on both its top-line and bottom lines. Revenue surged 17%, or 27% when adjusted for currency fluctuations, to $13.3 billion, while earnings per share improved by two cents to $0.85. Although pre-tax income increased by 10%, it was partly offset by the higher tax rate and markdowns due to inventory levels. Nevertheless, these results demonstrate that the company is in a position of strength as we advance.

While such drastic cuts are often detrimental to business, Nike made progress by liquidating excess merchandise and still delivered healthy growth in average selling prices for the quarter. The management’s effective inventory management has Nike well-positioned for continued success.

The company continues to thrive, even when the times have been difficult for much of the eCommerce sphere. The apparel giant saw an impressive 19% and 25% increase in wholesale and digital revenue, respectively. Moreover, sales from its China region are showing strong signs of recovery since the first quarter. Also, revenues outside the Greater China area grew by double-digit margins.

Nike Provided a Conservative Outlook

Management’s guidance for the rest of the year is mostly conservative. The Swoosh is taking a relatively measured approach and expects revenues to grow in the low teens. Moreover, it expects foreign currency headwinds to impact sales growth, which should also weigh down its gross margins.

Nevertheless, Nike’s recent performances have shown that it’s a step ahead of its competition. It expects healthy revenue expansion over the next couple of quarters while bucking broader macro headwinds compared to its peers. For instance, Adidas reported revenue growth of just 4% compared to Nike’s 27%.

Unsurprisingly, Nike is thriving and growing as the company continues to gain popularity among consumers through its iconic products and powerful brand name. The rising demand for its merchandise presents an enormous opportunity for growth. Even if a recession were to occur, Nike seems likely to remain one of the strongest players in its industry.

Is NKE Stock a Buy?

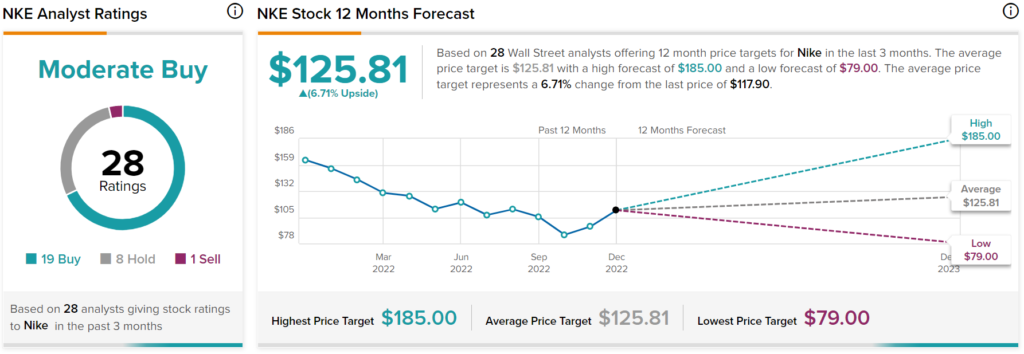

Turning to Wall Street, NKE stock maintains a Moderate Buy consensus rating. Out of 28 total analyst ratings, 19 Buys, eight Holds, and one Sell were assigned over the past three months. The average NKE price target is $125.81, implying 6.71% upside potential. Analyst price targets range from a low of $79 per share to a high of $185 per share.

Conclusion: Recession Won’t Cause Nike Significant Harm

Nike has been a powerhouse of a company over the past decade, and their latest earnings results have continued to showcase why. Despite the analyst community predicting a sizeable dip, Nike’s EPS held firm despite the headwinds. Moreover, a possible recession in 2023 will not cause significant harm to Nike’s bottom line. This is most likely due to the firm’s effective inventory management and robust brand equity that continues to shine despite consumer spending taking a substantial hit. Hence, it presents itself as an excellent bet at current price levels.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more