This month, several new Ethereum (ETH-USD) futures ETFs hit the market and began trading in the U.S. for the first time. These ETFs all invest in Ethereum futures contracts. Ethereum is the second-largest digital asset in the world, with a market cap of over $190 billion. After enduring a brutal bear market in 2023, Ethereum is up about 32% YTD. I’m bullish on the long-term future of Ethereum, and as we’ll discuss below, Ethereum ETFs can be a useful tool for investors who want to gain exposure to ETH.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What is Ethereum?

So, what is Ethereum anyway? Not only is it the second-largest and most popular cryptocurrency (after Bitcoin (BTC-USD)), but it is the largest proof-of-stake cryptocurrency. Ethereum.org explains that Ethereum is “a network of computers all over the world that follow a set of rules called the Ethereum protocol. The Ethereum network acts as the foundation for communities, applications, organizations and digital assets that anyone can build and use.”

It is a decentralized blockchain network that people can use to send and receive peer-to-peer payments, send and receive stablecoins and other assets, buy and sell non-fungible tokens (NFTs), and more. Users can even use Ethereum to create their own crypto tokens. Users can also “stake” their holdings to help process transactions and secure the network while earning interest for doing so. Ethereum has nearly 250 million users around the world.

What’s the Big Deal About an Ethereum ETF?

The appeal of an Ethereum futures ETF is clear — investors can now gain exposure to Ethereum through their brokerage accounts or retirement accounts without having to hold it themselves in a crypto wallet, a step that can be daunting for some investors. Ethereum ETFs also mean that these types of investors don’t have to open up a separate account on a centralized crypto exchange like Coinbase (NASDAQ:COIN) in order to invest.

Buying and holding Ethereum yourself involves some risks, as an individual can lose some or all of their holdings if they are hacked or if they interact with a malicious smart contract through a phishing link.

Furthermore, many investors lost the money that they had invested in crypto when centralized crypto exchanges like FTX, Celsius, and Voyager Digital imploded, meaning that leaving one’s holdings on an exchange isn’t necessarily a safe haven either. Investing in Ethereum via an ETF is thus an appealing option for investors, as it removes many of these risks.

Spot vs. Futures ETFs

It’s important to note that these ETFs invest in Ethereum futures contracts. They don’t directly buy and hold Ethereum. There are a number of applications out there for “spot” Ethereum ETFs that would do just that, but these have not yet been approved by the SEC, and it is unclear if they will be. Note that the SEC has approved a number of Bitcoin futures ETFs, but a spot Bitcoin ETF still doesn’t exist at this point in time.

It’s also important for investors to note that the price of futures contracts can differ from that of the underlying asset itself. So, for investors who are interested in investing in Ethereum in this way, what are the new options out there?

1. VanEck Ethereum Strategy ETF (BATS:EFUT)

EFUT is VanEck’s entry into this space. VanEck is a well-known traditional asset manager that has already launched several ETFs focusing on publicly-traded companies that are involved in cryptocurrency. EFUT has just under $8 million in assets under management and charges a relatively high expense ratio of 0.66%, but as you’ll see below, high fees are par for the course with this group of ETFs.

2. ProShares Ether Strategy ETF (NYSEARCA:EETH)

EETH is another option from what crypto investors would call a TradFi asset manager. EETH is a bit smaller than EFUT, with just $6.5 million in AUM, and is quite a bit more expensive than EFUT, with an expense ratio of 0.95%.

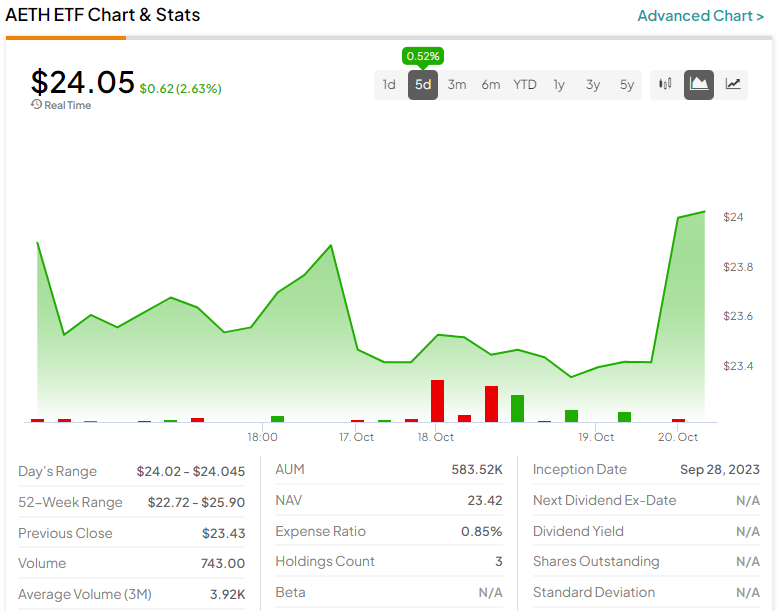

3. Bitwise Ethereum Strategy ETF (NYSEARCA:AETH)

The Bitwise Ethereum Strategy ETF has under $1 million in assets under management and charges an expense ratio of 0.85%. Bitwise has experience in the crypto space with several other crypto-related ETFs.

4. Bitwise Bitcoin and Ether Equal Weight Strategy ETF (NYSEARCA:BTOP)

This is another offering from Bitwise, and it’s an interesting one, as it is a bit different from the names preceding it on this list. BTOP invests in both Ethereum futures contracts and Bitcoin futures contracts at an equal weighting. This makes it an effective choice for investors who want to invest in both Bitcoin and Ethereum in one simple and convenient vehicle. The only downside of BTOP is that, like AETH, it has less than $1 million in AUM and a relatively high expense ratio of 0.85%.

5. Valkyrie Bitcoin and Ether Strategy ETF (NASDAQ:BTF)

Like BTOP, BTF provides investors with equal-weight exposure to both Bitcoin and Ethereum. Interestingly, BTF predates the other ETFs here, as it was previously a Bitcoin futures ETF but has now changed its strategy to invest in both Bitcoin and Ethereum futures.

BTF is a convenient way to invest in both of the most prominent digital assets without having to pick winners. It’s also larger than many of the other ETFs on this list, with about $26 million in AUM (although, again, this is still relatively small). The main downside of BTF is that on a list of ETFs with high expense ratios, it comes in with the highest of all, with an expense ratio of 1.20%.

6. ProShares Bitcoin & Ether Market Cap Weight Strategy ETF (NYSEARCA:BETH)

The name is a mouthful, but this ETF from ProShares essentially gives investors exposure to both Bitcoin and Ethereum futures. Unlike BTOP and BTF, BETH is market-weighted, so it invests more in Bitcoin futures than in Ethereum futures. BETH has a relatively steep expense ratio of 0.95%, and it has just $1.2 million in AUM.

Looking Ahead

These ETFs are all relatively expensive, especially compared to simply buying and holding ETH in one’s own crypto wallet or account. They are also all relatively minuscule ETFs in the grand scheme of things and are susceptible to volatility, as Ethereum can be a volatile asset.

On the plus side, these ETFs enable investors to gain access to Ethereum in their brokerage and retirement accounts in a convenient and hassle-free way. This makes them a good option for risk-tolerant investors who are bullish on the future of Ethereum and want to invest in it but don’t want to set up and manage a crypto wallet or an account on a crypto exchange.

I am personally bullish on Ethereum and invest in it directly, but these ETFs are a sensible option for investors who are bullish but don’t want to do this. Of the current choices, I like EFUT the best, as it has the most assets under management of the Ethereum-specific ETFs (although it is still very small) and the lowest expense ratio of the group.

Down the road, it’s possible that the Ethereum ETF landscape could change over time if spot Ethereum ETFs are approved by regulators and if bigger asset managers launch their own ETFs with lower fees.