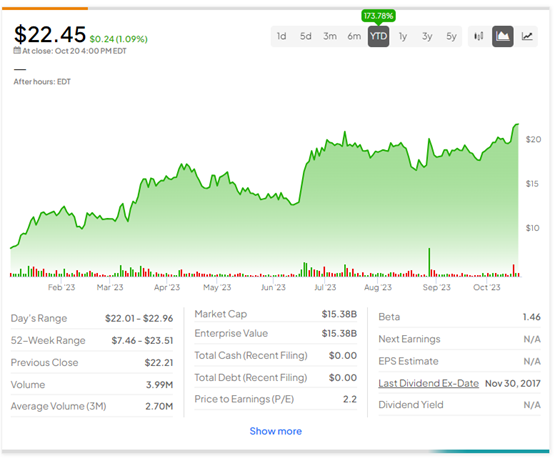

Grayscale Investments, an American cryptocurrency asset manager, is on track to launch the first spot Bitcoin (BTC-USD) ETF (exchange-traded fund) in the U.S. Grayscale is seeking to convert its existing $18 billion Grayscale Bitcoin Trust (OTCMKTS:GBTC) to a spot Bitcoin ETF as per a regulatory filing dated October 19. The Securities and Exchange Commission (SEC), which regulates the industry, had time until October 13 to appeal a court ruling to stop Grayscale but has decided not to do so. GBTC stock jumped as much as 3.3% following the news of the application.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As per the S-3 filing, Grayscale Bitcoin Trust’s shares are proposed to be listed on the NYSE Arca under the ticker symbol GBTC, after its conversion into a spot Bitcoin ETF is approved. Grayscale’s latest application follows an August ruling by the U.S. Court of Appeals for the District of Columbia Circuit, which questioned the SEC’s earlier decision to reject Grayscale’s application.

Bitcoin Futures ETFs are already traded in the market, and the court ruling argued that Grayscale’s application was in line with the Future’s ETFs. Meanwhile, the SEC’s approval for the renewed S-3 application will decide the fate of Grayscale’s spot BTC ETF application, as the regulator could reject it on other grounds. Interestingly, Grayscale also applied to convert its Grayscale Ethereum trust (OTCMKTS:ETHE) to a spot Ethereum ETF in early October.

What is the Future of GBTC?

The future of Grayscale Bitcoin Trust is uncertain at the moment as it mainly relies on the price movements of the underlying asset. Nevertheless, GBTC stock has zoomed 173.8% so far this year. At the same time, prices of the underlying crypto asset, Bitcoin have increased 71% year-to-date.