The big COVID gains that Netflix (NASDAQ:NFLX) shareholders enjoyed are gone, with the stock collapsing since highs around $700 in November 2021. For context, Netflix stock has shed over 62% of its value this year and is trading at a multi-year low of $226.19.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The significant decline in NFLX share price reflects the slowdown in growth. However, what sticks out is the loss of subscribers. Netflix announced that it lost 200,000 subscribers in Q1, compared to the addition of 2.5-4M subscribers previously projected by the company.

Netflix’s underperformance has weighed on the performance of billionaire investor Bill Ackman’s hedge fund, Pershing Square Capital Management. The hedge fund liquidated its investment in Netflix for a loss. In a letter to shareholders, Ackman stated, “The loss on our investment reduced the Pershing Square Funds’ year-to-date returns by four percentage points.”

While Ackman termed Netflix’s initiatives to reaccelerate growth as “sensible,” he finds it difficult to gauge the impact of these initiatives “on the company’s long-term subscriber growth, future revenues, operating margins, and capital intensity.”

It’s worth noting that the hedge fund acquired 3.1 million Netflix shares earlier this year. Back then, Ackman listed multiple factors, including its solid recurring revenue, content, and pricing power, among others, for his bullish stance on Netflix.

Now What?

Netflix blamed various factors, including competition, data costs, the uptake of connected TVs, and account sharing, for the slowdown. Moreover, the suspension of services in Russia also hampered its Q1 performance.

While Netflix is focusing on programming, password sharing, and advertising to reaccelerate its growth, the ongoing challenges could impact its Q2 performance in the short term, as reflected through its guidance. Netflix expects its subscriber base to contract further and register a 2% decline on a quarter-over-quarter basis.

In response to Netflix’s Q1 results, Wells Fargo analyst Steven Cahall stated, “1Q22 results debunked our thesis as negative net adds and slowing revenues put NFLX firmly on the defensive.” He added, “In a role reversal, NFLX now finds itself as the streaming incumbent facing emerging competition.”

The analyst sees password sharing to be revenue accretive. However, he added, “advertising is an 18-24 month build and the incrementality is uncertain.”

Cahall downgraded Netflix stock to a Hold from a Buy and lowered the price target to $300 from $600.

Bottom Line

Increased competition and macro headwinds suggest that more pain is ahead for Netflix. Further, its strategic initiatives would take time before positively impacting its financials. Also, a slowdown in growth and investments in growth will impact its margins.

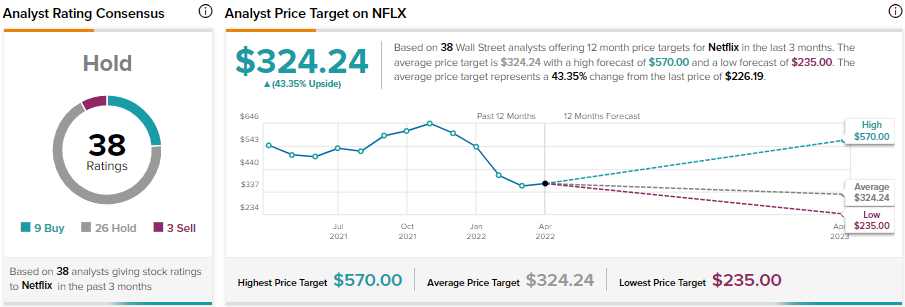

NFLX stock has received nine Buy, 26 Hold, and three Sell recommendations for a Hold consensus rating. Further, due to the significant decline in its price, the average Netflix price target of $324.24 implies 43.4% upside potential from current levels.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure