Could a Federal Reserve pause or pivot turn Netflix (NASDAQ: NFLX) stock into a sensation as disinflation kicks in? There’s no way to know for certain what America’s central bank will do. Nevertheless, I am bullish on Netflix stock ahead of the company’s earnings report as the company is cyclical, and when the U.S. economy recovers, NFLX stock should rebound sharply.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Netflix is known as the king of streaming companies, with a broad variety of legacy and original content. Yet, we can’t dismiss the competition in the streaming field, and of course, economic challenges made it difficult for Netflix to thrive in 2022.

Still, the coming year could prove to be outstanding for Netflix and its stakeholders. Even as a cyclical business, Netflix has been identified as a “safety” name by at least one prominent analyst. Yet, the potential for growth is still there, as an end to the current rate-hike cycle should put NFLX stock back into investors’ good graces.

Get Ready for an Earnings Beat with Netflix

It’s a great time to mark your calendar, as Netflix is set to report its fourth-quarter 2022 earnings data on January 19. Suffice it to say, Wall Street isn’t expecting much this time around – and that’s exactly why there’s a relief rally setup in the making.

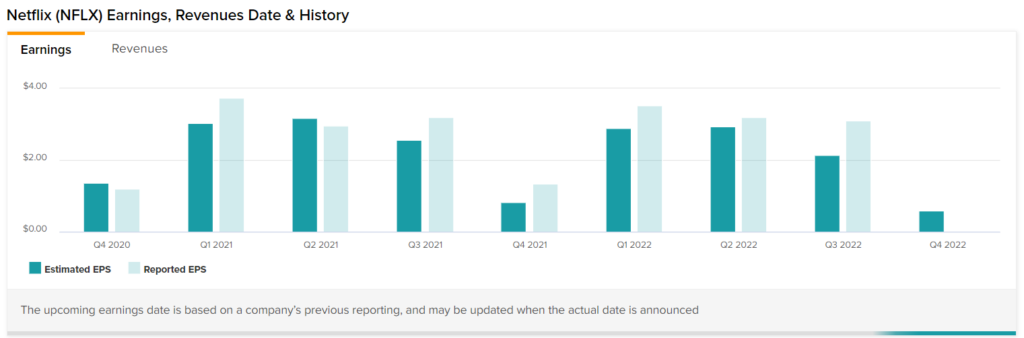

Impressively, Netflix has consistently exceeded analysts’ quarterly earnings expectations since the third quarter of 2021; some of those beats were by wide margins, too. Nonetheless, analysts aren’t expecting much from Netflix for Q4 2022.

For that quarter, Wall Street believes that Netflix’s earnings will come in at just $0.58 per share. That’s a vast fall-off compared to the prior three quarters, in which Netflix actually earned more than $3 per share per quarter.

Granted, the aforementioned challenges (competition, inflation, etc.) made it difficult for Netflix to grow its business in late 2022. However, should investors really believe that Netflix’s EPS shrank so drastically, from $3.10 in Q3 2022 to just $0.58 in Q4?

This, truly, is a relief rally waiting to happen. It takes guts to invest when expectations are so low, but that’s the crux of contrarian investing: buy before the crowd realizes they were wrong – or at least overreacting.

NFLX Stock Could Get a Kick-Start from Disinflation

If any word was the buzzword of 2022, it was “inflation.” It’s still on people’s minds, but December’s 6.5% annualized CPI print should give distressed NFLX stockholders the idea that, as the old saying goes, this too shall pass.

Just as economists had predicted, the U.S. inflation rate declined from 7.1% in November to 6.5% in December. In fact, inflation has consistently gone down for months, yet the market seems to be pricing in a hyper-inflationary future for America into NFLX stock.

It seems like forever ago, but Netflix stock traded at $500+ just a year ago; now it’s in the low-to-mid $300s. Don’t be scared by a terrific discount in a famous name like Netflix, and be grateful that you have an opportunity to buy shares in the company when its P/E ratio is 29.6x (it’s been much higher than that when seemingly everybody on Wall Street loved NFLX stock).

That valuation multiple could go much higher if the Federal Reserve taps the brakes on interest rate hikes. This won’t happen tomorrow or next week, but inflation is cooling off, and the Fed could engineer a “soft landing” for the economy in the coming months.

At the same time, NFLX stock could actually be viewed as a crisis hedge. At least, that’s what Jefferies’ five-star analyst Andrew Uerkwitz seems to be implying as he asserted, “With a potential recession looming, we are looking for safety and names that have downside de-risked” while recommending Netflix stock.

It’s interesting to consider that a cyclical business could also be considered a safe haven. In any case, Uerkwitz assigned an ambitious $385 price target to Netflix shares; now, let’s see what analysts generally expect from this stock.

Is NFLX Stock a Buy, According to Analysts?

Turning to Wall Street, NFLX stock is a Moderate Buy based on 15 Buys, 14 Holds, and three Sell ratings. The average Netflix price target is $308.81, implying 7.2% downside potential.

Conclusion: Should You Consider Netflix Stock?

Netflix deserves consideration from tech-sector investors with a contrarian approach, as a reversal in central bank policy could catalyze NFLX stock to the upside. Even before that happens, Netflix’s upcoming earnings event provides a prime setup for a positive surprise. With these considerations in mind, investors should definitely take a bullish stance on Netflix stock now.