Netflix, Inc. (NFLX) has witnessed its first quarterly decline in subscriber base in over a decade. Consequently, shares of the company declined nearly 35% on Wednesday. Overall, Netflix shares are down about 64% so far in 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This rapid erosion of the market cap has left major names on Wall Street staring at losses and corrections.

Major Names See Performance Dip

William Ackman’s Pershing Square Capital Management had lapped up over three million Netflix shares at the beginning of 2022. After Netflix shares recorded the largest one-day decline on Wednesday, Pershing offloaded its stake in the streaming giant.

Consequently, Pershing funds are down 2% in 2022. This puts the estimated loss for Pershing at about $430 million for this three-month bet.

In the exchange-traded fund (ETF) universe, funds focused on specific themes had the biggest exposure to Netflix. At the time, Invesco Dynamic Media ETF (PBS) and Communication Services Select Sector SPDR Fund (XLC) had exposure to Netflix of between 4 and 5%.

With a 5% weight, Netflix is among the top ten holdings of the Invesco Dynamic Media ETF. Its number of holdings is 30 and it has an expense ratio of 0.63%. While PBS has dropped by 18% so far this year, a major part of this drop, 11.8%, has come in the past month. The fund invests in media and entertainment, and communication services space.

The Communication Services Select Sector SPDR Fund has 28 holdings in the media and entertainment, communication services, telecommunication services, and diversified wireless telecommunication services spaces. It has an expense ratio of 0.1%, and Netflix makes up 4.59% of this ETF.

It is down 11.4% over the past month and has shed about 21.6% so far in 2022.

Cathie Wood Utilized The Dip

Meanwhile, Cathie Wood’s Ark Investment Management (ARKK) has used this Netflix-driven selloff to lap up shares of Roblox (RBLX), Roku (ROKU), and Unity Software(U). Interestingly, Ark completely exited Netflix in February 2022.

Analyst Take

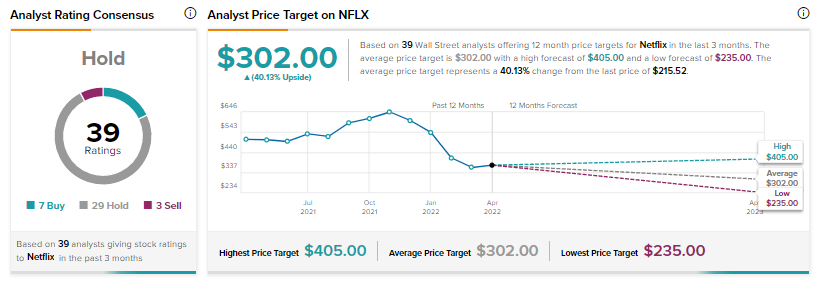

DZ BANK Ag analyst Manuel Muhl has lowered the stock’s rating to Hold from a Buy and set a price target of $280.

Overall, the Street has a Hold consensus rating on Netflix based on seven Buys, 29 Holds, and three sells. The average Netflix price target of $302 still implies a 40.1% potential upside.

Closing Note

The Netflix fall has impacted major names and funds on the Street while also leading to a broader selloff. Growing competition in the streaming space is expected to weigh on the stock. While the company is banking on advertising to regain its growth trajectory, the outcome of the strategy is uncertain and will take substantial time to play out.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Twitter Inks Crypto Payment Deal for Creators

NextEra Energy: Mixed Quarterly Results, Price & Supply Issues Continue

American Express Declines Despite Q1 Beat