Shares of Mullen Automotive (NASDAQ:MULN), an emerging EV (Electric Vehicle) maker, lost substantial value (down about 92%) in the past year. However, after hitting a 52-week low of $0.18, this penny stock has doubled (including a gain of about 92% in one month). While MULN stock has spiked on positive developments, worries about equity dilution and economic uncertainty could keep it volatile.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Last month Mullen Automotive announced that it received a purchase order for 6,000 EV cargo vans (Class 1) from Randy Marion Isuzu, LLC, a member of RMA, one of the largest dealer groups of commercial vehicles in the U.S. The purchase order is valued at about $200 million. Further, it signed a deal with Loop Global, an EV charging solution provider, to offer a comprehensive EV charging solution.

Also, Mullen’s I-GO (its commercial urban delivery EV) has arrived in Europe. Its exclusive sales and distribution agreement for I-GO in Europe offers revenue-generating opportunities and will promote the company’s brand.

Is MULN a Good Stock to Buy?

BlackRock’s (NYSE:BLK) latest 13F filing revealed that the asset management and investment company bought shares of Mullen Automotive. The recent developments and BlackRock’s confidence in the MULN shares are both encouraging.

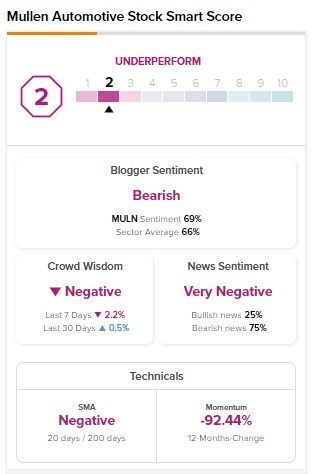

However, the stock could stay choppy as it is still in a developmental stage and might face challenges in accessing capital. Also, competitive headwinds could remain a drag. Meanwhile, MULN stock has an Underperform Smart Score of two on TipRanks.

Bottom Line

The favorable sector trends, the sharp decline in its price, and recent positive developments could support its stock. However, the stock could take investors on a roller coaster ride in the short term. Meanwhile, investors can use TipRanks’ Penny Stocks Screener to find attractive investments.