The latest 13F filing from BlackRock (NYSE:BLK) reveals that the asset management and investment company is bullish about penny stock Mullen Automotive (NASDAQ:MULN) and Helius Medical Technologies (NASDAQ:HSDT). It also increased its stake in Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) and Tesla (NASDAQ:TSLA). Meanwhile, it trimmed its stake in its biggest holdings, including Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Amazon (NASDAQ:AMZN).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

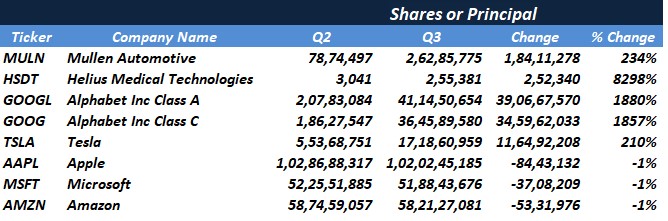

The table below summarizes BlackRock’s transactions in the above stocks in Q3.

Alphabet and Tesla

Using TipRanks’ database, we found that only Alphabet’s Class A and B shares are compelling investments. TipRanks’ Stock Comparison tool shows that the analyst community is bullish on Alphabet, and the stock carries a “Strong Buy” consensus rating on TipRanks. Also, its Class A and Class B shares have an Outperform Smart Score on TipRanks.

While Tesla stock has a Moderate Buy consensus rating on TipRanks, it has an Underperform Smart Score of one on 10 as supply chain, logistics, and cost headwinds have weighed on TSLA’s performance.

Mullen Automotive

Mullen Automotive stock has no analyst coverage on TipRanks. However, MULN stock carries an Underperform Smart Score of two. The EV (Electric Vehicle) maker has reduced its debt and is strengthening its balance sheet. Further, it has secured exclusive sales rights for I-GO (a compact urban delivery EV) in select European markets.

These positive developments have helped the MULN stock to recover from its lows. However, the stock is still down over 97% in one year. The company is still in a development stage, and concerns around access to capital and fear of equity dilution could continue to pressure the stock.

Helius Medical Technologies

Helius Medical Technologies stock has a Moderate Buy consensus rating on TipRanks. It’s worth highlighting that HSDT stock has crashed by over 96% in one year. However, Q3 was the first full quarter of commercial sales of its PoNS (Portable Neuromodulation Stimulator) device, which accounts for most of its sales.

Moreover, the company is upbeat and expects sales to continually increase quarter-over-quarter throughout 2023, reflecting benefits from the U.S. commercialization of PoNS. However, investors should note that HSDT is still in an early stage and a microcap stock, implying it can be highly volatile.

A Quick Look at BlackRock’s Q3 Portfolio Reshuffle

The 13F filing shows that BlackRock opened a new position in 184 stocks in Q3, including Healthcare Realty Trust (NYSE:HR), which has a Strong Buy consensus rating on TipRanks. Meanwhile, BlackRock closed positions in 236 companies during the same period.

Including the recent reshuffles, below are the top five holdings of BlackRock.

Bottom Line

BlackRock continues to be bullish on the shares of big tech companies, which could witness a steep recovery as inflation eases and the pace of interest rate hikes slows. Apple’s stock remains its biggest holding. Further, its top holdings are inclined towards tech and telecom companies, including Amazon, Microsoft, and AT&T (NYSE:T), which is a solid defensive play.

Also, it increased its stake in risky bets like Mullen Automotive, Helius Medical Technologies, and GameStop (NYSE:GME).

BlackRock’s portfolio value decreased to $2,940.26 billion at the end of Q3 from $3,117.36 billion at the end of Q2.

Find out which stock the biggest hedge fund managers are buying right now.