Enterprise companies are preparing for a possible recession, with many companies laying off hundreds of employees. On some level, cloud stocks can be somewhat resistant to a recession, although their stocks may be less so. In this piece, we compared two large cap software and cloud stocks. Oracle (NYSE: ORCL) is a fraction of the size of Microsoft (NASDAQ: MSFT), but both have announced layoffs in the last few months. However, Oracle’s stock has significantly outperformed Microsoft’s over the last month, and a closer analysis reveals why.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Microsoft (MSFT)

Microsoft was one of only two losers in the Dow Jones Industrial Average (DJIA) during a red-hot October with record gains for the index, while Oracle was up roughly 28%. Microsoft management warned about slumping computer sales with their most recent earnings report. While the company’s Cloud business appears to be solid, its other segments are likely to slow during the expected economic downturn. Thus, a neutral rating appears appropriate at this time.

Historically, Microsoft has been able to weather downturns reasonably well, but the recent warning about computer sales placed last quarter’s 14% year-over-year profit decline into context. Computer sales fell nearly 20% year-over-year in the last quarter, which took a bite out of Microsoft’s Windows licensing business, although the strength of its Cloud business helped ease some of that pain.

Google Cloud, Amazon Web Services, and Microsoft Azure hold over 75% of the cloud market, and that’s unlikely to change anytime soon. Additionally, Microsoft executives recently said gaming is “somewhat resilient” to economic weakness, as demonstrated by Microsoft having its best Xbox console calendar year ever in 2008 during the Global Financial Crisis.

Microsoft’s valuation has come down dramatically amid the current bear market, sending its P/E ratio down to around 24x. Between July 2020 and December 2021, Microsoft’s trailing P/E ratio was range-bound in the 35x to 40x range. Microsoft’s pullback was responsible for a significant chunk of the tech sector’s decline over the last week.

The three-year average P/E ratio for the tech sector is 37.5 times, although it’s currently trading at around 29x. The software industry as a whole is trading at a P/E ratio of around 48.6x versus its three-year average of 55.1x. Based on all these metrics, Microsoft looks undervalued, but given that a recession appears on tap, it puts everything into perspective.

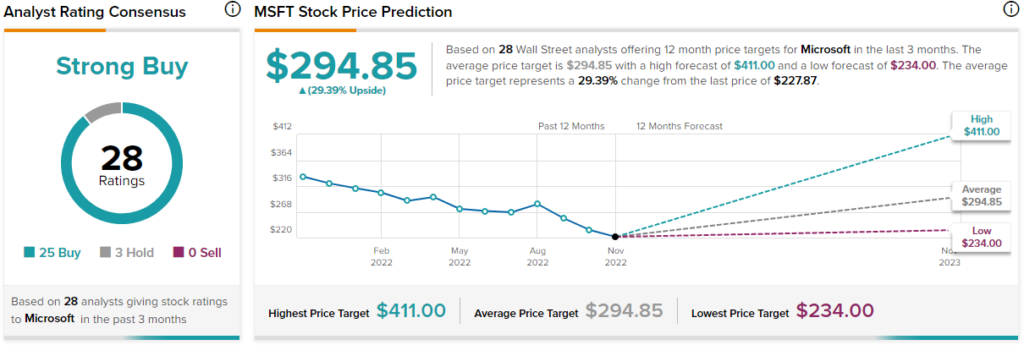

What is the Price Target for MSFT Stock?

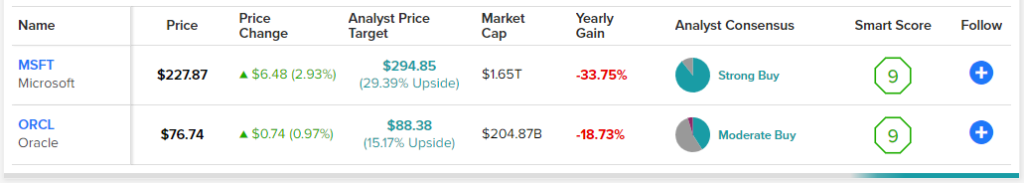

Microsoft has a Strong Buy consensus rating based on 25 Buys, three Holds, and zero Sell ratings over the last three months. At $294.85, the average price target for Microsoft implies upside potential of 29.4%.

Oracle (ORCL)

Oracle has been performing much better than Microsoft over the last month. Additionally, the company is more of a pure play on cloud and enterprise software, meaning it has fewer areas that could be a drag in a down economy. Further, its valuation is roughly in line with its history despite its Cloud growth. Thus, a bullish rating appears appropriate for Oracle at this time.

When Oracle released its fourth-quarter earnings results in June, it showed a 22% increase in Cloud revenue year-over-year, which boosted its total revenue by 10% year-over-year on a constant-currency basis (5% unadjusted growth). In the most recently completed quarter, Oracle reported a 50% increase in Cloud revenue year-over-year, demonstrating its resiliency at a time when many parts of the economy are starting to struggle.

A Microsoft executive reported recently that customers weren’t holding back on cloud purchases despite the industry slowdown. Oracle appears to be enjoying an outsized benefit from this trend since it doesn’t have extra businesses that will take a hit during a downturn.

Valuation-wise, Oracle is trading at a trailing P/E ratio of around 36x, displaying solid momentum in light of its Cloud growth. In 2020, during the pandemic, Oracle’s P/E was around 15x to 20x. Given the company’s steady Cloud growth and its stock’s momentum, it looks like there is more upside in the near term.

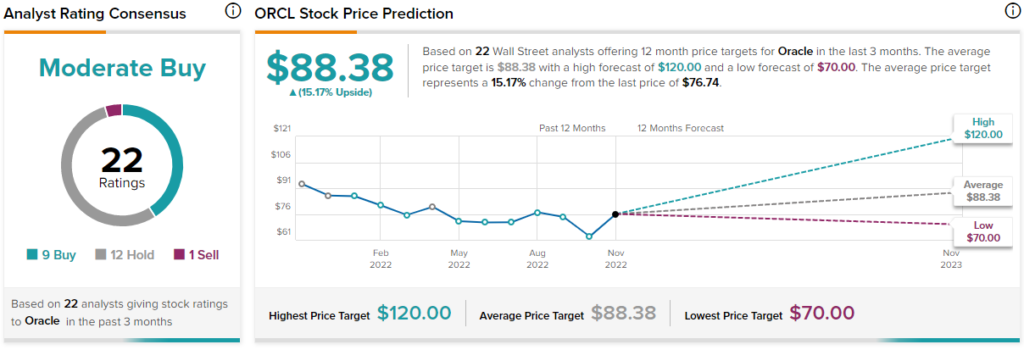

What is the Price Target for ORCL Stock?

Oracle has a Moderate Buy consensus rating based on nine Buy ratings, 12 Hold ratings, and one Sell rating over the last three months. At $88.38, the average price target for Oracle implies upside potential of 15.2%.

Conclusion: Bullish on Oracle, Neutral on Microsoft

It’s extremely difficult to choose between Oracle and Microsoft right now. Both Oracle and Microsoft are dividend stocks, and both are growing. However, Microsoft’s heft means slower growth from a much larger base, while Oracle enjoys much faster growth. In short, it could take time for Microsoft to return to its former glory, but Oracle’s Cloud business is soaring, potentially providing some upside left in the near term.