Investing in an economy that is on the verge of tipping into a recession can be frightening. TipRanks’s Analysts’ Top Stocks tool makes it simpler to choose stocks by offering a comprehensive view of the most recommended stocks currently on Wall Street. Marvell (NASDAQ:MRVL) and Walt Disney (NYSE:DIS) are two stocks that have been most recommended by Wall Street analysts over the past two days.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Marvell (MRVL)

Semiconductor company Marvell Technology is witnessing strong demand for its chips from the 5G infrastructure and data-center end markets. The company’s efficient supply-chain execution is helping it meet the strong demand for its Smart NICs and security adapters from cloud data centers.

Credit Suisse (NYSE:CS) analyst Chris Caso initiated coverage of Marvell with a Buy rating and a $56 price target. The analyst identified several company-specific growth drivers which are expected to fuel revenue growth in 2023.

Is MRVL Stock a Buy or Sell, According to Analysts?

Going into the Q3 results, which are expected to be out on December 1, various headwinds are keeping Caso’s expectations low. He believes that while the long-term view is undisputedly bullish, Marvell stock is not necessarily a Buy right before the earnings release. Rather, Caso suggests investors buy during a dip. MRVL stock has plenty of support on Wall Street, with a Strong Buy consensus rating based on 16 Buys against two Holds. The average price target of $68.89 indicates upside potential of 60.5%.

Walt Disney (DIS)

The hottest news about the entertainment company Walt Disney is the return of Robert A. Iger as CEO. His plans to boost the operations of the Media and Entertainment Distribution unit to a more efficient and cost-effective one are giving fresh hope to investors regarding its lackluster margins and mounting losses.

Bank of America (NYSE:BAC) analyst Jessica Reif Cohen maintained a Buy rating and $115 price target on DIS stock, believing that Iger’s leadership “could significantly boost investor sentiment and introduces a potential upcoming catalyst in the form of a new strategic direction.”

Not only that, but Morgan Stanley (NYSE:MS) analyst Benjamin Swinburne also agrees that Iger’s comeback can materially uplift the stock. Reiterating a Buy rating on DIS stock, Swinburne said that Disney’s content is not being monetized efficiently and not earning as much as it should, and this is what he believes Iger will revive.

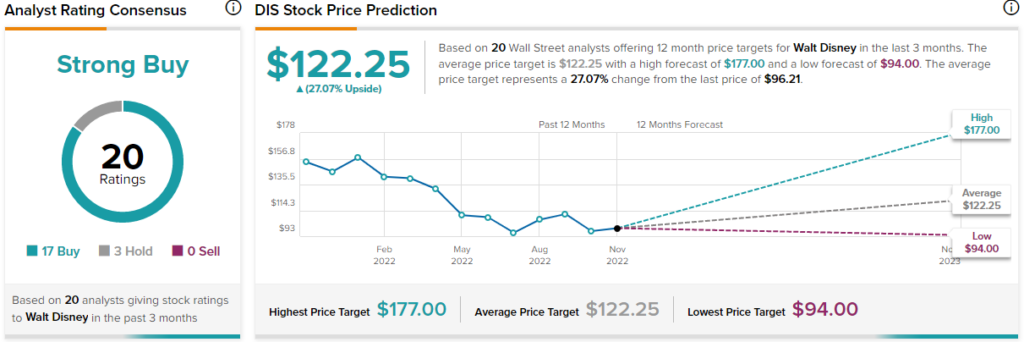

Is DIS Stock a Buy or Sell, According to Analysts?

Disney is a Strong Buy on Wall Street, with a Strong Buy consensus rating based on 17 Buys and three Holds. The average price target for Disney stock is $122.25, suggesting 27.07% upside potential over the next 12 months.

Takeaway: MRVL and DIS Look Like Winners

Both Marvell and Disney are companies with upbeat longer-term prospects. Moreover, with strong business strategies and leadership in place, the companies appear to be long-term winners.