It has undoubtedly been a hard operating environment for most banks, especially when it comes to investment banks such as Morgan Stanley (NYSE: MS). However, Morgan Stanley’s management team continues to demonstrate its superior ability to adapt to the underlying market conditions, generate robust profits, and return substantial amounts of cash back to its shareholders. Accordingly, I remain bullish on the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Rising Rates, Tough Capital Markets Don’t Scare Morgan Stanley

If you have a hard time deciding whether banks make for a worthwhile investment these days, it’s comforting to know that most investors likely feel the same way. It’s kind of hard to tell because the market environment is becoming increasingly unpredictable lately. On the one hand, higher interest rates are beneficial for banks because they boost the amount of interest they can earn on their loan originations. On the other, higher interest rates and a potentially deep recession resulting from the current macroeconomic turmoil can harm a bank’s clients and, ultimately, the bank itself.

Being an investment bank, Morgan Stanley (NYSE: MS) faces further pressure because of its intense exposure to the capital markets, which, as you know, have been incredibly volatile. However, Morgan Stanley’s most recent Q3 results showed that the company has so far been able to navigate the current setting rather impressively.

A Shift to Fixed Income Sustains Top-Line Revenues

Sure, when it comes to Morgan Stanley’s Investment Banking segment, things were rough. Investment Banking revenues declined 55% compared to last year. This is due to the ongoing market volatility that continued to weigh on the issuance of securities and led clients to delay strategic actions. Think about how many companies IPO’d last year against this year’s total lack of new companies raising capital. However, Morgan Stanley was able to offset much of the underperformance of its Investment Banking segment through a surge in demand for fixed-income securities.

This makes sense, after all. Investors are more likely to flock toward fixed-income securities in a tough capital market landscape. Accordingly, Fixed-Income revenues surged by 33% year-over-year. In fact, Fixed-Income revenues of $2.2 billion portrayed the highest Q3 segment revenues in over a decade.

Thus, even though Morgan Stanley’s total revenues for the quarter came in at $13.0 billion, implying a 12% decline compared to the prior-year period, that’s a rather solid performance taking into account the underlying operating environment.

Profits Appear Weak Until Put Into Perspective

Lower revenues can easily lead to compressed margins and, thus, even stronger declines in net income. This is precisely what we saw in Morgan Stanley’s Q3 results. While revenues declined by just 12%, the company’s adjusted earnings per share fell by a much deeper 26% to $1.47. However, it’s important to add some perspective here.

Firstly, it’s important to remember that bank balance sheets benefited from the release of COVID-era loss allowances last year. These are the reserves financial institutions amassed as soon as COVID-19 started to spread in order to sponge the possible shock of borrowers being incapable of paying their obligations. For this reason, last year’s earnings were inflated, resulting in a rough year-over-year comparison.

Secondly, based on Morgan Stanley’s year-to-date performance and management’s comments for its Q4 results, full-year consensus estimates point towards $6.55 in earnings per share. While this implies a year-over-year decline of around 20.3% due to last year’s inflated results, it also implies a flat performance against the company’s Fiscal 2020 results and a ~24% increase against the company’s Fiscal 2019 earnings per share.

Therefore, we can conclude that Morgan Stanley’s profitability remains robust even during such a highly challenging period, while its medium-term earnings-per-share growth trajectory remains positive.

Morgan Stanley Stock is Attractively Priced at Current Levels

Morgan Stanley’s management has not provided explicit guidance, but as I mentioned, consensus earnings-per-share estimates point toward $6.55 for Fiscal 2022. Based on the current stock price, this implies a forward P/E ratio of 12.8x. In my view, this multiple should imply a decent point for investors to add to their stakes or initiate a position in the stock. This is because earnings growth in the Investment Banking segment should re-accelerate once the current uncertainty fades, while the stock offers a hefty blended yield at its current levels.

Specifically, during Q3, Morgan Stanley continued to execute aggressive stock buybacks, repurchasing $2.6 billion worth of shares, lowering the total share count by 6% year-over-year. In fact, on a trailing-12-months basis, MS has a “buyback yield” of around 9.3%.

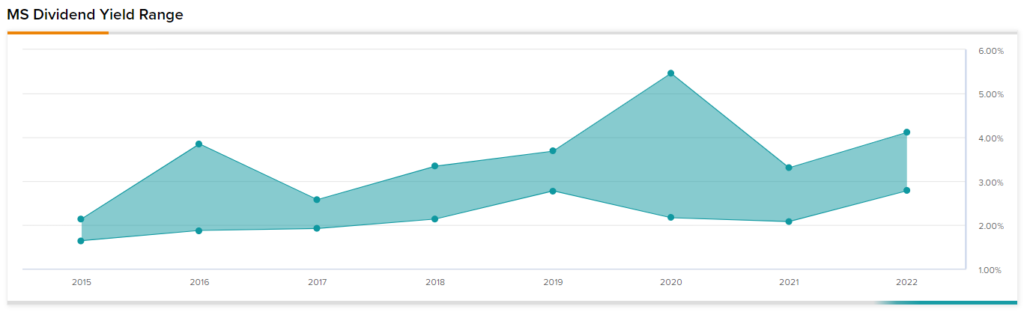

This, combined with the stock’s dividend yield of 3.6%, suggest that shares of Morgan Stanley trade at a blended yield that is north of 12%.

Consequently, despite some banks trading at slightly lower multiples, Morgan Stanley’s modest premium is well-deserved, with its bulky capital returns offering a wide margin of safety.

Is MS Stock a Buy or Sell, According to Analysts?

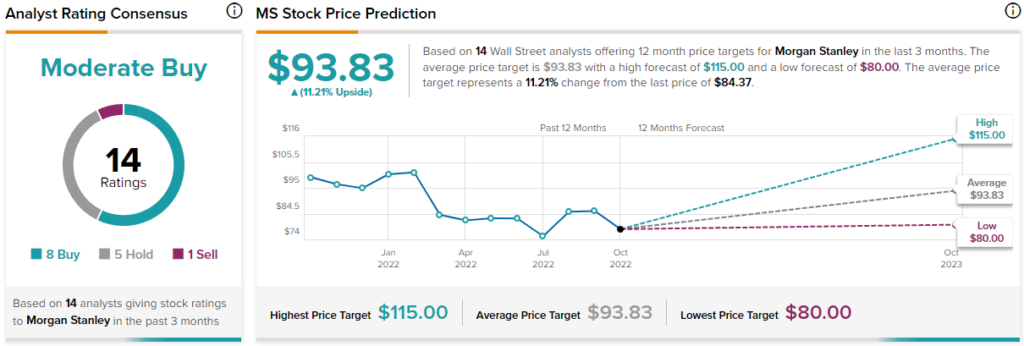

Turning to Wall Street, Morgan Stanley has a Moderate Buy consensus rating based on eight Buys, five Holds, and one Sell assigned in the past three months. At $93.83, the average Morgan Stanley price target implies 11.2% upside potential.

Takeaway: MS is a Solid Bank to Consider

Investing in banks these days can seem daunting. However, Morgan Stanley has clearly demonstrated that it can produce robust profits even with its Investment Banking segment underperforming in a tough capital market environment.

Considering its earnings growth should rebound once market conditions normalize, combined with the double-digit combined yield the stock is offering at its current levels, I believe that Morgan Stanley is a solid bank to consider buying.