Shares of Spikevax maker Moderna (MRNA) have stabilized in the $130-140 per-share range in recent months, potentially marking a bottom after its 75% peak-to-trough plunge.

Recently, the White House noted that COVID-19 vaccinations of young children could start on June 21 at the earliest, if approved. With so many Americans who’ve psychologically moved on from the pandemic, the news may not have been viewed as material for vaccine makers as it should have been. Regardless, all eyes will be on regulators as they move closer to making a decision.

The American economy has reopened, and it’s likely not returning to lockdowns at the hands of the coronavirus. Still, complacency could be on the rise, as many opt to skip their booster shots. For now, COVID-19 cases are down considerably, but it may not take much for another variant to spark an outbreak later this year.

Undoubtedly, the potential for further outbreaks makes it challenging to dub COVID-19 an endemic disease. With so much uncertainty and the likelihood that seasonal boosters from COVID-19 will need to be a thing, Moderna’s one big cash cow may not be nearly as quick to fade as many analysts may have thought. Add the potential for further cash cows to come out of the firm’s mRNA pipeline, and the perceived value in Moderna stock may be more real than many expect.

The stock’s absurdly-low 4x trailing earnings multiple may seem too good to be true. Though it will be virtually impossible for earnings to stack up against prior years, I think Moderna is a lot more than a value trap that’s about to face a slow and steady drop in both its top and bottom lines.

At the end of the day, Moderna is one of the most innovative companies in biotech today. The intriguing mRNA technology holds tremendous potential to treat or inoculate against diseases beyond COVID-19.

Though shares of Moderna are hard to value, given it has over-earned in the recent past, I think the stock seems too cheap, given its longer-term growth profile. For that reason, I remain bullish on MRNA stock.

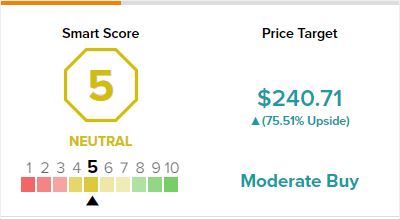

However, on TipRanks, MRNA receives a Smart Score rating of 5 out of 10, indicating that the stock is likely to perform in line with the broader market. Therefore, this is something to keep in mind.

Moderna Stock: Eager to Prove It’s More Than Just a Pandemic One-Hit Wonder

Moderna’s pandemic-era hyper-growth days may be over, but it’s still capable of sustaining a respectable growth rate. The COVID-19 business could be a cash cow for longer, feeding the firm’s impressive pipeline.

Further, there are potential catalysts that could beef up the COVID-19 business. Most notably, the approval of vaccinations in young children and the potential for China to give in and use American-made vaccines like Spikevax.

Undoubtedly, the zero-COVID policies in China are tremendously harmful, not only to the Chinese economy but to global supply chains. Perhaps a subtle improvement to U.S.-China relations would increase the likelihood of China being willing to use a foreign vaccine that’s proven more effective at preventing COVID-19.

For now, China’s acceptance of an American-made vaccine seems incredibly unlikely, but I still view it as a potential wildcard catalyst. If China can’t yield an as effective vaccine, they may have to choose between a U.S. vaccine or further economy-damaging lockdowns come the next round of outbreaks.

What’s Worth Getting Excited About in the Moderna Pipeline?

Given all the hype that drove Moderna stock to its euphoric peak, one has to imagine that the product pipeline, as opposed to the COVID-19 business, is the key to returning to the ~$400 levels.

Like any biotech, it’s impossible to differentiate between the next blockbuster or a disappointing flop. It can be a roll of the dice. Still, Moderna has a promising late-stage RNA-based pipeline that’s tough to stack up against. Currently, the flu and RSV remain compelling candidates that could help the COVID-19 segment do more of the heavy lifting.

The company’s personal cancer vaccines may also hold blockbuster technology. However, it is worth noting that such an ambitious effort is a high-impact, low-probability needle-mover (forgive the pun) for Moderna stock, moving forward.

Indeed, many promising products in the Moderna pipeline can be classified in the high-impact/low-probability-of-success category, making the stock so difficult to value as the COVID-19 business faces a bit of pressure. Though it could take a long time, I think its pipeline will yield something special as the firm moves beyond COVID-19 to new frontiers.

Wall Street’s Take

Turning to Wall Street, MRNA stock comes in as a Moderate Buy. Out of 10 analyst ratings, there are four Buys, five Holds, and one Sell recommendation.

The average Moderna price target is $240.71, implying upside potential of 75.5%. Analyst price targets range from a low of $155.00 per share to a high of $506.00 per share.

The Bottom Line on Moderna Stock

Moderna stock may be tough to value, but after a sizeable plunge in the share price, I’d argue that the long-term growth profile is hard to ignore. The company has incredible innovations behind the scenes, and management is capable of another blockbuster in a move to reduce its reliance on COVID-19.

Read full Disclosure