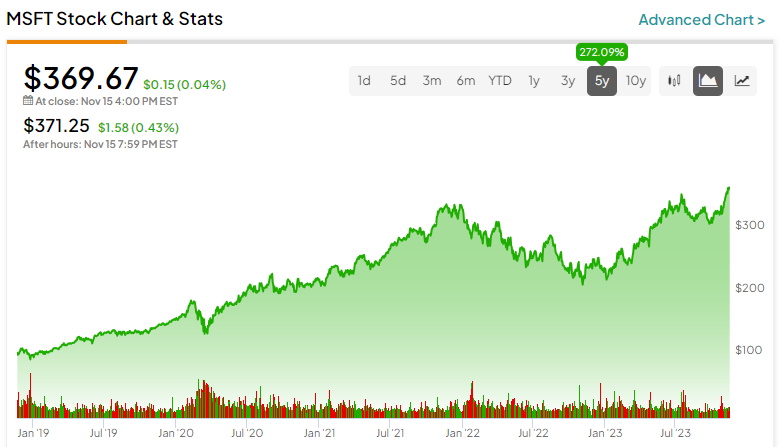

In the constantly evolving tech industry, tech giant Microsoft (NASDAQ:MSFT) has found a way to stay relevant year after year. Microsoft is undoubtedly one of the best businesses in the world, and financial metrics prove this, but that doesn’t necessarily mean you should buy its stock. Near an all-time high, Microsoft’s valuation just doesn’t make sense. Therefore, we are neutral on the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Numbers Point Toward an Amazing Business

There are several ways one could analyze Microsoft stock and justify buying it. MSFT bulls can talk about Microsoft’s AI and cloud computing growth potential, which is indeed very promising, as the company has a 49% stake in OpenAI (the owner of ChatGPT) and operates Microsoft Azure, a growing cloud computing platform. But investors can also simply point to the firm’s financial metrics to prove how good of a business it really is, and that’s what we’ll do.

Microsoft’s Competitive Advantage Can be Quantified

A great way of determining if a company has a competitive advantage is by looking at its gross profit margin because it represents the premium that consumers are willing to pay over the cost of a product or service. An expanding gross margin indicates that a sustainable competitive advantage is present. If an existing company has no edge, then new entrants would gradually take away market share, leading to decreasing gross margins as pricing wars ensue to remain competitive.

Microsoft’s gross margin has been trending higher since Fiscal 2016, rising from 64% in 2016 to 69.4% for the trailing 12 months. As a result, its rising gross margin indicates that a competitive advantage is present.

Microsoft’s Competitive Edge Allows the Company to Print Cash

Microsoft’s competitive advantage has allowed the firm to operate very efficiently over the past decade and rake in the cash. To measure its efficiency, we’ll take a look at MSFT’s cash return on invested capital (known as CROIC, calculated as free cash flow divided by invested capital).

Essentially, this measures how much free cash flow the company generates for every dollar of capital it invests. For the last 12 months, MSFT had a CROIC of 21.9%, which is well above the IT sector average of 3.2%. So, for every $1 the company invested in the past year, it generated 21.9 cents of free cash flow. Its five-year average CROIC of 24.2% is impressive as well. For context, Microsoft generated a whopping $63.2 billion worth of free cash flow for the trailing 12 months.

This excess cash can be used to return capital to shareholders through buybacks and dividends, as MSFT already does, although not in large amounts.

The Caveat: The Valuation is Unattractive

As mentioned above, Microsoft is a great business, but you can’t just buy a business at any price. Valuation matters. There are a few reasons why MSFT’s valuation isn’t attractive. First, its forward P/E ratio of 32.9x is high. It’s actually higher than its five-year average forward P/E of 29.2x, and that’s exactly the problem.

We’re now in a higher interest rate environment than usual, which means that investors should be expecting higher returns from stocks since they can get relatively high interest rates from risk-free government bonds. Therefore, it doesn’t quite make sense that MSFT has a higher valuation now, in a high-rate environment, than it did when interest rates were much lower.

Adding to this, MSFT’s five-year average earnings-per-share CAGR comes in at 35.4% and its three-year CAGR is 18.9%. Meanwhile, the firm’s EPS is now expected to grow by 14% and 15% in 2024 and 2025, respectively. So, lower growth is expected going forward, but the valuation is higher than usual? This just isn’t a great setup, in our opinion. And remember — these EPS forecasts factor in MSFT’s AI and cloud computing potential.

Is MSFT Stock a Buy, According to Analysts?

On TipRanks, MSFT comes in as a Strong Buy based on 30 Buys and just one Hold assigned in the past three months. The average MSFT stock price target of $408.76 implies 10.6% downside potential.

If you’re wondering which analyst you should follow if you want to buy and sell MSFT stock, the most accurate analyst covering the stock (on a one-year timeframe) is Alex Zukin of Wolfe Research, with an average return of 31.77% per rating and a 97% success rate. Click on the image below to learn more.

The Takeaway

Microsoft is a top-notch tech business, and this can be proven by looking at some of its financials. However, its valuation is too high for our liking, and we think there are better opportunities elsewhere. To conclude, we’re not saying that Microsoft stock will crash, but we believe that, at current levels, investors shouldn’t expect the same kind of gains from MSFT stock that they have become accustomed to. As a result, we’re staying on the sidelines until the stock falls to a more reasonable level.