While the artificial intelligence (AI) revolution arguably centers on OpenAI’s chatbot ChatGPT, Microsoft (NASDAQ:MSFT) may be the true long-term winner. With Microsoft’s heavy investment in OpenAI, the software stalwart features an underappreciated opportunity to dramatically bolster its Bing web search engine. Therefore, I am bullish on MSFT stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

MSFT Stock is a Slow but Steady Investment

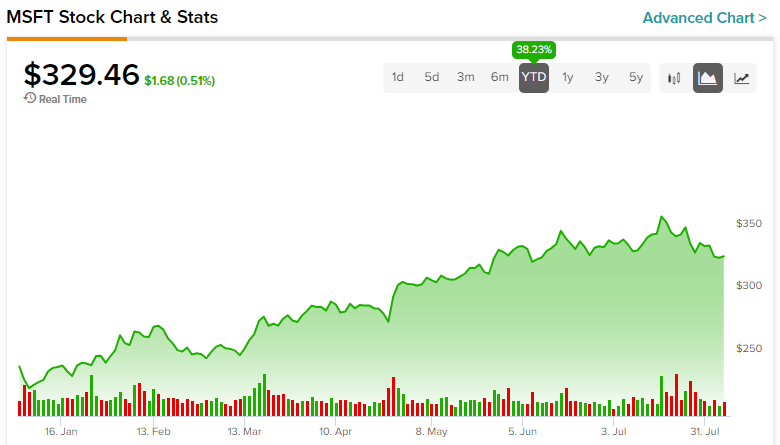

Under initial examination, MSFT stock doesn’t appear particularly remarkable. Sure, it gained 38% since the beginning of the year. At the same time, though, the tech benchmark Nasdaq Composite Index moved up by a similar 33%. Still, with many retail traders looking for flashes in the pan, Microsoft’s slow-but-steady approach should pay off in the long run.

For one thing, management appears to be careful and methodical about its approach to AI technologies. The evidence stems from Microsoft’s aforementioned investment in OpenAI. Today, it’s not hard to find stories about the partnership’s numerous practical applications. For instance, TipRanks contributor Khyathi Dalal mentioned that Microsoft will make GPT tech available for federal agencies using its Azure cloud service.

However, back when Microsoft first invested in OpenAI in 2019, it hardly received much attention. Still, the leadership team recognized the potential and put its money where its mouth was. Today, the Microsoft-OpenAI partnership represents one of the obvious leaders in the generative AI field.

Full credit goes to TipRanks contributor Joey Frenette for recognizing the opportunity in MSFT stock relatively early. Back in late 2022, he stated that Microsoft’s investment in OpenAI may only be the “tip of the iceberg,” to use his phrase.

“In a way, I believe that Microsoft’s budding relationship with OpenAI could transform the company over the next decade and beyond,” wrote Frenette. So far, he’s been proven correct. Moving forward, the opportunities are arguably even more compelling.

Microsoft May Breathe New Life Into Bing

Generative AI, while potentially being among the most groundbreaking innovations in recent times, is limited by connectivity issues. Simply put, an AI’s intelligence is only as profound as the information it can access. However, Microsoft’s ability – via its Bing search engine – to combine real-time data access with an AI platform could breathe new life into a previously irrelevant business.

Currently, data from GlobalStats shows that Bing commands just under 3% market share for the global search engine sector. One year ago, this metric actually stood at 3.29%. Therefore, even with Microsoft’s incorporation of AI capabilities with ChatGPT features into Bing, the search engine lost market share.

However, as people begin to trust chatbots like ChatGPT, Bing may enjoy a significant addressable market. Part of the problem with AI-accrued information is that the user doesn’t necessarily know the time relevance of the source. For instance, MSFT stock could have been extremely undervalued against earnings many years ago, but that’s not the case today. Therefore, users looking for undervalued market ideas may receive inaccurate information.

Still, moving forward, the deeper integration of Bing with AI should yield useful and timely information. In addition, as the underlying AI protocol learns, it can provide even better results. Ultimately, it’s an exciting time to bank on MSFT stock.

Not a Bargain but Reliable

To be sure, Microsoft isn’t exactly what you would call a bargain. Right now, the market prices MSFT stock at a trailing earnings multiple of 33.9. Also, the market prices shares at a forward multiple of 29.6. These stats aren’t unreasonable but they’re not exactly remarkable for bargain hunters. However, what’s undeniable is that MSFT has been a reliable investment.

The company has been consistently profitable, featuring solid net income growth along with providing passive income with a low payout ratio of 27.1%. As well, the consistent expansion of its top line in recent years has kept pace with many of its big tech peers. If circumstances in the underlying economy get shaky, MSFT stock represents a trustworthy investment.

Is MSFT Stock a Buy, According to Analysts?

Turning to Wall Street, MSFT stock has a Strong Buy consensus rating based on 31 Buys, one Hold, and one Sell rating. The average MSFT stock price target is $392.97, implying 19.2% upside potential.

The Takeaway: MSFT Stock Still Enjoys Growth Opportunities

Undoubtedly, one of the big winners of the year so far has been Microsoft. It bet big on OpenAI, and it’s reaping the rewards. However, the company can continue gaining by adding relevance to its Bing search engine. For that, investors should look to add MSFT stock for the long haul.