Metro (TSE: MRU) is one of the largest grocery retailers in Canada and, following its 2018 acquisition of the Jean Coutu Group, also boasts a meaningful drugstore footprint.

Noteworthy grocery banners include Metro, Metro Plus, Super C, and Food Basics, while its pharmacies primarily operate under the Jean Coutu and Brunet trademarks.

It utilizes an array of business models, but it most frequently acts as either a retailer, operating individual stores, or a franchisor, licensing its trademarks and supplying merchandise to franchisees.

The firm also acts as a distributor, leveraging its supply chain capabilities to service smaller neighborhood grocery stores. The bulk of its operations is in Quebec, which houses over 70% of both its owned and franchised food and drug outlets.

Although the company has fundamental growth catalysts that can act as tailwinds, it seems that the market has already priced them in. As a result, we are neutral on Metro.

Growth Catalysts

Metro is an essential business that provides food and medicine to customers. With inflation running hot, some companies are able to more easily pass on costs to consumers than others. As a consumer staple, Metro fits into the category of being able to pass on costs.

In addition, higher food prices mean that it is more expensive to go out to eat. As a result, people may begin to cut back on dining going forward and instead choose to purchase from grocery stores to save money.

This would also increase the volume of shoppers visiting the store, which, combined with higher inflation, means higher revenues for the company.

It’s also worth mentioning that Metro is not as large as some of its competitors, such as Loblaw (TSE:L) or Walmart (WMT). In fact, Metro only operates in the Canadian provinces of Ontario and Quebec. The two provinces are the largest in Canada in terms of GDP.

By focusing on just a couple of provinces, Metro is essentially using its resources to ensure that it can compete with larger players in the markets that matter most. This allows the company to avoid spreading itself too thin with aggressive growth targets that would likely require taking on too much debt.

Furthermore, if the company were to feel like it was ready to expand into other markets, it would have a greater growth runway than the larger competitors do.

Measuring Efficiency

Metro needs to hold onto a lot of inventory in order to keep the business running. Therefore, the speed at which a company can move inventory and convert it into cash is very important in predicting its success.

To measure its efficiency, we will use the cash conversion cycle, which shows how many days it takes to convert inventory into cash. It is calculated as follows:

CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

Metro’s cash conversion cycle is 12 days, meaning it takes the company 12 days for it to convert its inventory into cash. In the past several years, this number has trended upwards. At first glance, it would appear that the company’s efficiency has deteriorated.

However, a deeper look suggests that isn’t the case. Days inventory outstanding, which measures how quickly inventory is sold, has remained flat over the past decade. Therefore, it is not over-ordering or taking longer to move products.

Instead, the company is simply taking longer to collect its receivables outstanding. This isn’t necessarily a bad thing, and the increase is not worrisome, as the figure has gone from 9 days in 2017 to 15 days in 2021.

In addition to the cash conversion cycle, we can also consider Metro’s gross margin trend. Ideally, we would like to see a company’s gross margin expand each year unless the gross margin is already very high, in which case it is acceptable for it to remain flat.

In Metro’s case, its gross margin slowly expanded in the past several years, rising from 10.7% in Fiscal 2017 to 11.8% in Fiscal 2021. This is ideal because it allows the company the opportunity to increase free cash flow or reinvest a larger percentage of revenue into growth initiatives.

Dividend

For investors that like dividends, Metro currently has a 1.52% dividend yield, which is above its closest competitors’ dividends. For example, Loblaw, Walmart, and Costco (COST) have dividend yields of 1.26%, 1.42%, and 0.61%, respectively. When taking a look at Metro’s payout ratio of 29%, its dividend payment appears to be safe.

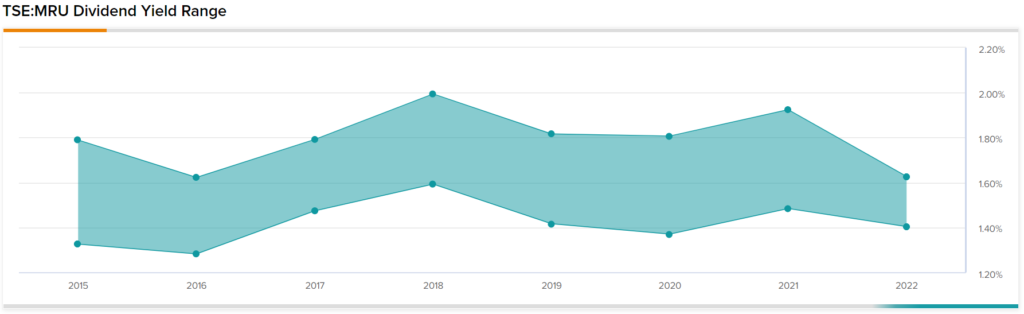

Taking a look at its historical dividend payments, we can see that its yield range has remained relatively flat in the past several years.

At ~1.5%, the company’s dividend is near the lower end of its range, implying that the stock price is trading at a premium relative to the yields investors have seen in the past.

Wall Street’s Take

Turning to Wall Street, Metro has a Strong Buy consensus rating based on two Buys, six Holds, and zero Sells assigned in the past three months. The average Metro price target of $70.88 implies 0.8% upside potential.

Final Thoughts

Although Metro has a greater ability to combat inflation and pass on costs because it is a consumer staple, it appears that the market has already priced this in, as the stock trades near analysts’ consensus price target. Therefore, we are neutral on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure