Shares of social-media powerhouse and metaverse frontrunner Meta Platforms (META) have been steadily sagging lower in recent sessions. Thanks in part to a bleak analyst downgrade and a fading of the market’s rebound rally, Meta stock now finds itself flirting with 52-week lows. Though a certain analyst turned their back on Mark Zuckerberg’s empire, I think there are catalysts that put the odds in favor of the bulls. In any case, it’s a bad idea to bet against Zuck and most of Wall Street. I am bullish.

A looming recession has taken a big bite out of ad growth prospects. Apple’s (AAPL) privacy updates have also wiped out a considerable amount of value in shares. It’s hard to believe that the FAANG mainstay is down nearly 60% from its all-time highs. Though the trend is no friend for Meta, I think the stock is beyond oversold, partially due to decaying fundamentals but mostly due to the firm’s horrible reputation with the general public.

Many of us want Meta to drop the ball. Once it fumbles, many want Meta to fail, even when it’s more than capable of bouncing back under its own feet. While a good reputation on Wall Street matters, I think the punishment in Meta is overdone, leaving considerable upside for those willing to give Zuck and his Meta mates the benefit of the doubt.

Meta Platforms: Catalysts That Many May Overlook

Meta Platforms may have delivered a Q2 result that was better than feared. Earnings came in just shy of expectations. However, the daily active user (DAU) freefall seems to be off the table. Further, I mentioned in prior pieces that user engagement would be likelier to improve in an economic downturn. While ad growth will fade, user count could grow, and that’s a net positive as Meta looks to leverage its network effect to expand into new frontiers.

New frontiers don’t just encompass the social-media space. Meta is getting into consumer hardware and the metaverse. By having an ear to so many users, Meta ought to have the means to have powerful AI-leveraged features.

Apple may get credit with Siri, but Meta has the tools to deliver an intriguing mix of software and hardware of its own.

Recessions are bad news for most companies, but for heavyweights like Meta, they may be a net positive in the grander scheme of things. Consider that many well-run firms treat recessions as opportunities to gain ground over rivals. As the lights go out on the broader social space, Meta has the means to continue investing in a way to take share.

For now, you’ll hear of fading ad revenues, but what you won’t hear of are Meta’s ambitions. Reels, a TikTok-like feature embedded in Facebook and Instagram, is the perfect weapon against a new rival in video-based social media. It’s not just Reels that could supercharge DAU growth over the next year.

Meta’s “Super Family of Apps” May Overcome Apple’s Privacy Update

Meta is finding ways around Apple’s ask-not-to-track updates. If Meta can’t follow users around on their devices, it can at least do so across its own app or “family” of apps. In China, super apps are all the rage. One app to rule them all. While they may not be the best design for users, they can help put power back in the hands of firms like Meta.

Recently, Meta was reported to track users who use its own in-app browser. With a strong network in WhatsApp, Meta may soon be able to find out what its users are up to and sell them tailored ads. In short, Meta doesn’t need to track you across the web. It has a family of apps that have become quite super. As usership increases, so will the value of Meta’s ads, whether or not iOS users don’t desire to be tracked across the web.

The way I see it, I’d much rather use Meta’s in-app browser out of convenience rather than having to paste URLs to other browsers to preserve privacy. While many users will take unkindly to in-app trackers, I think Meta can keep its users coming back with more features and functionality. Ultimately, social media is a great free form of entertainment, even if it’s not best for your health.

As Meta embraces gaming and the metaverse, I think Facebook is a terrific onramp to the realm of VR (virtual reality) and AR (augmented reality). Such technologies are hard to ignore. Many users have proven that they don’t mind if Facebook collects data about them as long as they’re transparent and willing to compensate via enhanced functionality.

At the end of the day, platforms need to provide more value if their business model is to monetize users. Many Facebook users realize that they’re the product, and they don’t want sneaky data-collection practices made behind their backs.

Meta’s reputation may not be great, but if it can be transparent, it can improve its reputation by leaps and bounds.

Is Meta Stock a Buy?

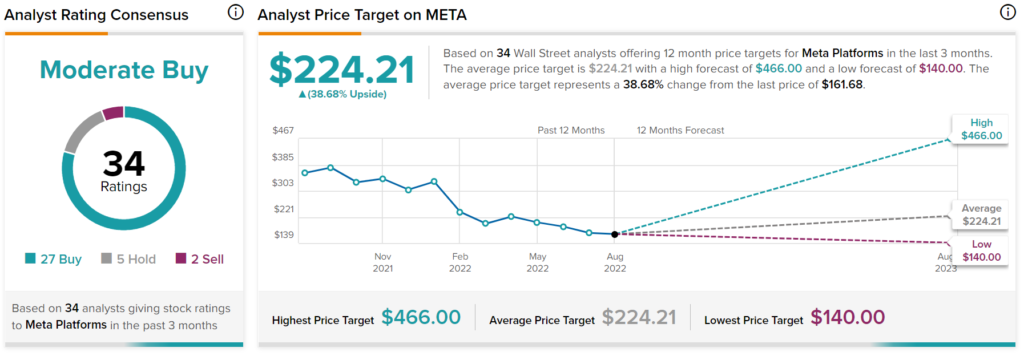

Meta has a Moderate Buy consensus rating based on 27 Buys, five Holds, and two Sells assigned in the past three months. The average Meta stock price target of C$224.21 implies 38.7% upside potential. Analyst price targets range from a low of $140.00 per share to a high of $466.00 per share.

Takeaway – Meta Stock Has the Resources to Turn Things Around

Meta may be under pressure, but I think far too many investors doubt its ability to recover. That’s likely because many hate the Facebook brand after so many negative headlines over the years. At the end of the day, Meta is profoundly profitable, and they have smart Meta mates that can turn the ship around. Looking ahead, I’d look for tighter integration across apps as a source of advantage.

With Reels touted across various apps already, I still think Meta has some of the most enticing options for advertisers in the long run.

Apple delivered a left hook to Meta’s chin. However, it’s not down for the count quite yet. Meta is ready to get up and move on. It’s a proven FAANG firm for a reason – Meta is innovative enough to persevere through tough times.