It’s been green shoots only this year for Meta (NASDAQ:META), and the stock has seriously outperformed the market. With the shares having accumulated year-to-date gains of a very impressive 125%, is it time to consider a cool down period?

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

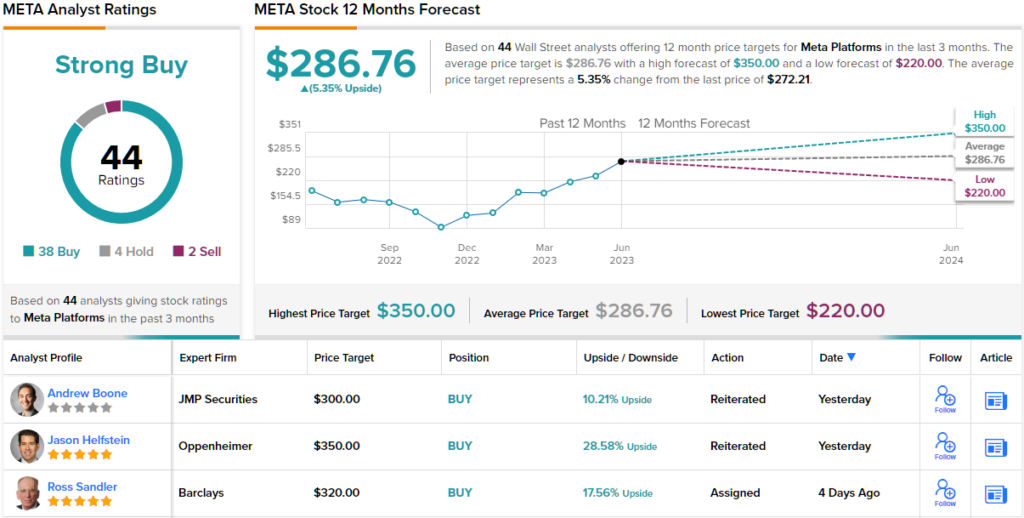

Au contraire says Oppenheimer’s Jason Helfstein. The 5-star analyst believes the stock is still “highly attractive at current levels,” and recently raised his price target from $285 to $350, indicating it has room for additional growth of ~29%. No need to add, Helfstein’s rating stays an Outperform (i.e., Buy). (To watch Helfstein’s track record, click here)

So, what’s behind the rosy outlook? 2023’s buzziest trend is the simple answer. “We believe META is well positioned to drive higher pricing and engagement from AI investments,” Helfstein explained. “We believe such investments have been the major reason for META’s outperformance vs. the digital ad market in 1Q23, and should support outperformance though 2024. Additionally, we see AI as a TAM expander into ecommerce marketplaces and SMB customer support, but not currently in estimates.”

Meta’s push into AI is multi-thronged. 20% of content is AI-recommended while its Advantage+ ads are powered by machine learning. Via AI Sandbox – an experimental product that alters text, images, and backgrounds – the company has launched other ad tools. Driven by these developments, 1Q23 also became the first instance since 2Q21 that Meta’s ad revenue outstripped its peers’ takings. Both Oppenheimer and consensus estimates call for further outperformance through 2024.

The better showing is expected to be fueled by other forthcoming AI tools. AI will be incorporated into click-to-message ads in addition to customer service chatbots, allowing SMBs (small and midsize businesses) to automate customer service chat. “We believe the industry is working toward generating synthetic video ads for SMBs made using AI and edited on a per-user basis to increase ROI,” notes Helfstein.

There’s also the potential for an expansion of Meta’s TAM (total addressable market) via making further inroads into ecommerce marketplaces and customer support. Should the AI tools appear to be effective, META marketplaces might be able to give other marketplaces such as eBAY, Etsy and Amazon a run for the money in capturing SMB spend, while customer support AI chatbots provide META with access to SMBs’ outlays on customer support staff. The combination of the two represents a “revenue opportunity” of $1.2 trillion.

So, that’s Oppenheimer’s take, what does the rest of the Street make of Meta’s prospects? 37 analysts join Helfstein in the bull camp, 4 others remain on the sidelines and two recommend staying away, all culminating in a Strong Buy consensus rating. However, given this year’s gains, the $286.76 average target makes room for only modest gains of ~5%. (See META stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.