Ongoing macro challenges have impacted the budgets of enterprises for marketing and advertising compaigns. This has significantly hurt social media stocks, including Meta Platforms (NASDAQ:META), Pinterest (NYSE:PINS), and Snap (NYSE:SNAP). Moreover, rising competition from TikTok and Apple’s (AAPL) iOS privacy policy changes have made matters worse. Keeping this challenging backdrop in mind, we used TipRanks’ Stock Comparison Tool to compare the above mentioned social media stocks and pick the one that Wall Street is optimistic about.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meta Platforms (META) Stock

Meta Platforms, formerly Facebook, spooked investors by reporting lower-than-anticipated third-quarter results. Q3 marked the second consecutive quarter of revenue decline, and the company expects its Q4 revenue to also fall on a year-over-year basis.

Additionally, there are concerns about the mounting losses of the Reality Labs division due to the significant investments in metaverse projects and the uncertainty associated with the success of this vision. In Q3 2022, the Reality Labs division’s operating loss increased to $3.67 billion from $2.63 billion in the prior-year quarter.

With near-term headwinds expected to persist, Meta is taking steps to bring down costs, including the recently announced decision to lay off over 11,000 employees. The company is also shutting down some of its hardware projects, like Portal and smartwatches, to bring down the losses of its Reality Labs division. The division continues to work on the company’s metaverse ambitions.

What is META’s Stock Prediction?

Last week, Canaccord analyst Maria Ripps slashed her price target for Meta stock to $170 from $200 to reflect recent multiple compression but maintained a Buy rating. Ripps sees the company’s decision to reduce its workforce and extend the hiring freeze into Q1 2023 as incrementally positive, given persistent macro challenges and the slowdown in digital advertising.

Meta Platform’s stock scores the Street’s Moderate Buy consensus rating based on 26 Buys, 10 Holds, and three Sells. The average META stock price target of $146.60 implies 28.4% upside potential. Shares have plunged 66% year-to-date.

Pinterest (PIN) Stock

Pinterest is an image-sharing social media site that allows users to create virtual pin boards based on their preferences. Investors cheered Pinterest’s Q3 results as the company exceeded analysts’ expectations. Revenue grew 8% to $685 million, while adjusted EPS declined 61% to $0.11.

It’s worth noting that the company’s global monthly active users (MAUs) were almost flat year-over-year at 445 million in Q3 but improved from 433 million in Q2. The company’s MAUs declined in the first two quarters of this year. Also, the average revenue per user (ARPU) increased 11% to $1.56 in Q3.

Pinterest is focused on enhancing engagement on its platform by creating more relevant experiences for the users and continues to improve its monetization.

Is Pinterest a Buy, Hold, or Sell?

Morgan Stanley analyst Brian Nowak feels that Pinterest’s stronger-than-anticipated results reflected management’s “early execution towards key initiatives.” However, Nowak lowered his estimates as he feels that the company’s turnaround would take time.

The analyst is also cautious due to a weaker Q4 outlook and a possible rise in consumer weakness heading into 2023. Nowak maintained a Hold rating on Pinterest stock and a price target of $18.

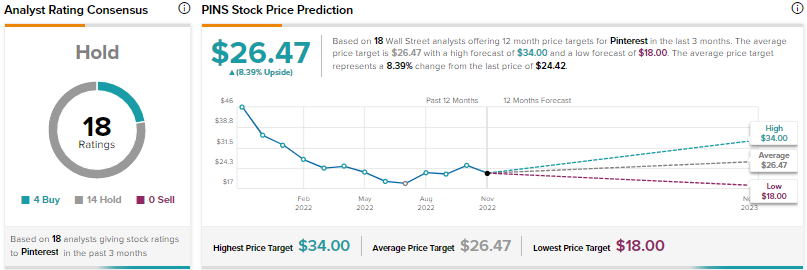

Overall, the Street is sidelined on PIN stock, with a Hold consensus rating based on four Buys and 14 Holds. The average Pinterest stock price prediction of $26.47 implies 8.4% upside potential. PINS stock is down 33%.

Snap Inc. (SNAP) Stock

Snap’s third-quarter revenue increased 6% year-to-year to $1.13 billion. This was the first time the growth rate came in at single digits since the company went public in 2017. Daily Active Users (DAUs) grew 19% to 363 million, but ARPU declined 11% to $3.11. Adjusted EPS declined 52% to $0.08.

Given a tough macro backdrop and intense competition, Snap is implementing several cost-cutting initiatives, including reducing its workforce and shutting down expensive projects, like Pixy drone. Given a net loss of $1.14 billion reported in the first nine months of 2022, the road ahead looks challenging for Snap.

What is the Target Price for Snap Stock?

Truist Securities analyst Youssef Squali feels that Snap is more affected by industry headwinds than Google and Meta due to its smaller size. That said, Squali believes that increased adoption of products like Spotlight, Map, and augmented reality or virtual reality should help drive monetization and thus re-accelerate growth. However, this would take time to materialize.

Squali kept his Hold rating on Snap stack but lowered his price target to $10 from $12.

Overall, the Hold consensus rating for Snap stock is based on seven Buys, 19 Holds, and two Sells. The average SNAP stock price target of $10.62 suggests a possible downside of 5.9% from current levels. Shares have tanked by a whopping 75.4%

Conclusion

Social media stocks are expected to remain under pressure due to weak consumer spending amid challenging macro conditions. Wall Street analysts are cautiously optimistic about Meta Platforms while they are sidelined on Pinterest and Snap. Moreover, they see higher upside potential in META stock.

As per Meta, about 3.7 billion people used at least one of its apps (including, Facebook, Instagram, Messenger, and WhatsApp) on a monthly basis in September. Meta’s extensive reach and further growth potential make it an attractive long-term play.