Social media company Pinterest, Inc. (NYSE:PINS) surprised shareholders with decent third-quarter earnings and revenue beat. Notably, the company reported stable year-over-year global monthly active users (MAUs) when most of the other players are struggling to retain them. The news pushed PINS stock higher by over 15% in the after-hours trading session on October 27.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q3 Results in Detail

Pinterest reported adjusted earnings of $0.11 per share, beating analyst estimates by 5 cents per share. However, the figure came in lower than the prior-year quarter’s adjusted earnings of $0.28 per share.

Similarly, revenue rose 8% year-over-year to $684.55 million and beat the consensus by $18.37 million.

Interestingly, global MAUs stood at 445 million, which also grew marginally compared to the Q2FY22 figure of 433 million. Meanwhile, Pinterest’s global average revenue per user (ARPU) grew 11% to $1.56.

Q4FY22 Outlook

Based on the current business momentum, Pinterest expects Q4 revenue to grow in the mid-single digits year-over-year. Also, the fourth quarter’s non-GAAP operating expenses are projected to grow in the low double digits compared to Q3FY22.

Pinterest CEO Bill Ready commented, “Despite the challenging macro environment, we are delivering performance and a distinct value proposition to advertisers, reaching users across the full funnel. Through clear focus on increasing engagement that delights our users, we are deepening our monetization per user, and building personalized and relevant experiences that go from inspiration and intent to action.”

Is Pinterest a Good Stock to Invest In?

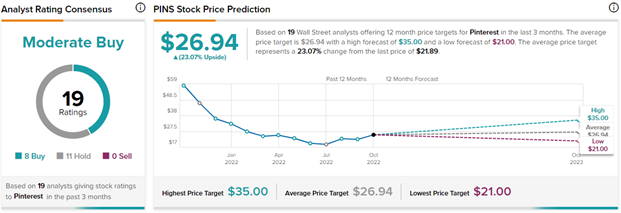

Amid the dwindling outlook for social media companies, Wall Street analysts remain split on Pinterest stock’s trajectory. On TipRanks, PINS stock has a Moderate Buy consensus rating based on eight Buys and 11 Holds. The average Pinterest price target of $26.94 implies 23.1% upside potential to current levels. Meanwhile, the stock has lost 39.9% so far this year.