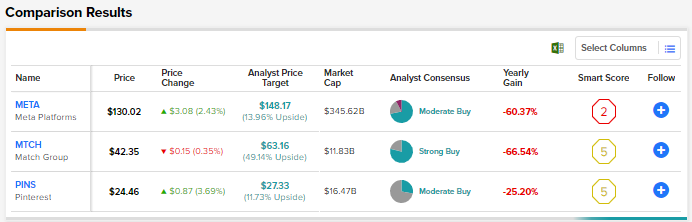

Social media companies struggled to sail through 2022. Macro pressures and a slowdown in ad spending due to fears of a looming recession dragged down social media stocks last year. These headwinds are expected to persist over the near term. Nonetheless, some of the social media stocks are expected to be great picks for the long haul. Using TipRanks Stock Comparison Tool, let’s place Meta Platforms (NASDAQ:META), Match Group (NASDAQ:MTCH), and Pinterest (NYSE:PINS) against each other to pick the stock that is most attractive as per Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meta Platforms (NASDAQ:META)

Meta Platforms (formerly Facebook) has been facing multiple challenges over the past year, including weak ad spending, the impact of Apple’s iOS privacy changes, growing competition from ByteDance’s TikTok, and regulatory woes. Furthermore, investors have been worried about the huge investments associated with the company’s metaverse ambitions.

Nonetheless, Meta’s extensive user base is expected to help it bounce back. In Q3, Monthly Active People (the number of users who used at least one of Meta’s apps – Facebook, Instagram, Messenger, and WhatsApp in the last 30 days) increased 3.6% to 3.71 billion. Such a vast reach will help Meta win ad dollars once the macro headwinds fade away.

Is Meta a Buy, Sell, or Hold?

Jefferies analyst Brent Thill has a Hold rating on the Internet sector for 2023 as he believes analysts would have to further reduce revenue estimates. Nonetheless, he feels that the downside is limited as valuation multiples have already plunged significantly.

Thill highlighted Meta Platforms, Etsy (ETSY), and Integral Ad Science (IAS) as his top three internet picks for 2023. Thill finds Meta attractive due to its valuation as well as the upside in revenue supported by the rapidly growing Instagram Reels and Click-to-Messenger and Click-to-WhatsApp ads. He also noted the company’s focus on expense discipline.

Overall, Meta scores the Street’s Moderate Buy consensus rating based on 28 Buys, eight Holds, and three Sells. At $148.17, the average META stock price target implies nearly 14% upside potential from current levels. Shares have declined 61% over the past year.

Match Group (NASDAQ:MTCH)

Match Group is the parent company of dating apps like Tinder, OkCupid, and Hinge. MTCH was one of the worst-performing S&P 500 stocks last year and declined nearly 69%. The company experienced strong interest in its online dating apps during the pandemic. However, the revenue growth rate subsided in 2022. In Q3 2022, revenue grew 1% year-over-year to $810 million.

It’s worth noting that Match’s business model is different from other social media companies as it generates a substantial portion of its revenue from subscriptions paid directly by the users and “à la carte” purchases than from advertising. The company is positive about delivering “accelerating year-over-year revenue growth” as 2023 progresses, driven by improved momentum in Tinder’s revenue. It also expects incremental sales from Hinge as the app continues to expand in international markets.

Is Match a Buy or Sell?

Recently, New Street analyst Daniel Salmon initiated coverage of Match Group stock with a Buy rating and a price target of $54. Calling Match his “Top SMID [small and mid-cap] Pick,” the analyst stated that Match can revive Tinder’s growth organically while expanding into new revenue streams. Salmon also believes that Hinge’s expansion and the reopening of Asia-Pacific should fuel sales recovery this year.

Overall, Wall Street is bullish about Match stock, with a Strong consensus rating based on 15 Buys and four Holds. The average MTCH price target of $63.16 implies 49.1% upside potential.

Pinterest (NYSE:PINS)

Image-sharing social media platform Pinterest allows users to create virtual pinboards based on their preferences. Its user base and revenue growth have been under pressure since the reopening of the economy due to macro factors. Nevertheless, Pinterest’s monthly active users (MAUs) increased slightly to 445 million in Q3 2022 from 444 million in the prior-year quarter and 433 million in Q2 2022. This marked an improvement as MAUs declined 9% year-over-year in Q1 2022 and 5% in Q2 2022.

Despite near-term challenges, Pinterest is positive about its user base and is focused on deepening engagement and boosting revenue per user. Also, during the Q3 conference call, CFO Todd Morgenfeld pointed out that by the end of 2022, the company “will have lapped the Google Search algorithm update from November 2021,” which had impacted its ability to grow MAUs.

What is the Target Price for PINS Stock?

Piper Sandler analyst Thomas Champion feels that there is an opportunity for Pinterest to grab market share from Twitter. Based on a study by Champion’s firm, he likes Pinterest’s vertical exposure to retail, auto, and consumer packaged goods (CPG) segments and a lack of exposure to tech. Champion reiterated a Buy rating for PINS stock and a price target of $30.

The analyst had recently upgraded Pinterest from a Hold to Buy, citing “multiple tailwinds” heading into 2023, including an improved ad product and rising market share.

Currently, the number of analysts sidelined on Pinterest stock is more than those who are bullish. Pinterest earns a Moderate Buy consensus rating based on five Buys and 13 Holds. The average PINS stock price target of $27.33 implies 11.7% upside potential. Shares have declined about 25% over the past 52 weeks.

Conclusion

Wall Street anticipates macro pressures to impact the near-term performance of social media stocks. Currently, they are more optimistic about Match Group than Pinterest and Meta Platforms and see higher upside potential in MTCH stock.

Match’s efforts to revamp its Tinder App, focus on enhancing Hinge’s presence, and new product rollouts are expected to drive future growth.