Last year, macro pressures hammered tech stocks and even the mighty FAANG (Meta Platforms (NASDAQ:META), previously called Facebook, Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), and Google’s parent company Alphabet (NASDAQ:GOOGL, GOOG)) were not spared. However, FAANG stocks have started 2023 on a positive note due to improved investor sentiment. Using TipRanks Stock Comparison Tool, we’ll place Meta Platforms, Amazon, and Netflix against each other to pick the most attractive FAANG stock as per Wall Street experts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meta Platforms (NASDAQ:META)

Shares of Meta Platforms have jumped 19% year-to-date, although they remain significantly below the 52-week high. A slowdown in ad spending due to macro pressures, rising competition from ByteDance’s TikTok, and Apple’s iOS privacy changes hurt Meta in 2022. Moreover, investors are concerned about the billions of dollars the company invested in its Metaverse projects.

However, Meta bulls remain optimistic about the company’s extensive customer base (2.93 billion users on average accessed at least one of Meta’s Family of Apps – Facebook, Instagram, Messenger, and WhatsApp, per day in September 2022). Moreover, Meta is taking initiatives to lower its costs and increase the monetization of its apps.

Is Meta Stock a Buy?

On Wednesday, Credit Suisse analyst Stephen Ju increased his price target for Meta Platforms stock to $180 from $145. Ju reiterated a Buy rating for the stock based on his updated thesis that highlighted “potential for positive operating margin and FCF [free cash flow] growth inflection starting in 3Q23 and accelerating thereafter.”

The analyst also sees the potential for better-than-anticipated ad revenue growth backed by increased monetization of Instagram, Reels, and other features. He also noted a possible moderation in Meta’s investments in Reality Labs as the company looks for greater efficiencies.

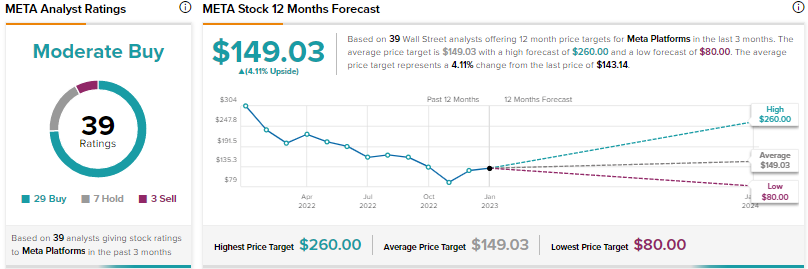

Overall, Wall Street’s Moderate Buy consensus rating for Meta Platforms is based on 29 Buys, seven Holds, and three Sells. The average price target of $149.03 for Meta stock implies 4.1% upside potential.

Amazon (NASDAQ:AMZN)

Amazon’s growth rate slowed down following the reopening of the economy as pandemic-induced tailwinds faded and macro pressures hurt consumers’ spending. The company’s lucrative cloud computing business, Amazon Web Services (AWS), helped in offsetting the weakness in the retail business in recent quarters. However, fears of an economic slowdown have impacted AWS’ growth rate.

Meanwhile, Amazon is aggressively reducing its costs and streamlining its operations to improve its financial position.

Is Amazon a Buy, Hold, or Sell?

Ahead of Amazon’s Q4 results scheduled on February 2, Telsey Advisory Group analyst Joseph Feldman reiterated a Buy rating on Amazon stock but cut his price target to $125 from $140. Feldman reduced his Q422 and 2023 estimates to reflect a tough consumer and corporate spending backdrop. Amazon is also getting impacted by currency headwinds and strategic investments.

Feldman expects business trends to improve in the second half of this year. He expects Amazon’s profitability to improve due to several initiatives, including its focus on higher margin categories, reduced spending on logistics and fulfillment centers, and the closure of unprofitable divisions. He also anticipates Amazon to benefit from newer businesses like grocery, pharmacy, and telehealth.

Feldman concluded, “The strong growth and profitability of AWS, as well as its media and advertising offerings, should continue to outperform the company average and support Retail.”

Wall Street remains bullish about Amazon stock, with a Strong Buy consensus rating based on 34 Buys and four Holds. At $132.10, the average price target implies 37.2% upside potential. AMZN stock has risen 15% so far this year.

Netflix (NASDAQ:NFLX)

Streaming giant Netflix spooked its investors when it reported a decline in subscribers in the first two quarters of 2022. However, the company revived investors’ hopes by adding 2.41 million net new subscribers in Q3 2022. Furthermore, Netflix recently reported net subscriber additions of 7.66 million for Q4 2022, surpassing analysts’ estimate of 4.57 million. Nonetheless, it missed earnings expectations due to a loss related to euro-denominated debt.

Netflix aims to improve its business through two key initiatives, the ad-based subscription tier and “paid sharing.”

What is the Price Target for NFLX Stock?

Following the Q4 results, Argus analyst Joseph Bonner increased his price target for Netflix stock to $390 from $340 and reaffirmed a Buy rating. Bonner highlighted the company’s robust Q4 net paid subscriber data and management’s focus on reviving its revenue growth through attractive original content.

While Netflix is facing challenging economic conditions and intense rivalry, Bonner believes that the company remains the “anchor tenant” for video streaming consumers.

The Moderate Buy consensus rating for Netflix stock is based on 17 Buys, 14 Holds, and three Sells. The average price target of $351.81 implies a possible downside of 3.3%. NFLX stock has rallied over 23% so far in 2023.

Final Thoughts

Wall Street is more bullish about Amazon than Meta Platforms and Netflix. Most analysts believe in Amazon’s long-term growth based on its dominance in the e-commerce space, solid prospects for AWS, and the potential to expand into other growth areas. Analysts see higher upside in AMZN stock than the other two FAANG stocks.

As per TipRanks’ Smart Score System, Amazon scores a nine out of 10, which implies that the stock could outperform the broader market over the long term.