2023 has been a tough year for real estate investment trusts (REITs). However, Medical Properties Trust (NYSE:MPW) is a REIT with turnaround potential. I am bullish on MPW stock because Medical Properties Trust seems undervalued and is taking proactive measures to slim down its real estate holdings.

Medical Properties Trust is headquartered in Alabama and holds a large real estate portfolio of hospitals. Thus, Medical Properties Trust is somewhat involved in the healthcare sector, but it’s a REIT first and foremost.

Sure, REITs tend to pay decent dividends, and Medical Properties Trust is no exception, declaring a $0.15 per share dividend this quarter (an annualized yield of over 11%). Yet, I wouldn’t want anybody to buy MPW stock just for the dividend distributions. It’s important to believe in the company, and Medical Properties Trust has comeback potential even during these challenging times.

A Harsh Price-Target Cut for Medical Properties Trust

For various reasons, REITs aren’t favored by analysts and investors in 2023. To a certain extent, the pessimism is understandable. After all, it’s tough to operate a real estate business when interest rates are high.

Still, the pessimism may be overstated. As we’ll discuss momentarily, analysts are generally lukewarm about MPW stock’s future prospects. Just to give you an example, Exane BNP Paribas analyst Nate Crossett initiated his coverage of Medical Properties Trust with a Neutral rating and price target of $5.50. That’s not extremely negative, but it’s also not an enthusiastic endorsement.

Much harsher was Wells Fargo (NYSE:WFC) analyst Connor Siversky’s downgrade of Medical Properties Trust stock from Equal Weight to Underweight. Siversky also deeply cut his price target on the shares from $7 to just $4.

Siversky pointed out that Medical Properties Trust has over $5 billion in debt expiring through the end of 2026. This, the analyst contends, implies a need for Medical Properties Trust to engage in large-scale asset sales as a source of funds.

I certainly concur that selling some of the company’s real estate holdings would help Medical Properties Trust pay off its debt. Is Medical Properties Trust actually doing this? That’s the billion-dollar question, which we’ll get to in a moment.

First, however, I just wanted to point out that MPW stock Medical Properties Trust has much lower trailing 12-month price-to-book (P/B) and price-to-sales (P/S) ratios than the sector medians (even after taking today’s share-price surge into account). Plus, Medical Properties Trust shares are so far below their 2021 peak price that all of the market’s pessimism may have already been baked into the stock, and then some.

Medical Properties Trust Stock Gets an Earnings Boost

For today, at least, the short sellers are on the run as Medical Properties Trust stock is up by double digits. What’s going on, exactly?

As it turns out, Medical Properties Trust just published its third-quarter 2023 results. CEO Edward K. Aldag, Jr. touted his company’s “capital allocation strategy,” which, among other objectives, is intended to “increase liquidity” and “effectively address” Medical Properties Trust’s “debt maturities.”

That’s a fancy way to say that Medical Properties Trust is shoring up its capital position by selling some properties. For example, Medical Properties Trust sold its four remaining Australian facilities to HMC Capital for approximately A$470 million (Australian dollars) or $305 million (U.S. dollars).

That’s just one of the company’s property sales. In July, Medical Properties Trust sold three hospitals to Prime Healthcare for roughly $100 million. Moreover, the company agreed “in principle to sell seven facilities back to a tenant comprising approximately 1% of MPT’s total assets in the first half of 2024.”

Could a slimmer and better-capitalized Medical Properties Trust be better positioned to serve its shareholders? I’d say the answer is yes, as Medical Properties Trust delivered decent results for 2023’s third quarter.

Specifically, Medical Properties Trust reported net income of $0.19 per diluted share, which was in line with what Wall Street expected. Additionally, the company announced third-quarter normalized funds from operations (NFFO, another bottom-line financial metric for REITs) of $0.38 per diluted share. That result beat the consensus estimate of $0.35 per share.

Is MPW Stock a Buy, According to Analysts?

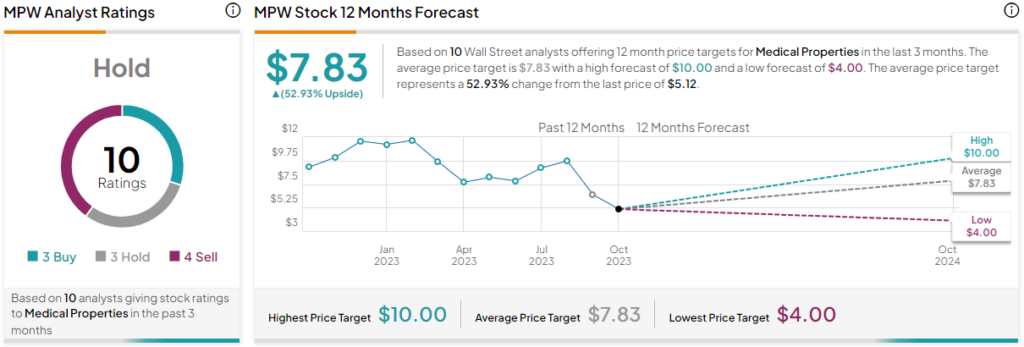

On TipRanks, MPW comes in as a Hold based on three Buys, three Holds, and four Sell ratings assigned by analysts in the past three months. In other words, the general sentiment is lukewarm at best. Furthermore, the average Medical Properties Trust stock price target is $7.83, implying 52.9% upside potential.

Conclusion: Should You Consider MPW Stock?

You don’t have to wait for analysts or other investors to give their blessing to Medical Properties Trust. The company’s quarterly bottom-line results were as good as expected, and Medical Properties Trust is slimming down to improve its capital position.

So, don’t dismiss Medical Properties Trust just because REITs are under pressure in 2023. MPW stock deserves your consideration whether you’re a dividend collector, a value hunter, or just a believer in Medical Properties Trust’s compelling turnaround story.