Mastercard stock (NYSE:MA) boasts a marvelous track record of delivering compounding returns. Duopolizing the card processing space with Visa (NYSE:V), Mastercard has grown effortlessly, capitalizing on the shift toward a cashless society and rising consumer spending trends. Combined with its high-margin business model and buybacks aiding EPS growth, MA stock has grown into a compounding machine—recording annualized returns of 21.5% over the past decade—a trend poised to persist.

Thus, I’m bullish on the stock.

The Economy Remains Hot, Bolstering Mastercard’s Growth

Surprisingly to investors, and perhaps even to the Fed, the economy has defied expectations by staying hot despite the sharp interest rate hikes of 2022 and 2023. Consumer spending has grown in 13 out of the last 14 quarters. Throughout this period, unemployment has consistently remained below 4%, with February’s rate sitting at a healthy 3.9%. Simultaneously, February saw inflation at 3.2%. Sure, it remains higher than the Fed’s ideal target, but it’s still within manageable bounds.

Looking at this data, it’s not unreasonable to suggest that the Fed has likely achieved, or is on track to achieve, the much-desired soft landing scenario. It appears that interest rates will need to stay elevated for a longer duration than initially anticipated, given the strength of the economy, even in this climate. In any case, the unbelievable resiliency the U.S. economy is showcasing continues to bolster Mastercard’s growth. Even better, this trend appears poised to continue based on Wall Street’s consensus estimates.

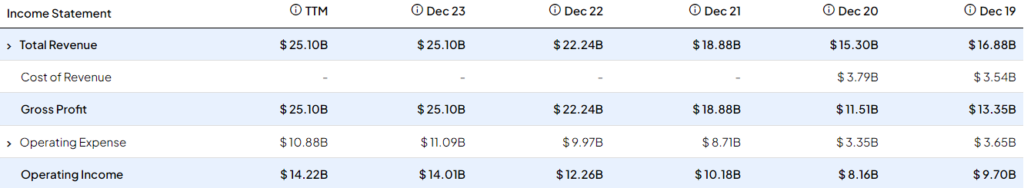

To illustrate, in FY 2023, Mastercard recorded revenue growth of 13% to $25.1 billion. To show you how tremendous Mastercard’s momentum is, keep in mind that this double-digit revenue growth rate came after FY 2022’s 18% and FY 2021’s post-pandemic-rebound-infused growth of 23%.

Again, this growth continues to be driven by strong fundamentals in the overall economy. With the labor market remaining strong and unemployment remaining low, rising wages and growing spending keep fueling Mastercard’s top line. You can also see the strength in consumer spending by looking at cross-border payments, whose volumes rose by 24% last year. The travel industry’s discretionary nature means that strong cross-border payment volumes indicate vigorous discretionary spending.

Wall Street anticipates that Mastercard will continue growing revenues at comparable rates, at least for the next few years. Consensus revenue estimates suggest growth of 12.0%, 12.6%, and 12.3% in FY 2024, FY 2025, and FY 2026, respectively. Combined with the possibility of margin expansion and buybacks, Mastercard’s earnings, and thus, stock price, appear set to keep compounding for the foreseeable future.

High Margins, Buybacks, To Compound Total Return Prospects

To say that Mastercard’s margins are high is an understatement. Due to the frictionless, royalty-like nature of its business model, the company’s gross margin is essentially 100%. While the company spends quite a bit on R&D and SG&A, operating margins consistently hover above 50%. Mastercard’s profit margins are also easy to expand due to the business model’s scalability. Last year, Mastercard’s operating margin rose from 55.2% to 55.8%.

At the same time, Mastercard’s ongoing buybacks keep boosting EPS growth. The company bought back about $9.1 billion worth of stock last year. While this may translate to a buyback yield of just about 2%, buybacks have proven highly accretive over the long term due to Mastercard retaining its high growth rates extensively. For context, the company has repurchased and retired nearly 29% of its shares since 2011.

These trends are set to persist, which, combined with the company’s vigorous growth rate estimates, are expected to compound EPS and, thus, returns. In particular, the consensus EPS estimates forecast a five-year CAGR of 17%, meaning that EPS growth over the medium term is expected to exceed the revenue growth estimates stated earlier.

One could argue that Mastercard’s premium valuation could cap the stock’s total return prospects despite the rather impressive EPS growth forecasts. Still, I would disagree. Mastercard stock is not cheap, but it’s not expensive either, in my view. At 33 times this year’s expected EPS, I believe that Mastercard is more or less fairly valued given such an optimistic medium-term EPS forecast and the fact that this is one of the deepest-moat businesses in the world.

Given that Mastercard has historically traded at a premium, future returns are likely to compound in line with the company’s underlying double-digit growth, essentially signaling a promising medium-term total return outlook.

Is MA Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Mastercard maintains a Strong Buy consensus rating based on 28 Buy and one Hold recommendation assigned in the past three months. At $515, the average MA stock price target implies 6.9% upside potential.

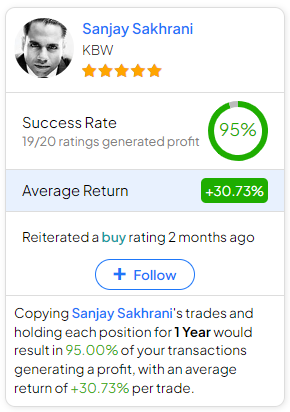

If you’re wondering which analyst you should follow if you want to buy and sell MA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Sanjay Sakhrani from KBW, with an average return of 30.73% per rating and a 95% success rate. Click on the image below to learn more.

The Takeaway

In conclusion, I believe that Mastercard’s dominance in the card processing industry, along with a rather favorable economic landscape, positions the stock for continued gains. Undeniably, Mastercard’s strong revenue growth prospects, driven by robust consumer spending trends, and even more promising EPS growth prospects reinforce its status as a compounding machine. Thus, even though the valuation does indeed seem like it carries a premium, long-term investors are likely to continue to be rewarded nicely.