TipRanks’ website traffic screener tracks changes in consumer behavior and helps gauge the impact of those changes on a company’s financials and stock price. Furthermore, the tool tracks all of a company’s domains and subdomains (which are sections of the company’s main website and relevant to its financials), which is unique to TipRanks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Using this website traffic tool, let’s look at the 10 most-visited affordable luxury brands’ websites in June. Learn how Website Traffic can help you research your favorite stocks.

This is important, as looking at websites that scored the most visits compared to the prior year could be a solid starting point to identify top businesses that are outgrowing others.

Moreover, we have combined web visits with TipRanks’ other valuable datasets, such as analysts’ recommendations and insider and hedge fund signals, to shed more light on these affordable luxury companies’ business growth.

Top 10 Most-Visited Websites in June 2022

EssilorLuxottica (ESLOY)(DE:ESL)

Rank: #10

Year-over-year Traffic Growth: 23.47%

EssilorLuxottica owns an extensive portfolio of luxury and lifestyle eyewear brands, including Ray-Ban, Oakley, Persol, and Alain Mikli, among others.

ESLOY benefitted from solid demand and delivered double-digit revenue growth in Q1. Furthermore, TipRanks’ website traffic tool shows that the momentum in its business has been sustained in June and the first half.

TipRanks’ website traffic tool shows that the number of visits to essilorusa.com and its seven other websites increased 23.47% year-over-year in June 2022. Moreover, traffic has grown by 13.91% in the first half.

EssilorLuxottica stock has received three Buy and three Hold recommendations for a Moderate Buy rating consensus. Further, analysts’ average price target of €170.67 implies 10.79% upside potential.

The Swatch Group (SWGAF)

Rank: #9

Year-over-year Traffic Growth: 27.92%

The Swatch Group is a multinational holding company and the world’s largest watchmaker. It owns 17 famous brands, including the namesake brand, Omega, Rado, and Tissot, among others. It also manufactures and sells jewelry and watch components.

According to TipRanks’ website traffic tool, visits to swatch.com and its 15 other websites rose 27.92% year-over-year in June. Meanwhile, web traffic increased by 54.33% in the first half.

The strong web traffic trends indicate that Swatch Group could deliver impressive financial numbers in the upcoming quarter. Notably, Swatch’s management is upbeat and expects to deliver double-digit sales growth (in local currency) in 2022. Further, management highlighted that the growth prospects for all price segments are extremely positive.

Swatch Group sports a Hold rating consensus on TipRanks based on five Buy, five Hold, and two Sell recommendations. Further, analysts’ average price target of $290.58 implies 16.23% upside potential.

Moncler (MONRY)(GB:0QII)

Rank: #8

Year-over-year Traffic Growth: 34.22%

Moncler is an Italian luxury fashion house that is benefiting from solid demand. In Q1, the group’s revenue jumped 60%, led by strength across its brands. Meanwhile, the rising website traffic trends indicate momentum has been sustained in Q2.

Per the web traffic tool, visits to moncler.com increased 34.22% year-over-year in June. Further, for the first half, visits jumped 41.05%.

Moncler’s CEO, Remo Ruffini, is upbeat about the future despite the challenging macro and geopolitical environment. The strong demand for its brands, strength across the direct-to-consumer channel, and momentum in the Americas will likely support its growth.

Moncler stock has six Buy and three Hold recommendations for a Moderate Buy rating consensus on TipRanks. Moreover, analysts’ average price target of €57.78 implies 36.98% upside potential.

Adidas (ADDYY)(GB:0OLD)

Rank: #7

Year-over-year Traffic Growth: 58.52%

Adidas is a German sportswear designer, manufacturer, and seller. Moreover, it is the world’s second-largest sportswear company.

The number of visits to adidas.com, including the U.K. website, increased 58.52% year-over-year in June 2022. Meanwhile, it grew 30.14% in the first half. The improving traffic trends suggest that Adidas could deliver stellar growth in Q2 on the back of continued strength in the western market.

Adidas recently stated that Q2 results are ahead of expectations, led by solid momentum in western markets and recovery in the Asia-Pacific. However, the company turned cautious for Q3 and expects a slower-than-expected recovery in China. It expects revenue to decline in China for the remainder of the year.

Adidas stock has 11 Buy, seven Hold, and three Sell recommendations for a Moderate Buy rating consensus. Further, analysts’ average price target of €216.45 implies 27.53% upside potential. Adidas also has a positive signal from corporate insiders who bought its shares worth €30K in the last quarter. Meanwhile, it has an Outperform Smart Score of 9 out of 10.

Nike (NYSE:NKE)

Rank: #6

Year-over-year Traffic Growth: 64.33%

Nike is the world’s leading athletic footwear, apparel, equipment, and accessories designer and seller. Furthermore, its Converse brand designs, licenses, and sells athletic lifestyle sneakers, clothing, and accessories.

TipRanks’ website traffic tool shows that Nike’s brand strength continues to attract consumers. Per the website traffic tool, visits to nike.com and its another website (converse.com) increased 64.33% year-over-year in June 2022. Moreover, traffic improved by 38.72% in the first half.

The improving web traffic trends are in line with the management’s guidance. Nike’s management expects its top line to grow at a low double-digit rate (constant currency basis) in FY23 despite worries about inflation and its impact on consumer demand. However, COVID disruptions in China could impact its near-term financials.

Nike sports a Moderate Buy rating consensus on TipRanks based on 16 Buy, nine Hold, and one Sell recommendations. Further, their average price target of $129.82 implies 20.36% upside potential.

While analysts are cautiously optimistic about NKE stock, hedge funds are accumulating it. Hedge funds increased their holdings in NKE stock by 537K shares in the last three months. Further, NKE stock also has a positive signal from bloggers. NKE stock has an Outperform Smart Score of 8 out of 10.

Pernod Ricard (PRNDY)(GB:0HAT)

Rank: #5

Year-over-year Traffic Growth: 81.16%

Pernod Ricard is the second-largest wine and spirits company in the world. It owns a portfolio of over 240 premium brands (including Chivas, Ricard, Jameson, Ballantine’s, and Malibu, among others) and sells its products in more than 16 markets.

TipRanks’ website traffic tool shows that Pernod continues to benefit from solid growth in the majority of markets. According to the website traffic tool, visits to chivas.com and 10 other websites increased 81.16% year-over-year in June 2022. Moreover, traffic improved by 55.93% in the first half.

While rising web visit trends are positive, inflationary pressure on consumer demand, COVID disruptions in China, and the Russia/Ukraine conflict could hurt its growth. However, travel recovery, momentum in several markets, and increased investments will likely support its growth.

Pernod stock has 10 Buy and five Hold recommendations for a Moderate Buy rating consensus. Moreover, analysts’ average price target of €217.73 implies a 16.23% upside potential.

Lululemon Athletica (NASDAQ:LULU)

Rank: #4

Year-over-year Traffic Growth: 81.16%

Lululemon Athletica designs and retails athletic apparel, footwear, and accessories. Its apparel assortments include pants, tops, and jackets to promote healthy lifestyle activities like yoga and running.

Lululemon continues to deliver strong financial performance and is navigating the headwinds from COVID-19, inflation, and the supply chain well. While Lululemon is not immune to these headwinds, its website traffic trends show that the momentum in its business has been sustained in Q2.

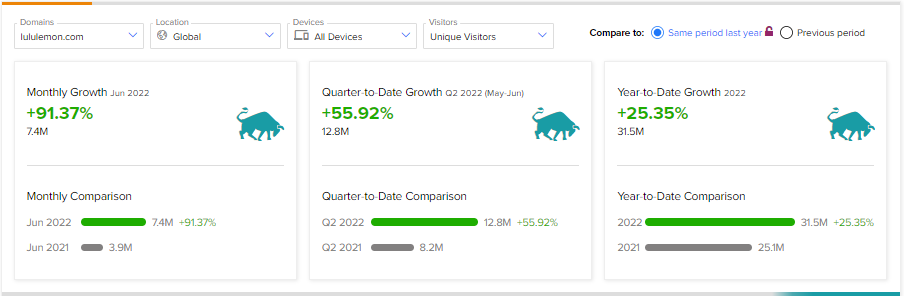

TipRanks’ website traffic tool shows that visits to lululemon.com increased 91.37% year-over-year in June 2022. Moreover, traffic grew by 25.35% in the first half.

LULU stock has a Moderate Buy rating consensus based on 16 Buy, seven Hold, and one Sell recommendations. Further, the average analysts’ price target of $373.54 implies 26.38% upside potential.

LULU stock has a positive signal from insiders, who bought shares worth $56K in the last three months. However, hedge funds and retail investors have sold their LULU stock recently. Overall, it has an Outsmart Score of 8 out of 10.

Revolve Group (NYSE:RVLV)

Rank: #3

Year-over-year Traffic Growth: 113.99%

Revolve is a next-gen fashion retailer offering apparel, footwear, and accessories for millennial and generation Z consumers. It operates through two segments – REVOLVE and FRWD.

According to TipRanks’ website traffic tool, visits to revolve.com increased 113.99% year-over-year in June 2022. Moreover, traffic grew 55.61% in the first half.

The surge in website traffic indicates that the momentum in its business has continued into Q2. It continues to add active customers at a healthy pace, which is positive. However, softness in Greater China could remain a drag.

RVLV stock has received 13 Buy and four Hold recommendations for a Strong Buy rating consensus. Moreover, the average price target of $49.53 implies 83.51% upside potential.

Besides analysts, RVLV stock has positive signals from hedge funds and bloggers. Hedge funds bought 381.4K RVLV stock in the last quarter. Furthermore, RVLV stock has a maximum Smart Score of 10.

Estée Lauder (NYSE:EL)

Rank: #2

Year-over-year Traffic Growth: 122.17%

Estée Lauder is the world’s leading manufacturer and seller of skincare, fragrance, makeup, and hair care products. The strong consumer demand for its products continued to drive its organic sales even in the high inflationary environment.

Meanwhile, the spike in web traffic indicates that Estée Lauder is well-positioned to deliver another strong quarter. Per TipRanks’ website traffic tool, visits to esteelauder.com and its two other websites jumped 122.17% year-over-year in June. Meanwhile, web visits were up 77.54% in the first half of 2022.

EL stock carries a Strong Buy rating consensus on TipRanks based on 14 Buy and four Hold recommendations. Further, analysts’ average price target of $304.61 implies 15.64% upside potential.

Hedge funds have increased their holdings in EL by buying 729.6K shares in the last quarter. Further, 4% of TipRanks’ investors also increased their exposure to EL stock in one month. However, insiders have sold EL stock worth $7.6M in the last quarter. Nevertheless, EL Stock has a maximum Smart Score of 10.

Williams-Sonoma (NYSE:WSM)

Rank: #1

Year-over-year Traffic Growth: 131.54%

Williams-Sonoma is a specialty retailer of premium home and kitchen products. WSM has delivered strong organic sales in recent quarters, and the surge in website traffic data suggests that the momentum in its business continued in Q2.

According to TipRanks’ website traffic tool, visits to williams-sonoma.com spiked 131.54% year-over-year in June 2022. Moreover, traffic grew by 40.90% in the first half.

While its multi-brand portfolio continues to support its growth, the fear of an economic slowdown and its impact on consumer demand and spending has led to a decline in its stock price and keeps analysts sidelined.

WSM stock has four Buy, five Hold, and four Sell recommendations for a Hold rating consensus. Meanwhile, the average analysts’ price target of $137.25 is almost in line with the current market price.

It has negative signals from hedge funds, insiders, and retail investors who have lowered their exposure to WSM stock. Meanwhile, it has a Neutral Smart Score of 6 out of 10.

Bottom Line

The website traffic trends show that affordable luxury has proven resilient to the dynamic economic environment in the first half of 2022. However, investors should take caution as high inflation, other macro headwinds, and COVID-led disruptions in China could continue to play spoilsport.

Built with the help of TipRanks’ stock comparison tool, here is the summary of how these stocks stack up on TipRanks’ valuable datasets.

Continue to watch this space for updated website visit data for these affordable luxury companies.

Learn how website traffic can help you research your favorite stocks.