I am neutral on Marvell Technology (NASDAQ: MRVL) as its near-unanimous support from Wall Street analysts and massive growth potential are offset by its significantly elevated valuation relative to its recent historical averages.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Marvell Technology is an American technology company that produces semiconductors and other related products and services. The company was founded in 1995 and is based in Delaware.

Strengths

Marvell Technology has over 10,000 patents across the globe with 5,340 employees. The company has made many strategic acquisitions, including that of Cavium, a fabless semiconductor company.

In 2019, the company completed the purchase of Aquantia, a high-speed transceiver company and in 2021, it acquired Inphi, another semiconductor company.

Most recently, the company completed the acquisition of Innovium on October 5, 2021, just 25 days before the end of its third quarter of 2022.

Recent Results

Marvell reported revenue of $1.21 billion for the quarter ended October 2021, which exceeded the guidance provided by the company in August. The company’s revenue saw a 13% growth quarter-over-quarter and 61% growth year-over-year.

Increases were substantial in all five of the company’s segments, particularly Data Center, which contributed 41% to total revenue and grew 15% from the previous quarter, and 109% from the previous year’s quarter.

Marvell has beaten consensus revenue estimates over the past four quarters, consecutively.

The company also posted a GAAP net loss for the third quarter of 2022 of $63 million or a loss of $0.08 per diluted share. Non-GAAP net income for the third quarter of 2022 was $364 million, or earnings of $0.43 per diluted share.

For the fourth quarter of 2022, Marvell is expecting revenue to be approximately $1.32 billion, give or take 3%, primarily attributed to 5G, which is expected to improve by 30% from the third quarter.

The company also expects its GAAP gross margin to show improvement in the range of 47.9% and 49.8%, while its GAAP operating expenses are expected to be between $630 and $640 million.

Valuation Metrics

MRVL stock looks richly priced right now as its EV/EBITDA ratio is 34.5x compared to its five-year average multiple of 19.6x, and its P/E ratio is 42.2x compared to its five-year average multiple of 25.5x.

That said, it is expected to grow revenue by over 33%, EBITDA by over 40%, and normalized earnings by over 51% over the next year.

Wall Street’s Take

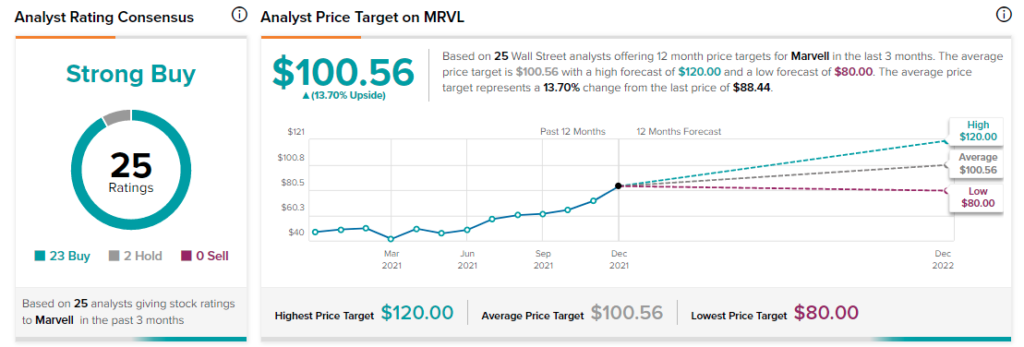

From Wall Street analysts, MRVL earns a Strong Buy analyst consensus based on 23 Buy ratings, two Hold ratings, and zero Sell ratings in the past three months. Additionally, the average Marvell price target of $100.56 puts the upside potential at 13.7%.

Summary and Conclusions

Marvell Technology is a rapid grower in a red-hot industry. As a result, it has very strong growth potential for the foreseeable future and enjoys near unanimous support from Wall Street analysts.

That said, investors should keep in mind that the valuation multiples look quite elevated here relative to recent historical averages.

Download the TipRanks app here.

Disclosure: At the time of publication, Samuel Smith did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >