Shares of long-time department store chain Macy’s (NYSE:M) will be making headlines this week as it flies balloons across a slew of new floats for the Macy’s Thanksgiving Day Parade. Indeed, the event is sure to give the brand a nice boost the day before Black Friday. With a recession on the way, though, this Black Friday could see retail sales coming in far lower than in prior years. Regardless, Americans are hungry for a good deal after dealing with horrid levels of inflation for more than a year, and Macy’s stock itself seems like a great deal for value hunters with the holiday season up ahead.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Macy’s is ready to go, not just with the Thanksgiving Day festivities, but with strong inventory (quarter-end inventory was up a solid 4% in the latest quarter) to meet demand in what could be one of the biggest shopping days of the year. Further, Macy’s stock has muted expectations baked in as we march into a period of seasonal strength. With so much recession risk factored into the share price, I remain bullish on the stock.

Macy’s Stock Could be Ready to Float Higher

Macy’s parade balloons may not be the only things flying higher this quarter. With markets acting constructive and hopes that a Santa Claus rally will come to town, things are starting to look up for beaten-down discretionary retailers like Macy’s. The company has come a long way since the second quarter, which saw inventory levels take a hit due to macro-related concerns.

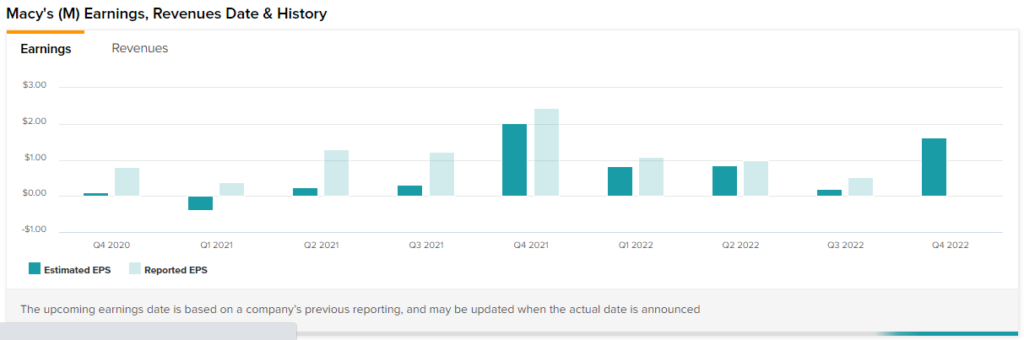

With a big third-quarter beat in the books ($0.52 EPS vs. $0.18 consensus), many folks, including management, were a tad too conservative going into the quarter. Moving forward, expectations are still relatively muted for a company that’s done a reasonably good job of coping with a tough retail environment.

Though consumer spending could wind down further from here, elevated inventory could pave the way for some incredible deals on discretionary (nice-to-have) goods. The only question is whether consumers will bite as they continue to feel the pinch of price increases.

In a sitdown with CNBC, ex-Macy’s CEO Terry Lundgren thinks retail sales will end the year 6%-7% higher. That would be a nice jump.

With a strong labor market and more of a bargain-hunter mentality, I do think the stage could be set for considerable relief in bid-down retailers that are beginning to show signs of life.

Don’t Discount Macy’s Tech Savviness!

Traditional retailers disrupted by e-commerce firms have had to pivot and adapt to the new age. Digital retail has been a huge pressure point on the old-time brick-and-mortar giants. Fortunately, Macy’s is one of the physical retailers that’s made the investments to grow its online presence. The retailer has a pretty impressive omnichannel presence going into Black Friday and the holiday season. Undoubtedly, deal-seekers will leverage both channels as they look to get the most out of their limited holiday shopping budgets.

It isn’t just online retail that Macy’s is getting right. The company is also exploring the metaverse with a parade metaverse experience. Indeed, NFT (Non-Fungible Token) projects and a “web3 virtual landscape” could make the Macy’s Thanksgiving Day Parade its highest-tech one yet.

Sure, the metaverse may not be ready for prime time yet, but there’s not much for Macy’s to lose, as it looks to market to the high-tech crowd this time of year. I think Macy’s is incredibly smart to explore the new frontier and I think the move could give the retailer a nice boost ahead of what could be a much stronger season than expected.

Is Macy’s a Good Stock to Buy, According to Analysts?

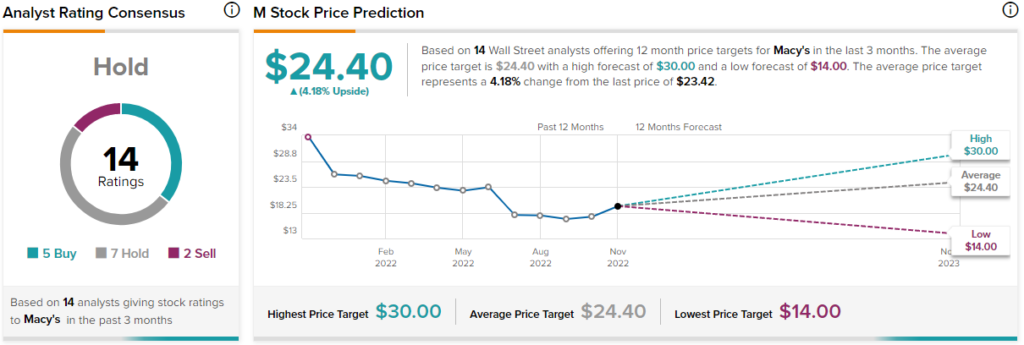

Turning to Wall Street, M stock comes in as a Hold. Out of 14 analyst ratings, there are five Buys, seven Holds, and two Sells. The average Macy’s price target is $24.40, implying an upside of 4.2%. Analyst price targets range from a low of $14.00 per share to a high of $30.00 per share.

Takeaway: A Tempting Bargain Going Into Year’s End

Macy’s stock is down more than 67% from its 2015 all-time high. At 0.2x sales and 4.9x trailing earnings, Macy’s is a deep-value play in retail with compelling catalysts going into year’s end. With an alarmingly-high 1.77 beta, though, the stock will be far choppier than the S&P 500 (SPX). Only a handful of Wall Street analysts think the turbulent ride will be worthwhile.

At these depressed levels, I view M stock as more of a bargain than a trap for those willing to exercise patience. The company is doing its best to power through these transitory headwinds, and I do think there’s a chance it could finish the year strong.