Stocks, and particularly tech stocks connected to the promising AI technology, have enjoyed a great run over the past 15 months, with some of them reaching outsized valuations. Their blistering rally has many market participants worrying that history is about to repeat itself and that we are going through a stage of bubble inflation, which could end badly for exuberant investors.

Is history repeating itself with another dot-com bubble? While there are similarities with the past, there are strong arguments suggesting that this time is different. However, investors should be wary of the hype to avoid falling victim to irrational exuberance 2.0.

1

“Let’s Party Like It’s 1999”

On December 5, 1996, the chairman of the Federal Reserve Alan Greenspan, in his famous speech, used the term “irrational exuberance” to describe the market rally that was then closing its second year. According to the term’s author, Nobel Prize laureate Robert J. Shiller, “irrational exuberance is the psychological basis of a speculative bubble,” when asset price increases spur fast-spreading investor enthusiasm, and more and more investors are drawn into the rallying asset “despite doubts about the real value of an investment.”

As we now know, both Shiller and Greenspan were correct in their assessment, recognizing the budding dot-com bubble that would burst spectacularly three and a half years later. The stock-market bubble was ignited by the rising adoption of the Internet, which profoundly changed the economy, the business world, and our everyday lives. While the new technology was indeed life-changing and the opportunities it opened were immense, the stock market’s frenzy was completely out of proportion. The Nasdaq Composite (NDAQ) index surged 800% in five years, only to crash by almost 80% when the bubble burst, giving back all its frothy gains.

1

A Bubble Story Told by Cisco

In the past year, we have witnessed another potentially life-changing technology, Artificial Intelligence (AI), which has taken the world by storm. AI is expected to greatly benefit productivity, increase profits, and open a myriad of exciting business opportunities. However, as we have learned from the dot-com example, the fact that today’s exuberance is laid on a solid ground of real potential wealth doesn’t mean that it is all rational. In short, AI will surely make the economy better off, but the stocks connected to the technology might still be in a bubble.

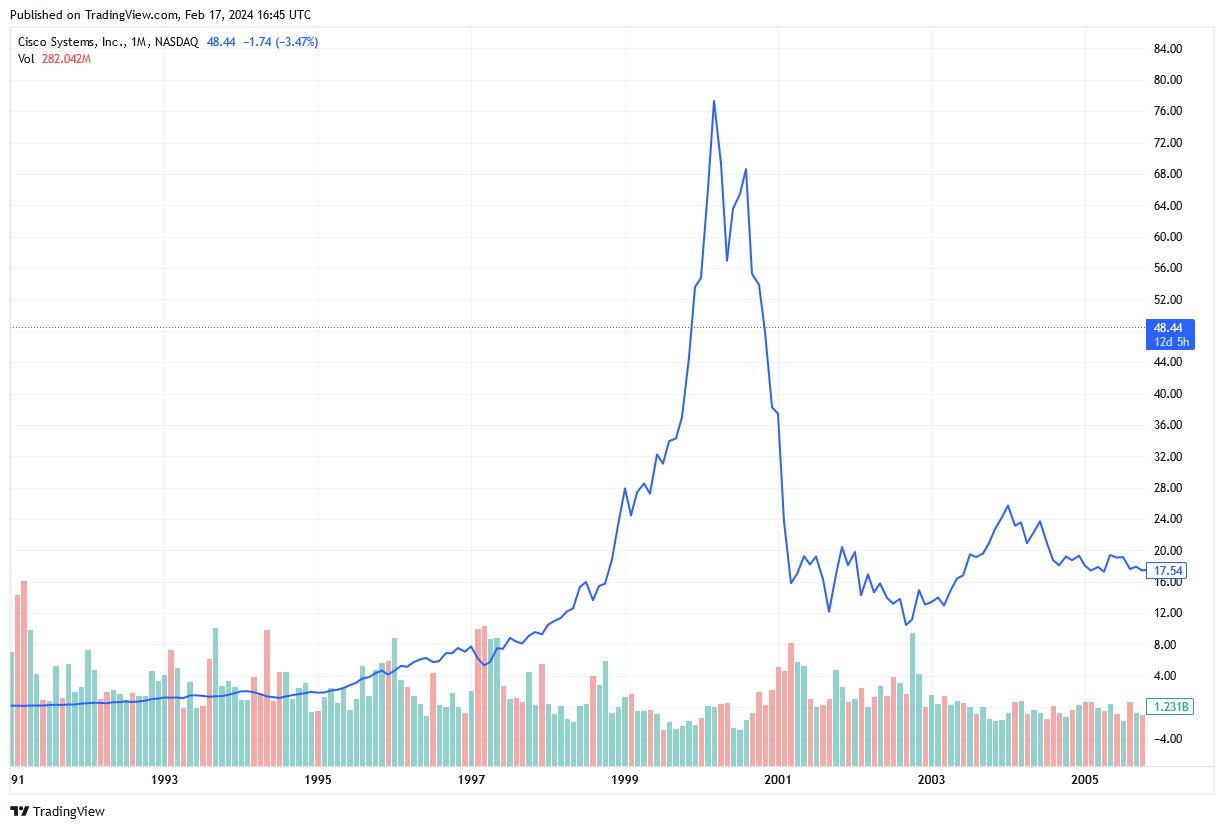

In the late 1990s, Cisco Systems (CSCO) was the poster child of the Internet mania. The growing use of the web meant a surge in demand for key network equipment supplied by the company. As a result, CSCO stock saw a parabolic surge, rising almost tenfold in market cap in the years leading to the bubble’s burst. Then, within one year, it lost about 85% of its stock value.

Source: TradingView

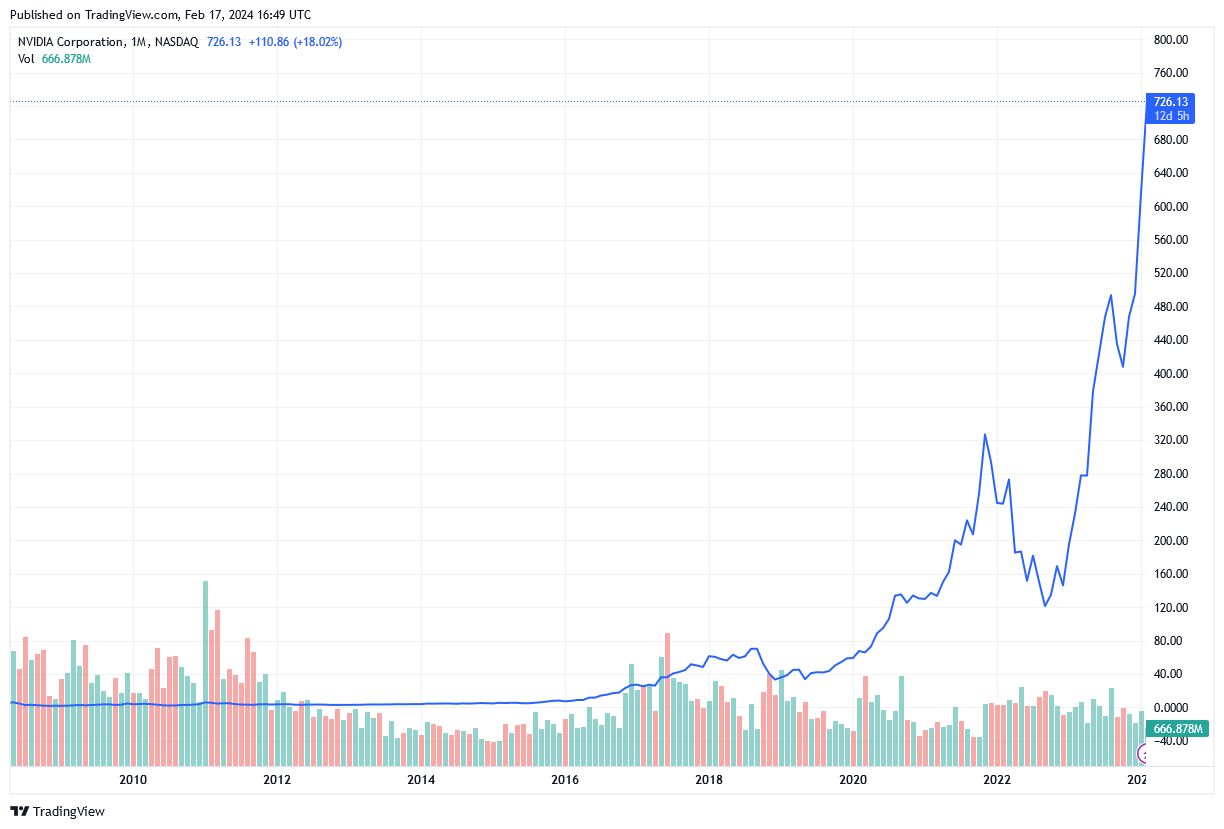

Fast forward three decades, and now it is Nvidia (NVDA) which embodies the AI bubble-in-question. Since the release of ChatGPT to the general public on November 30, 2022 – the event that sparked the surging excitement and investor flows into anything connected to AI – the chip designer’s stock has surged over 310%, and its market capitalization has more than quadrupled.

1

History Rhymes, Not Repeats

The similarities are eerie. In both instances, the companies in focus are not hype-riding money-burning startups, but firms with real achievements under their belt before the start of the mania around their stocks. Just like Cisco then, Nvidia provides cutting-edge products crucial to the development of a transformative technology, while reporting enviable profit margins and forecasting (and achieving) high earnings growth.

Source: TradingView

Of course, history rhymes, but it does not necessarily repeat. Before the dot-com bubble began inflating, Cisco was one of many hardware suppliers with strong, but not magnificent, sales and margin growth. Contrastingly, Nvidia expanded revenues by 3.5 times in the five years prior to ChatGPT sparked the market’s scorching love for the stock; i.e. it was doing just fine without AI’s help. CSCO was riding a strong economic wave throughout the late 1990s, while NVDA and its friends from the AI winners’ cohort surged despite high interest rates and elevated economic uncertainty. And so on, and so on. Still, the parallels are unnerving.

1

“This Time Is Different,” or Is It?

If Nvidia is the new Cisco and tech stocks are in a dot-com-like bubble, we might still have a couple of years until it bursts – if it bursts.

While voices comparing the current market situation to the dot-com bubble are increasingly vocal, so are their opponents, claiming that no bubble exists. The non-bubble supporters do have some strong arguments bolstering their case. Thus, Nvidia and other technology behemoths that were responsible for the lion’s share of stock-market gains last year have very solid fundamentals that prop up their market caps.

Besides, these companies have shown double net profit margins and are still forecasting twice the rate of earnings-per-share growth as the rest of the market. These factors suggest that their high valuations are based on financial logic. In addition, the tech megacaps’ valuations are nowhere as crazy as some from 2000: at its high, Cisco traded at a P/E over 200, making NVDA’s price-to-earnings ratio of 95 look reasonable by comparison.

However, that, too, rhymes with the past. In March 2000, Wharton School professor Jeremy J. Siegel wrote an article for the Wall Street Journal named “Big-Cap Tech Stocks Are a Sucker Bet,” explaining that large-cap tech stocks’ exceedingly high P/E ratios would be unjustified even if they achieved long-term earnings growth twice the rate of the S&P 500. To quote: “History has shown that whenever companies, no matter how great, get priced above 50 to 60 times earnings, buyer beware.” History immediately showed the professor was right.

1

The Investing Takeaway

Cisco’s stock has never recovered from its 2000’s downfall, even though the company continues to churn out revenues, selling networking equipment for ever-growing Internet connectivity. Its only problem was that after several years of fast growth, revenues slowed down below overheated expectations. The self-inflicted investor disappointment brought it down, and those who bought Cisco at the height of its popularity have only clawed back a little over half of the price they originally paid.

As Professor Siegel said in the same article, “The excitement generated by the technology and communications revolution is fully justified, and there is no question that the firms leading the way are superior enterprises. But this doesn’t automatically translate into increased shareholder values.” In simple words, even stocks of great companies riding a sweeping technological change can be devastatingly impacted by over-valuation.

Nvidia and other high-flying tech companies have real, significant value, but it is currently obscured by the market’s AI obsession, pushing valuable assets to the state of a speculative bet. Investors are advised to steer clear of the delirious run after the “unstoppable growth story” du jour. History shows that nothing is unstoppable, and all that hype and overinvestment can only make the subsequent fall that much more painful.