Shares of aerospace and defense kingpin Lockheed Martin (LMT) were under pressure on Tuesday, tumbling more than 4% on a relatively decent day for markets. Amid Russia’s invasion of Ukraine, the defense industry has done incredibly well, outperforming the broader markets by a considerable amount. Even after Lockheed’s big day down, its stock has just fallen into a correction, while the S&P 500 is slogging through a bear market.

Even down 11% from its highs, LMT stock seems like a terrific value, especially for those seeking a big dividend and a hedge against a worsening of geopolitical tensions. Undoubtedly, the Ukraine-Russia crisis has enticed many nations to invest a bit more in national security. Greece is the latest nation to submit orders to Lockheed, with 20 F-35 fighter jets requested.

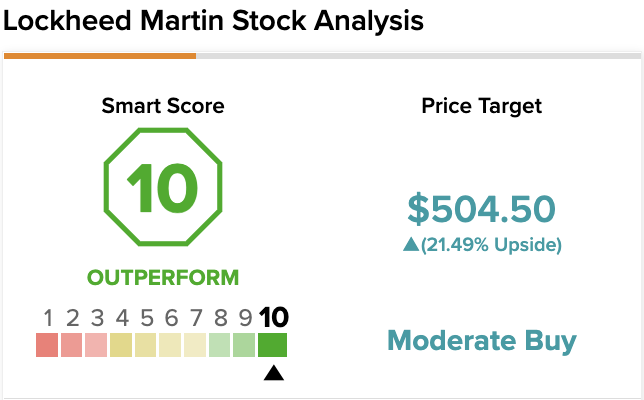

On TipRanks, LMT scores a 10 out of 10 on the Smart Score spectrum. This indicates a high potential for the stock to outperform the broader market.

Lockheed Martin: F-35 and Robust U.S. Defense Spending are Key

Though Lockheed has an excellent operational track record, especially relative to the likes of Boeing (BA), the F-35 jet remains a single source of error, accounting for around 30% of Lockheed’s sales.

Indeed, such heavy exposure to one project leaves the company with a great deal of operational risk. As we saw with Boeing, a few issues with production or delays could have a detrimental impact on a stock.

Undoubtedly, the jet is viewed as the latest and greatest, with its impressive stealth capabilities and a growing number of features that separate it from the competition. The F-35 is not a cheap jet, but it’s gotten somewhat more affordable in recent years.

As Lockheed continues investing in its top jet, it’s likely to become even more affordable and feature-rich with time. Amid rising geopolitical turmoil, the future looks bright for the F-35.

Despite the promising long-term outlook, Lockheed’s dependence on the U.S. military is another reason its stock may be deserving of a discount. Recently, the Navy pulled back on its F-35 orders. Lockheed has faced a bit of turbulence in response to such unforeseeable pieces of news.

Finally, a peaceful resolution to the Ukraine-Russia conflict and a global recession could knock the wind out of defense spending. Indeed, there’s a lot of uncertainty when it comes to Lockheed Martin.

In any case, the stock seems modestly priced at 18.3 times trailing earnings, 1.8 times sales, and 15.2 times cash flow. With a 2.7% dividend yield and a 0.73 beta, LMT stock definitely appears to be a way to barrel roll past the rough tides of the market.

For now, I am neutral on the stock, given its over-dependence on the F-35 and the U.S. economy.

A Safe Place to Hide for Jittery Investors?

Worries over the Ukraine-Russia war have allowed LMT stock to hold its own relative to the rest of the market. Looking ahead, things could change if geopolitical tensions begin to ease. Recent U.S.-China trade talks and the potential lifting of tariffs are very constructive. Though the lifting of tariffs and a Russian pullout from Ukraine would be applauded by everyone, Lockheed Martin stock may be one of the names left out of what would be an epic market rally.

Even at these modest multiples, Lockheed Martin seems like a fair value at best. When there are so many great bargains in this market, settling for fair value may not be a great idea.

Lockheed may be a market leader today, but in the second half, it’s unclear. In any case, expect the company to continue innovating and moving forward as the economy tilts into a slowdown.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, LMT stock comes in as a Moderate Buy. Out of 12 analyst ratings, there are six Buy recommendations and six Hold recommendations.

The average Lockheed Martin price target is $504.50, implying an upside of 21.49%. Analyst price targets range from a low of $470 per share to a high of $539 per share.

The Bottom Line on Lockheed Martin Stock

Lockheed Martin is arguably one of the highest-quality defense stocks out there. The stock isn’t expensive for what you’re getting. However, given the lack of diversification, exogenous events could take a toll on the stock in a hurry.

The defense cycle is super long. And while a looming recession may not mark the end of high demand for F-35 jets, I do think a better entry point could be in the cards as market jitters begin to ease. They’re at a high point right now, and the stock could be in for cooling if geopolitical progress is made.

Read full Disclosure