The vintage sci-fi series, The Twilight Zone, told unsettling stories in which ordinary folks found themselves in bizarre situations and encountered extraordinary circumstances.

For Larry Adam, chief investment officer at Raymond James, given the “rapidly changing twists and turns we’ve seen in the global economy and the financial markets over the last few years,” it sometimes feels as if we have stepped into a modern-day iteration of the Twilight Zone.

However, for those spooked by what does seem like a never-ending barrage of headwinds, Adam sees light at the end of the tunnel. “With the Fed’s fourteen month long tightening campaign near completion and the pandemic-related disruptions normalizing, we are optimistic that the financial markets’ recent strength can continue in the months ahead,” he said.

Running with that optimistic outlook, Raymond James analysts have pinpointed several stocks as Strong Buy opportunities. We ran 3 of their recent recommendations through the TipRanks database to see what the rest of the Street makes of these picks. As it turns out, there is widespread agreement – all of them are rated as Strong Buys by the analyst consensus as well. Let’s take a closer look.

Everi Holdings (EVRI)

The first Raymond James pick we’re looking at is Everi Holdings, a Nevada-based developer and manufacturer of games and equipment for the casino industry. The company’s product line started with traditional slot machines, and over the years has added loyalty programs, financial tech solutions, server-based digital gaming, and mobile gaming apps. In short, Everi offers its customers a one-stop-shop for their gaming floor equipment.

It may be a one-stop-shop, but it’s not one-size-fits-all. Everi offers customizable casino floor games, including standalone slot cabinets, banked slot games, and even ‘tournevent’ installations. Casinos can choose from a library of video slots with over 170 titles. Additionally, the company’s fintech solutions meet the main needs of every casino, including casino operator compliance operations, cash disbursement, customer payment solutions, and even mobile financial apps that smooth out the customer’s casino experience.

The casino business has long been notorious for dripping cash, and Everi has taken its own share of that pie. The company saw $665 million in revenues for 2021, a total that grew by 19% to reach $792 million in 2022. The first quarter of this year shows that Everi is on track to continue its revenue gains; the quarterly top line was reported as $200.5 million, up 14% year-over-year and beating analyst expectations by $9.9 million.

At the bottom line, Everi’s quarterly earnings have been somewhat more variable over the past few years, but the Q1 non-GAAP EPS of 43 cents beat the forecast by an impressive 19 cents and was up 1 penny from the prior year. The company did report a y/y decline in free cash flow for Q1, from $51.6 million to $37.1 million. Everi is guiding toward $150 million to $160 million in free cash flow for the full year 2023, compared to the company-record FCF of $186.7 million reported for 2022.

The company’s management took concrete action to boost the shares and return value to shareholders in Q1, through a substantial increase in the share repurchase program. Everi’s Board authorized a $180 million repurchase program for the next 18 months, replacing the previous authorization of $150 million. The previous program still had $66 million remaining, and was set to expire in November of this year.

For Raymond James analyst John Davis, all of this adds up to a Strong Buy proposition.

“[The] solid 1Q results featured upside to both revenue (+5%) and adj EBITDA (+2%) relative to the Street. More importantly, we were encouraged by the new $180M share repurchase authorization… While some may pick at the fact that the install base actually declined sequentially, it has grown at a ~6% CAGR over the last three years and two new lease specific cabinets are set to be introduced to operators at the end of the month… All told, the stock is certainly not priced for perfection at sub 6x our 2024 EBITDA, and we continue to view the risk/reward favorably with estimates biased higher,” Davis opined.

Along with the Strong Buy rating, Davis gives EVRI a target price of $25, suggesting the stock can grow by ~70% in the next 12 months. (To watch Davis’s track record, click here)

Overall, this stock gets a unanimous Strong Buy vote of approval from the Street’s analysts, based on 5 positive reviews. The shares are priced at $14.56 with an average price target of $24.75 implying a one-year upside potential of 70%. (See EVRI stock forecast)

I3 Verticals, Inc. (IIIV)

The second Raymond James choice is I3 Verticals, a software company offering a line of omni-channel solutions for a variety of functions necessary to the operation of small- and mid-sized businesses. These include point-of-sale, e-commerce, and mobile payment transactions; I3’s software packages have found application in sectors ranging from property management, retail, and healthcare to government, education, and nonprofits. The company works with its enterprise customers to create tailor-made solutions.

This company has been following a merger & acquisition strategy to expand its market share, with the last such move being announced in early January of this year. At that time, I3 made public the completion of its acquisition of Accufund, an accounting solutions provider for US-based non-profits and government entities. The move expanded I3’s ability to fully serve public sector customers.

The company’s quarterly revenues have been steadily increasing and that was the case again in the most recent quarterly report – for Q2 of fiscal year 2023 (March quarter). Revenues hit $93.9 million, up 20% y/y and beating the forecast by $3.3 million. The non-GAAP EPS figure came in at 38 cents, up one cent from last year and in-line with the analyst forecasts.

We turn again to Raymond James analyst John Davis, who has long been enthusiastic about I3. In his most recent note on the stock, he writes: “IIIV is continuing to gain share in under-penetrated end-markets, and we see a path for estimates to move higher throughout the year given what appears to be a conservative guide + majority non-discretionary end markets. With the stock trading at just ~11x FY24E EBITDA, we continue to view the risk/reward favorably and recommend initiating, or adding to positions.”

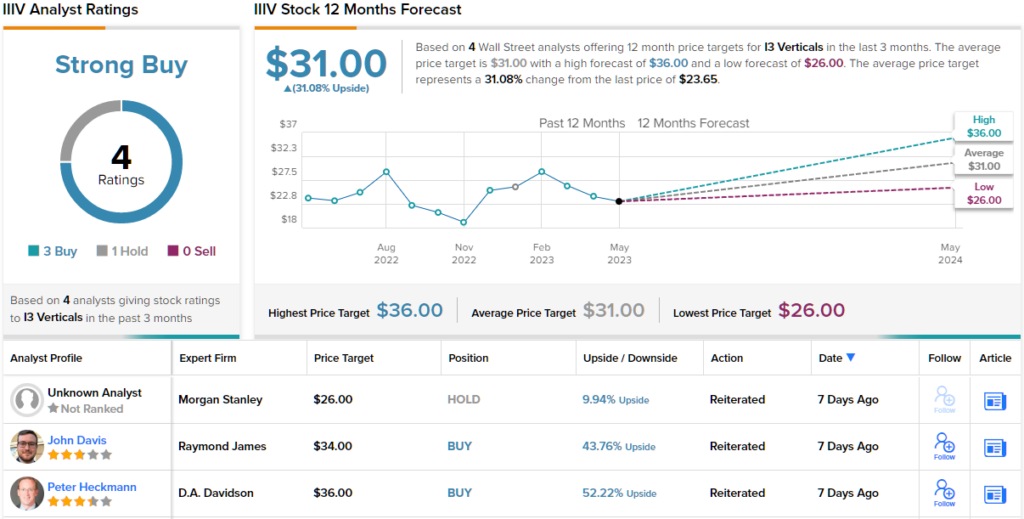

Davis’s comments support his Strong Buy rating on IIIV stock, and his price target, of $34, implies ~44% gain for the year ahead.

IIIV holds a Strong Buy rating from the analyst consensus as well. This rating is based on 4 recent analyst reviews, breaking down 3 to 1 in favor of Buy over Hold. The stock’s average price target of $31 suggests a 31% upside from the current trading price of $23.65. (See I3’s stock forecast)

ARKO Corporation (ARKO)

We’ll wrap up with a company you may not have heard of – but one that you have probably engaged with. ARKO is one of the country’s largest fuel wholesalers and convenience store operators. From its Richmond, Virginia base, ARKO’s network of stores offers a wide range of products, in snacks, candy, hot and cold beverages, beer, prepared foods, and quick serve restaurant brands, along with other non-good merchandise.

In addition to its convenience stores, ARKO is a major fuel wholesaler. Operating through its GPM subsidiaries, ARKO supplies fuel to retail and wholesale sites, as well as to major vehicle fleet operators. The company deals in many recognizable fuel brands, including Shell, Sunoco, Phillips 66, BP, Conoco, Marathon, 76, Citgo, and Chevron. ARKO also manages third-party fueling sites, and markets fuels cards nationwide.

ARKO has been expanding its operations and network through a merger and acquisition strategy. In the first quarter of this year, the company announced the closure of the acquisition of TEG, which brought 135 convenience stores into ARKO’s network, as well as 192 fueling sites. This acquisition was centered on the Southeastern US, and expanded ARKO’s retail presence into the states of Alabama and Mississippi. Also in Q1, ARKO announced that its planned acquisition of WTG will close in 2Q23. This move will add 24 convenience stores to ARKO’s lineup, all in West Texas. And, in recent weeks, ARKO has been making acquisition overtures to TravelCenters of America, reportedly offering a price of $92 per share.

Turning to the financial results, we see that at the top line in 1Q23 ARKO brought in $2.09 billion in total revenues. This was up 6% year-over-year, but missed the forecast by $83.7 million. At the bottom line, the company’s earnings shifted from a net gain to a GAAP EPS loss of 3 cents, a result that was 10 cents below expectations.

Nevertheless, Bobby Griffin, one of Raymond James’ 5-star analysts, has looked under the hood at ARKO, and comes to an upbeat conclusion.

“We continue to view ARKO as a solid small-cap investment opportunity as it is still in the early stages of a multi-year EBITDA growth story driven by further M&A, continued expansion of wholesale partners, as well as organic growth driven by numerous in-store initiatives… in our view, ARKO is well positioned to drive EBITDA growth over the next few years due to future M&A (benefit from scale; synergy flow-through from the recently closed acquisitions), as well as incremental in-store gross profit through category refreshes,” Griffin opined.

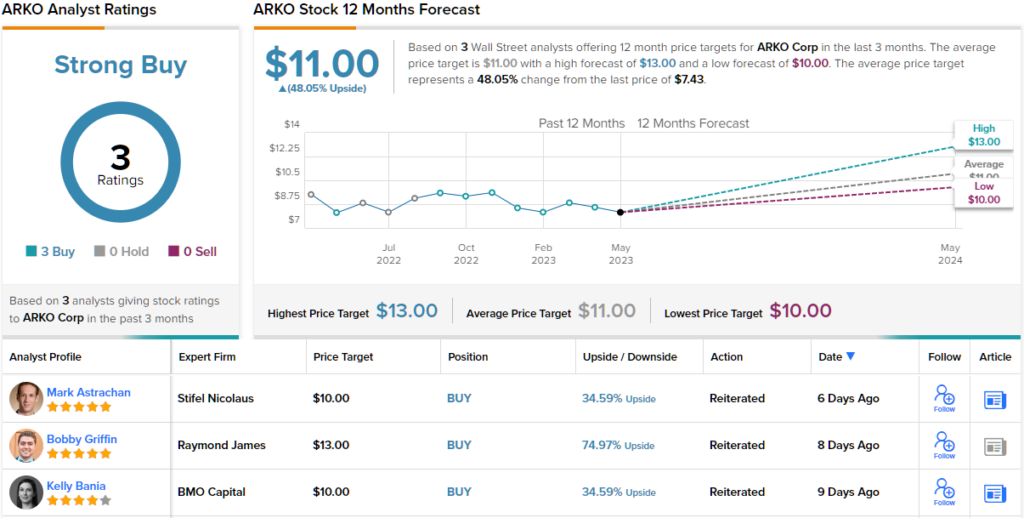

Looking ahead, Griffin rates ARKO shares a Strong Buy, with a $13 price target to indicate potential for a robust 75% upside in the months ahead. (To watch Griffin’s track record, click here)

Overall, there are 3 analyst reviews on record for this stock, and they all agree that it’s one to buy, making the Strong Buy consensus rating unanimous. The shares are trading for $7.43, and the average price target of $11 suggests a 48% upside potential on the one-year horizon. (See ARKO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.