Mick Jagger turns 80 in July, but the Rolling Stones frontman is showing no signs of slowing down just yet. Well, great for Jagger and the Stones, but what’s that got to do with the stock market, you say?

For Raymond James CIO Larry Adam, Jagger’s ‘never stop’ spirit resembles the never-ending barrage and staying power of the headwinds plaguing market sentiment. Fed tightening, inflation, recession worries, and geopolitical fears have all been present and unabating for a while now, and with equities having a hard time and interest rates pushing higher, Adam thinks “investors could be seeking some emotional rescue.”

However, don’t despair, appears to be Adam’s message, as there could be some Satisfaction ahead.

“We believe we are closing in on the end of the equity bear market, peak yields, Fed hawkishness and expect investors to be rewarded for enduring the current volatility as it should lead to robust performance for most asset classes in the long term,” Adam went on to say.

So, is it time to get bullish on equities? Certainly on some, according to Adam’s analyst colleagues. The Raymond James stock experts have identified a pair of stocks as ‘Strong Buy’ picks, and they are not alone in showing confidence in these names. According to TipRanks, the world’s biggest database of analysts and research, both are also rated as Strong Buys by the analyst consensus. Let’s see why they are drawing plaudits across the board.

Atlas Energy Solutions (AESI)

We’ll start with Atlas Energy Solutions, an energy industry company that works with hydraulic fracking companies. Atlas is a provider of proppants, the solid materials, usually sands or ceramics, that are used to keep the induced fractures open during fracking operations. The company also provides logistical services and support to fracking operators. Atlas is headquartered in Austin, Texas, and its activities are directed mainly in the Permian Basin on the Texas-New Mexico border.

In an interesting development, Atlas, which was founded in 2017, went public in March of this year. The company’s IPO was the first public offering of a fracking logistic and proppant company since 2016 – and it turned out to be the second-largest IPO so far this year. The company was valued at $1.8 billion post-IPO, and raised $324 million in the offering.

In December of last year, shortly before going public, Atlas announced its Dune Express, a logistic solution for the delivery of proppant to major oil producers, via a conveyor system that will serve the Delaware of West Texas, part of the larger Permian formation. The company has begun deploying built-for-purpose trucking assets on the project, and is expected to achieve commercial in-service of the Dune Express next year.

Covering this newly public stock for Raymond James, analyst James Rollyson writes: “The upcoming Dune Express project will add to logistics to further enhance proppant delivery into the Northern Delaware Basin, aiding costs and reliability, while providing numerous ESG benefits over traditional trucking. As the expansion of Kermit and the Dune Express ramp up over the next 18 months, Atlas should see its earnings/ cash flow improve in a very material way. As growth capex fades upon completion of these projects, the company should see a solid ramp in free cash flows, much of which we would expect to be returned to shareholders — of which Atlas management remains a large one.

“Hence, we think the outlook for the company is solid, while the discounted value post-IPO provides a compelling entry point for investors that can wait through the expansion period,” Rollyson summed up.

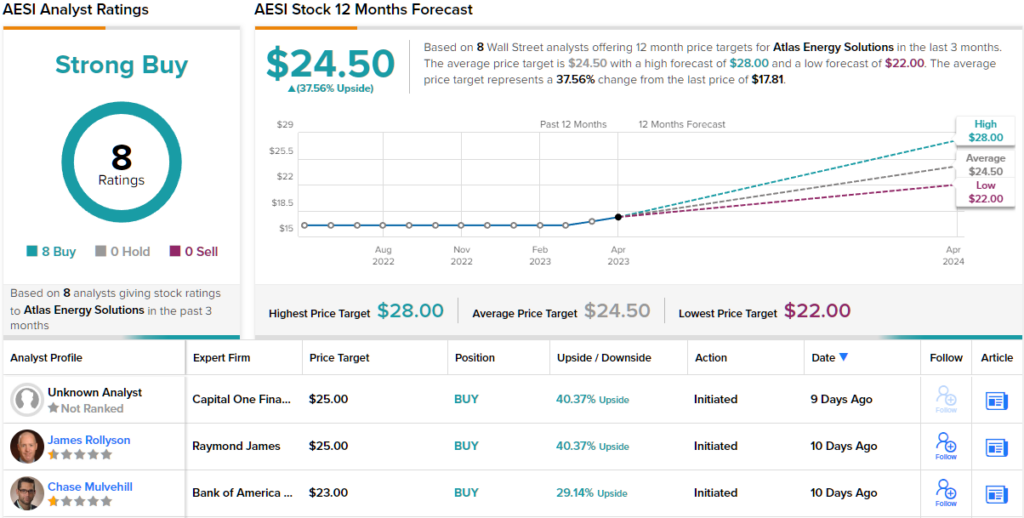

Rollyson takes this forward with a Strong Buy rating on AESI stock and a $25 price target that suggests a 40% upside potential over the next 12 months. (To watch Rollyson’s track record, click here)

In its short time on the public markets, Atlas has picked up 8 analyst reviews – and all are positive, for a unanimous Strong Buy consensus rating. The shares are trading for $17.92 and have an average price target of $24.50, implying ~38% upside on the one-year horizon. (See AESI stock forecast)

Alaska Air (ALK)

Now let’s change our focus to the airline industry, where Alaska Air has long held a leading position on the West Coast of North America, occupying a niche between the small regional airlines and the big legacy carriers.

Alaska Air operates both domestic and international flights, with destinations in the US, Mexico, Central America, and even into the Caribbean. The airline has long had a positive reputation among air travelers, and consistently ranks among the top-ten carriers in the North American air travel market, when rated by passenger count.

Alaska Air has long prospered by operating in and out of important cities that are occasionally bypassed by the legacy carriers – but that are big enough to need regular service from a major airline. The company is headquartered in SeaTac, Washington, operates hubs in Anchorage, Portland, and San Francisco, and has regular service to Boise, San Diego, and San Jose. Alaska Air recently entered into an agreement with Shell Aviation to expand the supply of, and the market for, sustainable aviation fuel (SAF) in the Pacific Northwest region. The company has a goal of achieving net-zero by 2040.

The agreement on SAF comes just a few months after Alaska Air announced important moves to modernize its fleet of aircraft. In January of this year, the company retired the last of its Airbus A320-family narrow-body medium-range airliners – and later that month announced upgrades to its fleet of Embraer E175 regional jets. The E175 upgrades include improved wifi service for passengers, and make Alaska the first major airline to offer fast satellite wifi on a regional jet. These moves come after Alaska, at the end of last year, entered into agreements with Boeing for the purchase and delivery of five new 737-9 aircraft, and for the conversion of two 737-800 passenger liners into air freighters. Air freighter service is in high demand in the state of Alaska.

ALK will release Q1 results next Thursday (April 20), and while Raymond James’ resident expert on the airline industry Savanthi Syth does not expect any fireworks, she finds the company in a strong position.

“We are upgrading ALK from Outperform to Strong Buy as it exits the seasonally weakest quarter (generally experiencing a weaker 1Q than most U.S. peers) and is in a position to unlock benefits from the A320/Q400 fleet transition, which is expected to be completed by May. While favorable hedges in 2022 create a tougher y/y comp relative to most peers and the A321 fleet transition in 2H23 and greater exposure to the Tech sector remain potential risks, we believe a relatively unimpaired balance sheet and commercial initiatives will support strong shareholder value creation in this historically well-managed airline,” Syth opined.

Along with her new Strong Buy rating on the stock, Syth gives ALK a $68 price target, indicating her confidence in the airline’s ability to deliver 61% share appreciation this year. (To watch Syth’s track record, click here)

The Street’s overall Strong Buy consensus rating on this stock is backed up by 9 analyst reviews, including 8 Buys and a single Hold. The shares have an average price target of $66.31, implying ~57% one-year upside from the current share price of $42.11. (See ALK stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.