It’s tough to think of the holiday season and not think of all the wonderful holiday food involved. All the irresistible delights, both sweet and savory, are coupled with creating endearing memories during these good times.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Still, as an investor, wherever a concept comes to mind, I can’t help but ask myself how to profit from it! However, the last thing I want during the holidays is to worry. Thus, here are three food stocks that should remain unshakable during the ongoing market meltdown and provide some stress-free returns. Their resilient business models and high-margin cash flows should keep backing investors’ confidence and maintain their share prices elevated.

McDonald’s Corporation (NYSE: MCD)

There is no way McDonald’s wouldn’t be included in a list featuring robust food stocks. Both the company’s and the stock’s resiliency is just unrivaled. While the S&P500 (SPX) is down roughly 15.7% over the past year, shares of McDonald’s have gained around 5.0%. That’s a massive outperformance, which is attributable to McDonald’s ingenious business model.

Basically, even though McDonald’s is a “food stock,” the company generates the largest chunk of its revenues from the real estate and royalties its franchisees pay it. Hence, McDonald’s is not actually entangled with running each individual location, resulting in the company generating cash flows that are largely frictionless and high-margin.

Simultaneously, because royalties are taken from each location’s gross sales, McDonald’s profitability is largely not being impacted by the ongoing inflationary pressures restaurants currently suffer from. It’s the franchisees who enjoy lesser profits, as McDonald’s take rate remains constant despite higher ingredient costs or higher wages.

This is evident in that the company is expected to produce earnings per share of $9.95 this year, suggesting a year-over-year increase of 7.2%, even though the QSR (quick service restaurant) industry is experiencing compressed margins these days.

McDonald’s 47-year track record of consecutive annual dividend hikes further solidifies investors’ confidence in the stock. In that sense, I would expect shares to remain more or less unshakable during the ongoing market environment.

Is MCD Stock a Buy, According to Analysts?

Turning to Wall Street, McDonald’s has a Strong Buy consensus rating based on 17 Buys and three Holds assigned in the past three months. At $284.70, the average MCD stock price target implies 4.1% upside potential.

Restaurant Brands International (NYSE: QSR)

With its portfolio of brands comprising names such as Tim Hortons, Burger King, Popeyes Louisiana Kitchen, and Firehouse Subs, Restaurant Brands International is one of the most prominent players in the QSR space. This is another food stock that has managed to remain unfazed by the ongoing market turmoil.

The stock is up 11.3% over the past year, also substantially outperforming the overall market, as its results have kept impressing investors throughout this period. Similar to McDonald’s, Restaurant Brands’ business model is lean and able to generate high-margin revenues via royalties and rents collected. For instance, Tim Hortons franchisees who lease property from the company generally pay a royalty of 3.0% to 4.5% of weekly restaurant gross sales.

Well-known fast-food brands naturally attract high foot traffic and post heavy delivery volumes even in times when consumers are selective with their spending, like in today’s economy. The combination of higher comparable-store sales and net new openings has set the stage for the company to achieve record revenues this year. Specifically, Restaurant Brands is expected to post revenues of $6.48 billion for FY2022, an increase of 13% year-over-year, and earnings per share of $3.15, suggesting growth of 11.7% compared to FY2021.

The stock’s 3.3% yield has also contributed to maintaining shares at elevated levels. This is because, besides the company’s resilient underlying performance, Restaurant Brands has made a name for itself among income-oriented investors for its above-average yield in the industry.

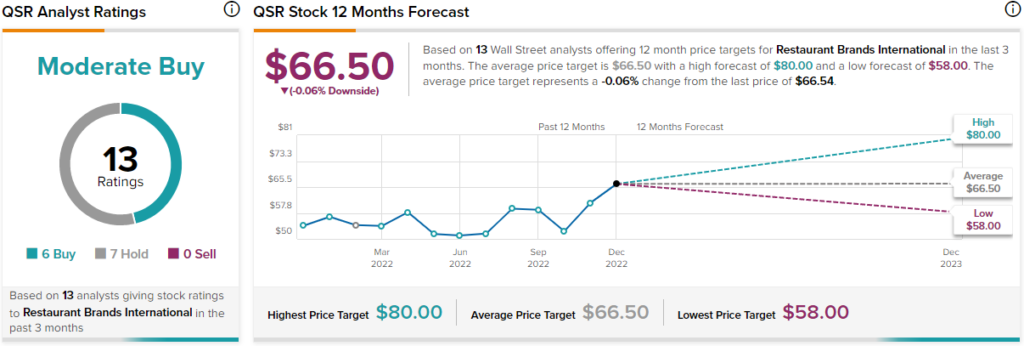

Is QSR Stock a Buy, According to Analysts?

Turning to Wall Street, Restaurant Brands International has a Moderate Buy consensus rating based on six Buys and seven Holds assigned in the past three months. At $66.50, the average QSR stock price target implies no upside potential, nonetheless.

Chipotle Mexican Grill (NYSE: CMG)

Chipotle is another food stock that has managed to outperform the market against all headwinds despite being down 11.3% in the past year. Chipotle has long been a Wall Street darling due to retaining consistent, double-digit growth over the years with little to no signs of slowing down.

Specifically, Chipotle’s five-year revenue growth CAGR stands at a praiseworthy 13.8%, while its five-year net income growth CAGR stands at n even more remarkable 40.4%. Chipotle’s most recent Q3 results further demonstrated the company’s ability to sustain its ongoing growing momentum, with sales rising 13.7% to $2.22 billion.

Admittedly, at a forward P/E of nearly 46x, the stock trades at a hefty premium. However, investors seem willing to overpay, given the company’s consistency in growing its top and bottom line very rapidly. Be careful about potential valuation headwinds in this name. Still, it’s quite possible that Chipotle stock will remain relatively unshakable compared to its industry peers due to its invariably impressive performance.

Is CMG Stock a Buy, According to Analysts?

Chipotle Mexican Grill also features a Strong Buy consensus rating based on 16 Buys and two Holds assigned in the past three months. At $1,834.78, the average CMG price target suggests 20.2% upside potential.

Takeaway – 3 Food Stocks You Can Count On

Food stocks and the QSR industry, in general, are expecting several challenges during the ongoing highly-inflationary and uncertain landscape. That said, McDonald’s, Restaurant Brands, and Chipotle feature unique qualities that investors have appreciated in the current environment.

This has resulted in their stocks remaining rather unshakable despite most of their peers recording substantial share price losses over the past year. In fact, they have overperformed all major indexes quite significantly.

With McDonald’s and Restaurant Brands generating lean cash flows and paying growing dividends and Chipotle growing at an impressive pace against all market headwinds, you may want to consider taking a bite out of these food stocks.