While much has been made of the large rally in U.S. tech stocks this year, China’s leading tech stocks have not experienced the same lift, meaning that there is plenty of value to be had in the sector, and they look attractive based on their potential to narrow the gap with their U.S. peers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As an ETF focused exclusively on China’s top internet and technology stocks, the KraneShares CSI China Internet ETF (NYSEARCA:KWEB) is an attractive and targeted way to invest in all of China’s leading tech stocks in one investment vehicle. I’m bullish on KWEB for this reason, plus the fact that it receives high ratings from both TipRanks’ Smart Score system and Wall Street analysts alike.

What is the KWEB ETF’s Strategy?

According to KraneShares, “KWEB tracks the CSI Overseas China Internet Index, which consists of China-based companies whose primary business or businesses are focused on internet and internet-related technology. The Index is free float market capitalization weighted and includes publicly traded securities on either the Hong Kong Stock Exchange, NASDAQ Stock Market, or New York Stock Exchange.”

KraneShares further explains that KWEB provides “access to Chinese internet companies that provide similar services as Google, Facebook, Twitter, eBay (NASDAQ:EBAY), Amazon (NASDAQ:AMZN), etc.” These stocks benefit from “increasing domestic consumption by China’s growing middle class.”

KWEB launched in 2013, and with $5.8 billion in assets under management (AUM), it is now the second-largest China-focused ETF in the U.S.

Significant Value

Chinese stocks are inexpensive, and China’s top tech stocks look particularly cheap, especially compared to their U.S. peers. U.S. tech stocks like Microsoft (NASDAQ:MSFT) and Amazon trade at demanding multiples of 33.7 times forward earnings and 42.6 times consensus 2024 earnings estimates, respectively, after massive runs in 2023. While these are great companies, these are definitely elevated valuations.

Comparable Chinese stocks haven’t yet benefited from any tech rally of their own, as we have seen in the U.S., and trade at bargain valuations in comparison.

For example, Alibaba (NYSE:BABA) offers a good illustration of this dynamic. It features exposure to e-commerce (like Amazon) and the cloud (like Microsoft and Amazon through AWS) and trades at just a paltry 8.7 times Fiscal 2024 consensus earnings estimates and an even cheaper 8.0 times 2025 estimates. JD.com (NASDAQ:JD), another major Chinese e-commerce player, trades for just 8.6 times 2024 earnings estimates.

Baidu is another good example. Baidu (NASDAQ:BIDU), which can be seen as China’s answer to Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) based on its search business, trades for just 11 times 2024 earnings estimates, a significant discount to Alphabet, which trades at 20.7 times 2024 estimates. Baidu also gives investors exposure to growth drivers like artificial intelligence and self-driving cars, just like Alphabet, but it clearly isn’t getting the same credit from the market.

These aren’t necessarily pure apples-to-apples comparisons, but they illustrate the wide gulf between U.S. and Chinese tech stocks.

Other Chinese tech stocks look compelling as well. At 18.9 times 2024 earnings estimates, PDD (NASDAQ:PDD), the parent company of Temu, is more expensive than Alibaba, but it’s still significantly cheaper than top U.S. tech stocks. The same can be said about tech giant Tencent (OTC:TCEHY), which trades for 15.8 times forward earnings.

Quite a few of the U.S.’s top investors are recognizing this value and have added these stocks to their portfolios during the past quarter. For example, Michael Burry recently initiated positions in Alibaba and JD.com, while David Tepper added significantly to his position in PDD.

What Does KWEB’s Portfolio Look Like?

KWEB is not very diversified, as it owns 31 stocks, and its top 10 holdings make up 61.9% of the fund. However, this is a targeted play for investing in China’s top tech stocks, so broad diversification isn’t necessarily the goal here. Still, it is nice to gain exposure to all of these Chinese tech stocks in one vehicle, so KWEB does offer diversification in this way.

Below, you’ll find an overview of KWEB’s top 10 holdings using TipRanks’ holdings tool.

KWEB’s top holdings include China’s tech and internet powerhouses like PDD, Tencent, and Alibaba.

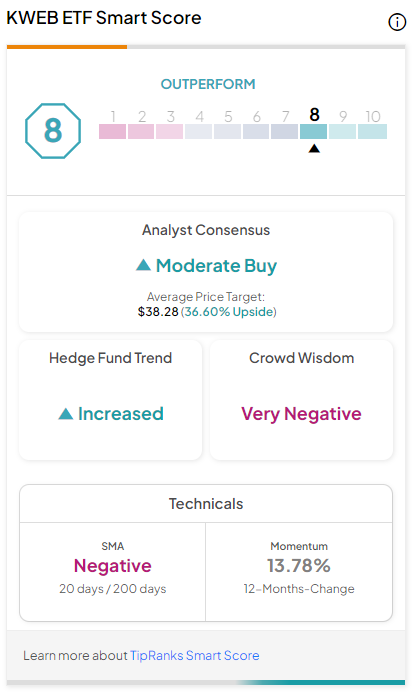

One thing investors will immediately notice is that these top three holdings all have fantastic Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

PDD, Tencent, and Alibaba all feature perfect 10 Smart Scores, the highest rating possible, and so does Netease (NASDAQ:NTES).

KWEB itself has an Outperform-equivalent ETF Smart Score of 8.

What is KWEB’s Expense Ratio?

KWEB has an expense ratio of 0.69%.

This 0.69% expense ratio means that an investor in the fund will pay $69 in fees on a $10,000 investment in the fund over the course of one year. If the fund returns 5% per year going forward and the expense ratio remains at 0.69%, this same investor would pay $859 in fees over the course of 10 years.

While this is somewhat steep, remember that gaining access to the Chinese market can be difficult for investors based outside of China, and investing in the local-listed shares can be expensive/prohibited.

Plus, it’s not as if KWEB’s expense ratio is out of line with its China-focused peers. For example, the iShares MSCI China ETF (NASDAQ:MCHI), the largest China-focused ETF, features an expense ratio of 0.58%, while the iShares China Large-Cap ETF (NYSEARCA:FXI), the third-largest China ETF and an attractive opportunity in its own right, has an expense ratio of 0.74%.

Is KWEB Stock a Buy, According to Analysts?

Turning to Wall Street, KWEB earns a Moderate Buy consensus rating based on 26 Buys, five Holds, and one Sell rating assigned in the past three months. The average KWEB stock price target of $38.17 implies 34.1% upside potential.

The Takeaway: An Intriguing Bargain

China’s leading stocks look very cheap compared to their U.S. peers. This makes KWEB an attractive investment opportunity going forward, as it offers targeted exposure to all of these companies. Additionally, analysts see substantial potential upside here, and TipRanks’ Smart Score system also rates KWEB highly.

Lastly, investing in China can also help U.S. investors diversify their portfolios, spread out their risk, and gain exposure to growth opportunities outside of their home market.