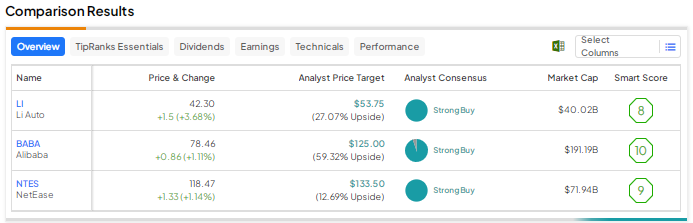

Investors were expecting a spike in business activity in China following the reopening of the economy after the COVID-19 lockdowns. However, the recovery has not been as expected due to the real-estate crisis and macro pressures. Also, the U.S.-China tensions have impacted investor sentiment. Keeping this background in mind, we used TipRanks’ Stock Comparison Tool to pit Li Auto (NASDAQ:LI), Alibaba (NYSE:BABA), and NetEase (NASDAQ:NTES) against each other and find the most attractive Chinese stock as per analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Li Auto (NASDAQ:LI) Stock

Chinese electric vehicle (EV) maker Li Auto has been growing rapidly and faring better than rivals like Nio (NYSE:NIO) and XPeng (NYSE:XPEV). The company recently reported better-than-anticipated third-quarter results, fueled by more than 296% year-over-year rise in deliveries to 105,108 vehicles. Sales grew 271% to RMB34.7 billion, while adjusted earnings per ADS (American Depositary Shares) jumped to RMB3.29 ($0.45) from RMB1.27 in the prior-year quarter.

The company also issued a solid outlook for Q4 2023, with revenue growth expected in the range of 117.9% to 123.1%. Li Auto, which manufactures four extended-range, hybrid SUV models, is now gearing up to commence the deliveries of its first fully electric model, called MEGA multi-purpose vehicle (MPV), in February 2024.

To summarize, Li Auto’s robust deliveries reflect solid demand for its vehicles despite intense competition and macro uncertainty in the world’s largest EV market.

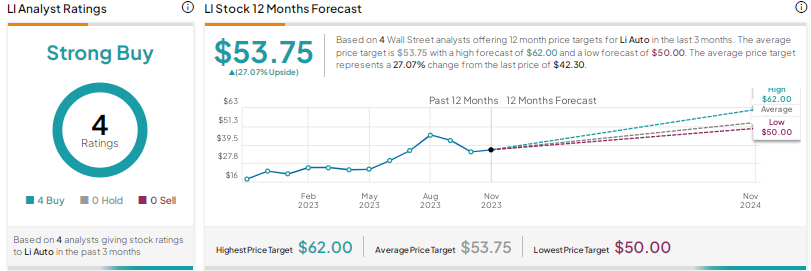

What is the Forecast for Li Stock?

On November 10, Bank of America analyst Ming-Hsun Lee reiterated a Buy rating on the stock and raised his price target to $62 from $61 in reaction to the Q3 earnings beat on lower operating expenses. The analyst adjusted his net income estimates for 2023, 2024, and 2025.

Overall, Wall Street has a Strong Buy consensus rating on Li Auto stock based on four unanimous Buys. The average price target of $53.75 implies about 27.1% upside potential. Li Auto shares have rallied 107% year-to-date, including nearly 33% over the past month.

Alibaba (NYSE:BABA) Stock

Shares of China-based e-commerce giant Alibaba declined last week after the company reported mixed fiscal second-quarter results and announced that it would no longer go ahead with the planned listing of its Cloud Intelligence Group. The company cited the U.S. restrictions on chip exports to China as the reason for aborting its IPO plans. The company thinks the spin-off of Cloud Intelligence Group may not enhance shareholder value, as the chip restrictions have created uncertainties for the unit.

Coming to Fiscal Q2 performance, Alibaba’s revenue increased 9% to RMB224.8 billion, in line with analysts’ estimates. The company’s adjusted earnings grew 21% to RMB15.63 or $2.14 per ADS (American Depositary Share) and exceeded the Street’s expectations.

Additionally, Alibaba announced that it will pay its first-ever dividend. The company’s board has approved an annual dividend of $1 per ADS for the current fiscal year.

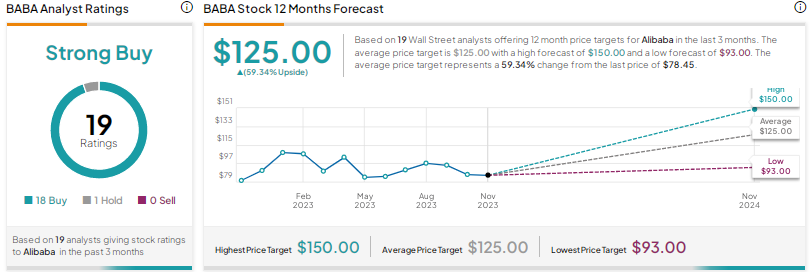

Is BABA a Buy, Sell, or Hold?

Last week, Barclays Capital analyst Jiong Shao reiterated a Buy rating on Alibaba with a price target of $138. The analyst noted that the cancellation of the much-awaited cloud IPO removed a near-term catalyst for unlocking value, disappointing investors. That said, the analyst contends that given the regulatory uncertainties in the U.S. and China and limited access to the most advanced chips, calling off the IPO may turn out to be the right decision in the longer term.

Shao added that the management of Alibaba’s cloud unit can now focus more on growing the business than dealing with regulatory pressures. The analyst believes that the aggressive share repurchases and dividends would make the company’s stock highly attractive to long-term shareholders.

Despite the recent developments, most analysts remain bullish on Alibaba stock. With 16 Buys against just one Hold rating, BABA stock earns Wall Street’s Strong Buy consensus rating. The average price target of $125 implies 59.3% upside potential. The company’s U.S.-listed shares have declined 11% year-to-date.

NetEase (NASDAQ:NTES) Stock

NetEase is an internet service provider and one of the leading game developers in China. The company recently reported mixed results for the third quarter of 2023. Revenue grew 11.6% to RMB27.3 billion, driven by strength in its Games and Related Value-Added Services segment and search engine Youdao. However, Q3 revenue lagged expectations, mainly due to the decline in the Cloud Music segment’s revenue.

That said, Netease’s adjusted earnings per ADS increased to RMB13.30 ($1.82) per ADS from RMB11.34 and handily surpassed expectations. The company’s bottom line benefited from the higher gross margin of the Games and Related Value-Added Services segment, driven by a higher proportion of revenues from the company’s self-developed games.

Management highlighted that the company’s latest games, Racing Master, Justice, and Dunk City Dynasty, rapidly gained popularity. The company is optimistic about its games business, with multiple high-profile titles scheduled for launch in 2024.

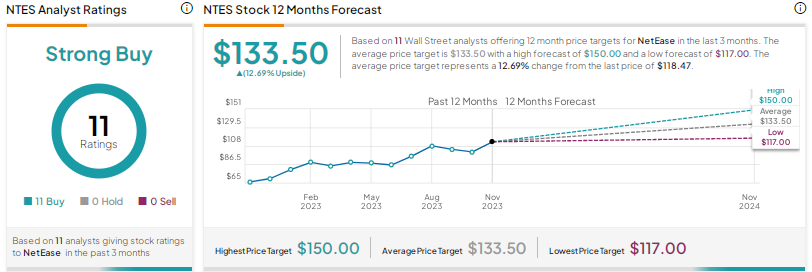

What is the Price Target for NTES?

On November 17, Benchmark analyst Fawne Jiang raised his price target for NetEase to $140 from $130 and reaffirmed a Buy rating on the stock, noting its solid earnings beat. Jiang highlighted “two notable structural trends” in NetEase’s games business in recent quarters. Firstly, the company’s breakthrough into games with a large user base and high daily active users (DAU), and secondly, its success in developing and launching titles across various game genres beyond its core massively multiplayer online (MMO) games.

Including Jiang, all 11 analysts covering NetEase stock have a Buy rating on the stock, leading to a Strong Buy consensus rating. The average price target of $133.50 implies about 13% upside potential. Shares have risen more than 65% year-to-date.

Conclusion

Wall Street is highly bullish on Li Auto, Alibaba, and NetEase. That said, analysts see the pullback in Alibaba shares as a good opportunity to buy the stock with a longer-term investment horizon. The company’s streamlining efforts are expected to increase its focus on the key businesses and boost profitability.