American supermarket chain operator, Kroger (NYSE:KR), is set to release its second quarter Fiscal 2023 results on September 8, before the market opens. Retailers are operating in a tough environment with inflation and high interest rates eating away at consumers’ pockets. Even so, Kroger’s core strength lies in its fast-growing digital business and the ability to deliver orders within 30 minutes through its “Kroger Delivery Now” service.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

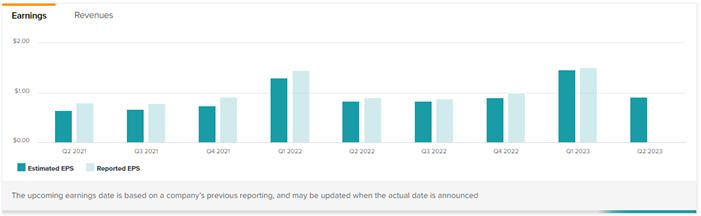

Despite the tough macro backdrop, Kroger has consistently outpaced earnings estimates in the past eight quarters. Most importantly, Kroger’s pending acquisition of Albertsons Companies (NYSE:ACI) stands as a promising catalyst for Kroger’s future market dominance. Year-to-date, KR stock has gained 3.3%.

Here’s What Wall Street Expects from Kroger

Wall Street expects Kroger to post adjusted earnings of $0.91 per share on revenues of $34.12 billion. This represents a somewhat similar performance compared to the year-ago period. In Fiscal Q2 2022, Kroger earned adjusted earnings of $0.90 per share on sales of $34.64 billion.

Recently, Evercore ISI analyst Michael Montani cut his price target on KR stock to $53 (implying 17.4% upside potential) from $54 but maintained a Buy rating. The analyst revised his estimates for Kroger, owing to the disinflationary pressure that poses a threat to grocers overall.

Conversely, JPMorgan analyst Kenneth Goldman raised the price target on Kroger stock to $56 (implying 24% upside) from $53 and maintained a Buy rating.

Meanwhile, Telsey Advisory analyst Joe Feldman reiterated a Buy rating and price target of $55 (21.8% upside) on KR stock. Feldman is highly optimistic about Kroger’s long-term growth potential, aided by continued momentum in at-home food consumption trends, inflation, and its emphasis on creating a seamless digital experience. The analyst is also bullish about the combined (KR + ACI) company’s profitability prospects.

Is KR a Good Long-Term Investment?

Analysts are cautiously optimistic about Kroger’s long-term trajectory. Plus, the fate of the KR-ACI deal remains in jeopardy due to competitive concerns. Recently, seven secretaries of state have urged the Federal Trade Commission (FTC) to block the merger on the same grounds.

To dodge the monopolistic nature of the deal, Kroger and Albertsons announced the sale of over 400 grocery stores to C&S Wholesale Grocers.

On TipRanks, Kroger has a Moderate Buy consensus rating based on six Buys and five Hold ratings. The average Kroger stock price target of $51.82 implies 14.1% upside potential from current levels.

Ending Thoughts

Going by Kroger’s past performances, it’s likely that the retailer can outpace expectations in the to-be-reported quarter. Kroger faces the same challenges that are haunting retailers across the U.S. but gains strength from its digital business and home delivery services. Meanwhile, investors will be keen to hear any updates about the pending ACI acquisition.